What is eFXData?

eFXdata is a unique online resource that is providing news, trading sentiments, market signals, and trades issued by the biggest players in the Forex market. The part of the website is free the use, but the majority of insights and recommendations are kept behind the paywall that is called eFXData Plus. The data derived service is provided by the Boston based fin-tech company that has partnered with Thompson Reuters. The service is more suitable for experienced traders.

Pricing

eFX Data Plus is available on a monthly subscription basis where the price of the basic package is $99 while the premium package costs $129. An annual premium subscription can be purchased for $999. There is a 7-day trial period available for both packages and it cost $19. The difference between the premium and basic package is that in premium all the feeds and notifications can be sent to your email.

Feature overview

The free version just displays certain market insights while in the plus version you will see the actual orders, FX Forecasts, Trade Stats, Quantitative analysis. Models, trade of the week, data previews, and other insights. In the plus version, all the data is synthesized. Free notification feeds are tweeted. So, what can eFXdata Plus do for you? Well, is it not tempting to know actual trading positions that are entered by trading professionals and to be notified about those entries. The service provides trades that are taken by leading banks and investment firms, market players that have an opportunity to influence the trading instrument price action. These big players include UBS, Royal Bank of Scotland, City Bank, Morgan Stanley, Goldman Sachs, Societe General, Deutsche bank, and many others.

What can it do for me?

EFXData platform is intuitive and easy to use. As a first time user, you will not have problems in navigating and finding the information you are looking for. If you are logged in as a new notification feed comes in, you can be notified by the sound alert. It ensures that you will not miss the information and you will be informed on time. If you cannot stay all the time at your computer I strongly advise opting for a premium edition because you can be informed by email as new feed appears.

The market orders section shows orders and positions taken by big players. Positions can be, grouped by trading instrument and by the institution. For every position, you can see the type (market or pending), direction, entry price, current market price, and profit in pips. For every big player, you can see his statistics which include profit (in pips) and win rate. Track records are available for the previous five years.

The detailed forecast section is another very useful tool. The forecast provides the price expectation for every forex instrument on the future date. Most institutional players release the forecast for the end of the quarters. You will also get the average price forecasts and you will know the collective market sentiment for each pair. A special part of this section is forecast change where the expected change is in the spotlight.

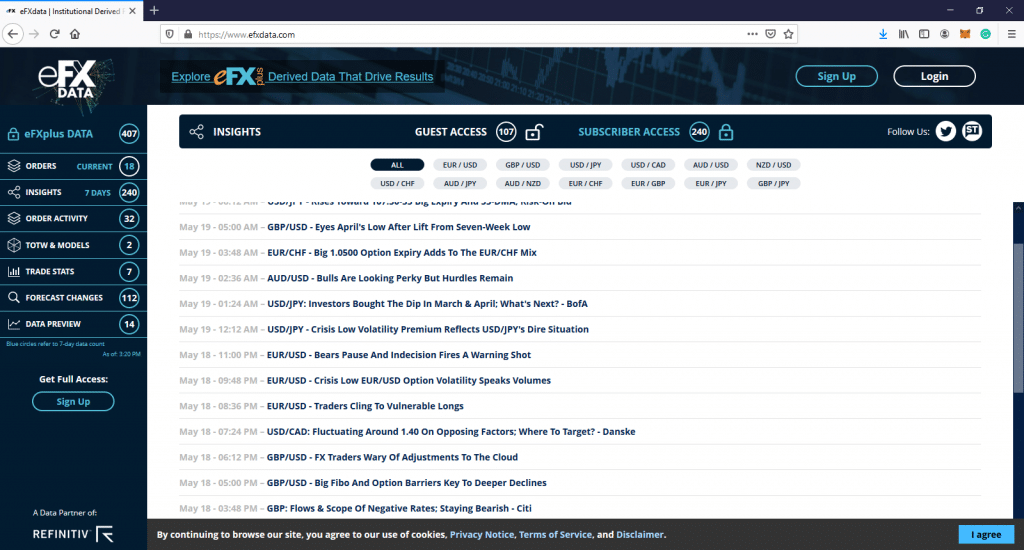

Insight section notifies you about key sentiment switch in each session. You may also see what is behind the reasoning of the institutional player and what parameters caused their forecast or trading decision. All eFXdata insight is summarized so you will be freed from endless analysis reading with only key information stated. This will help you to filter out the latest views and to stay focused. Insights can be researched by the currency pair and are sorted by the date of their release.

eFXData Plus provides two proprietary indicators that interpret the order data. These are the Long-Short Indicator (LSI) and the Intact Strategy Indicator (ISI). Both can be beneficial to the traders. LSI can help you to discover medium-term and long-term trading opportunities while ISI is more convenient for short term trading.

Conclusion

Thus, eFXData is a very useful, highly recomendable and unique resource that every forex trader should use. It is providing orders, forecasts, insights, and sentiment in the forex market by the big institutional players, world-leading banks, and investment companies. All information is organized in an intuitive way and the pricing is competitive. Moreover, two of their interesting custom indicators will help you to improve your trading. Some news feed is also available for free.