- Larger stimulus packages in the US and other major economies could shakeup 2021. Already, an expanded relief bill is before US senators. But reports of new COVID-19 strains should offset some of the boosts that relief bills could bring.

- Additionally, central banks might continue with lower interest rates, with China and other major emerging economies likely to further cut the rates. As such, the DXY is expected to recover and take an upward trajectory this year. In short, risk-on conditions are likely to heighten this year, meaning traders could begin making bigger bets than in 2020.

The foreign exchange (forex) market remains the largest and most liquid in the world. After all, the market opened with a bang in 2020, where daily forex trading volume hit $6.6 trillion, or 40% growth in 10 years.

The year just ended and almost witnessed the recession of the century as COVID-19 wrecked global economic havoc. The pandemic made 2020 the most volatile year, not only for forex but all markets. As 2021 cruises into the first week, the possibility of 2021 turning more volatile than 2020 is unmistakable.

Fundamental background

The US dollar remains the undisputable market leader in terms of trade involvement, meaning anything that influences the greenback’s behavior impacts the direction of the entire forex market.

The US President Donald Trump ratified the $600 per person relief bill in the last week of December. Shortly after, some House Representatives started pushing for an expanded program that extends $2,000 to every American in need. As things stand, the $2,000 bill is uncertain, but it could have significant repercussions if Congress passes it.

More dollars from stimulus packages this year will likely encourage risk-on behavior from investors across all markets. Ongoing talk of relief packages could imply another thing that is even more consequential in the Forex market. According to The Bloomberg Central Bank Outlook for 2021, the majority of central banks will “spend 2021 maintaining their ultra-easy monetary policies even with the global economy expected to accelerate away from last year’s coronavirus-inflicted recession.”

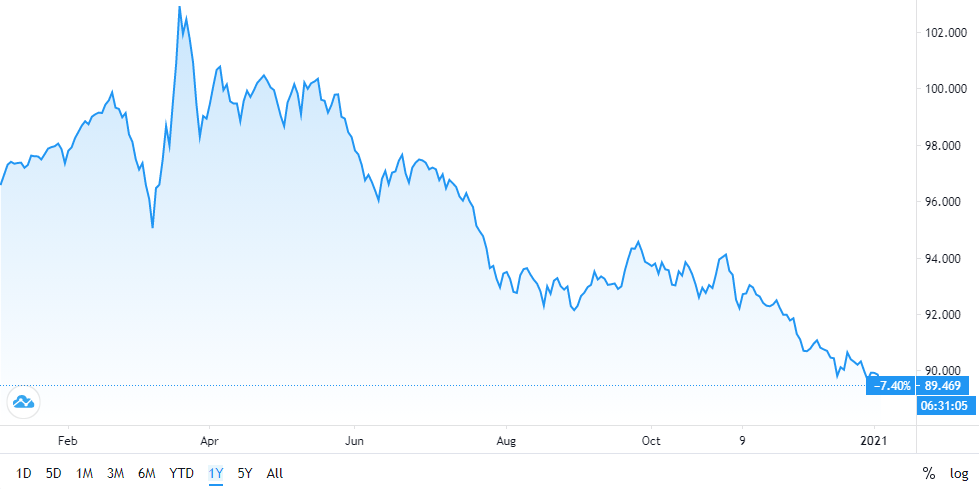

The need to buoy economic activity will encourage countries such as India, China, Mexico, and Russia to cut lending rates further, Bloomberg predicts. These four countries’ currencies make up the bulk of minor currency pairs. As such, the likely scenario here is that the US dollar and other majors might gain significant value this year. The market could help the US dollar index change its downward trajectory, one that has been firming over the past year.

Further, Bloomberg predicts that the central bank recession-battling efforts recorded so far are just warm-up acts for finance ministries worldwide. Finance ministers in many countries are in the process of initiating massive fiscal stimulus programs, in addition to programs to strengthen healthcare systems.

What is the technical view of the market?

Epidemiologists think the COVID-19 pandemic could stretch on for a better part of 2021 because of the discovery of new strains. Indeed, this is enough reason to worry about 2021 that is more roiled than the previous year.

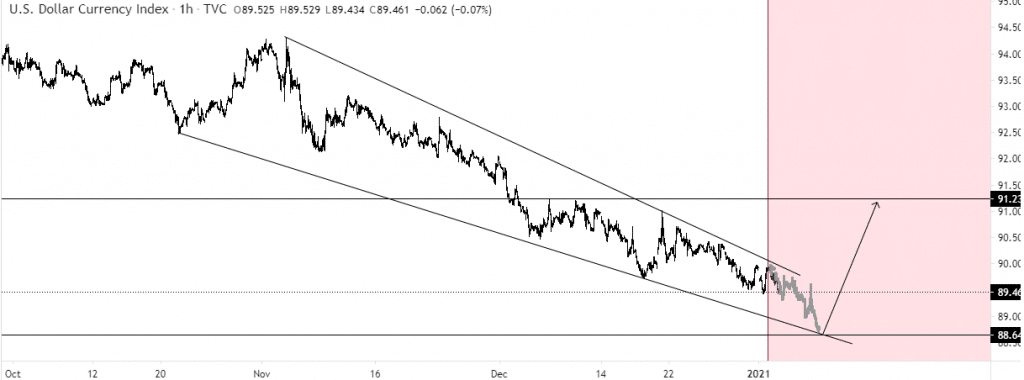

Nevertheless, all is not gloom, at least from a technical view. In Figure 2 below, the US Dollar index (DXY) shows signs of bottoming out soon. Over the past year, the DXY has been down-trending, especially after the global economy descended into the doldrums.

For the US, 2020 comprised more market-moving events than other major economies. The country just went through an unprecedented electioneering period whose fate is still hanging in the balance. These events must have exerted great pressure on the greenback.

However, the down channel in Figure 2 indicates that the DXY’s decline is almost turning an important corner. According to the pattern, the DXY looks likely to hold strong at 88.64, after which it should change the trajectory.

Conclusion

The USD gaining value simply implies market risk-on. Based on this analysis, 2021 should experience a more confident market with traders willing to make bigger bets.