The forex learning curve can be a killer for those who are just starting. There is so much to learn and start doing that most people end up giving up before they realize the mindset needed for this field. There are certain steps that one can take to cut down the learning curve and make forex learning smoother.

Learning Curve and the path to Mastery

If you’re looking to build a career in trading, be prepared to go through the learning curve phases. Veteran traders suggest that having an education in forex trading can take anywhere from a few months to a few years. This, of course, will depend entirely on your aptitude and level of experience.

The learning curve is quite steep and there is enough time for despondency to set as you sit in front of your computer for hours on end before you manage to make any money. However, this is not unique to forex trading. All valuable skills that are worth learning – take time.

The steep learning curve means that there might be many beginner traders who will give up on trading before they succeed with it. But, that only works to the advantage of those who persevere and stay committed to their education. If forex trading was easy, everyone would be doing it and it wouldn’t have the same charm.

But, the forex trade is governed by multiple shifting variables that are hard to predict. It makes it necessary to understand them and creates a niche that only those who understand can get into. Naturally, then, the learning curve is quite steep.

The Cycle of Confidence

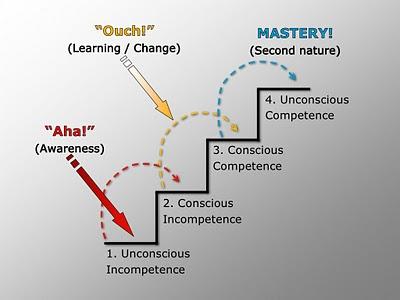

The forex trading model, with its four stages of competence, highlights the different signs of development and confidence levels that go along with developing the skill of forex trading. These can be broadly categorized into the following:

- Unconscious Incompetence

In the first stage, traders are blissfully oblivious of forex trading. In this step, the beginner takes the first step of downloading a trading platform. S/he may open a small trading account and start to place trades but will inevitably lose money. Either the trader will move on to the next stage or stop trading entirely.

- Conscious Incompetence

In this stage, traders become aware of how much they don’t know. In order to correct that and trade better, they look to gain trading knowledge. This stage can be quite dangerous for beginner traders. Whether or not you are in this stage can be answered by the following questions:

- Am I taking responsibility for losing trades?

- Do I know why I’m entering or exiting a trade?

- Am I sticking to a trading system?

- Do I use a trading journal?

If the answer to any of these questions is a ‘No,’ then it shows that you’re stuck in this stage. The development forward to the next stage is a fairly straightforward one.

- Conscious Competence

By the time traders have reached this stage, they have understood why they should avoid going after winning trades. Traders in this stage can be described as disciplined and confident. Traders will soon realize that this is all part of the system.

As they proceed, they start to gain an edge over the market by developing their own systems and protocols to work on. Traders are able to control their emotions and are aware of how they can impact the bottom line. As they gain more experience, they move to the final stage.

- Unconscious Competence

By the time traders get to this stage, they have learned enough strategies and gone deep into the trading psychology to make complex trading seem effortless. Traders can manage risk and adapt their trading styles to different market conditions effectively. The trader has complete confidence in his/her abilities and can place trades almost automatically. This signals that the trader has reached the last stage and that their efforts and discipline have made trading their second nature.

Overcoming the Challenges in Trading

Every stage has a special prescription for it that will make the steep learning curve bearable. Let us discuss what traders can do in different stages of learning to further their development.

Traders in the first stage require education above all else. But, it is crucial to choose a package that has been crafted by professional traders. On top of that, it is imperative that traders go through their forex education, again and again, to get the basics right down to the core. All this information will take on a different meaning as you start associating with real-world trading scenarios.

Traders in the second stage must have a trading journal. All successful traders record their trades, both good and bad, and reflect on what they’ve learned. Though it may seem cumbersome, this step itself can cut down on the learning curve by a big margin. Only through studying your mistakes, you can find patterns of your trading behavior that need correcting.

Traders in the third stage should gain as much experience as possible and continue with the previous two prompts. Learning from other traders and professionals is a big thing in the market. This way, they will be able to compare their trading strategies with others and learn how to better them.

In the last stage, traders highlight a perfection that is attained by people to whom trading has become second nature. There aren’t many challenges there, but continuing to gain experience and keep on trading will ensure that they retain their powers’ peak in the long term.

Conclusion

The forex learning curve is just like the learning curve of any skill that is worth having. It is steep and requires dedication and hard work but is not without its rewards and successes. As traders move from unconscious incompetence to unconscious competence, they move up in terms of their skill, confidence, and ability to understand the bigger picture.