Timing is of the utmost importance when it comes to forex trading. Spending the whole day glued to the screen trading viciously and watching every release data does not guarantee the riches that forex trading always promises. Some traders have seen their hard-earned capital wiped out in a matter of minutes on trading haphazardly.

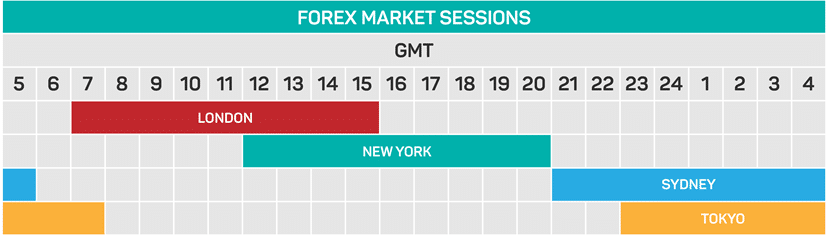

Not all hours are equally suitable for forex trading. While some may provide ideal trading opportunities, some may plunge one into a deep hole. The forex market is made up of four markets that present unique trading opportunities at different times.

The Biggest Forex Trading Sessions

New York Forex Session

The New York forex session presents the second largest currency trading platform. The market runs from 8 am to 5 pm EST. It is the most-watched forex trading session by foreign investors, given that the U.S dollar accounts for over 80% of all trades in the currency market.

Movements in the New York Stock Exchange tend to have a significant impact on the U.S Dollar conversely, influencing trading activities in the forex market.

European Forex Session

The European session dominates the currency market worldwide, given that it plays host to some of the world’s biggest economies. The market is most active from 3 am to 12 pm EST.

The session accounts for about 40% of global trading. Euro, British Pound, Swiss francs are some of the major currencies in the region that elicit strong trading activity whenever the London session is opened.

Sydney

Forex trading hours officially begin when the Sydney markets open every day. The market is usually opened at 5 pm and runs to 2 am. ET. While it is the smallest session for trading volume, it sees a lot of action when the market is opened Sunday afternoon, as institutional investors try to regroup after a long pause over the weekend.

Tokyo

The Tokyo forex session, which starts at 7 pm to 4 am EST, is the first Asian trading session. The session accounts for the most considerable bulk of forex trading activities that take place in Asia. The session sees traders in Hong Kong, Tokyo and Singapore account for big moves in the session. Some of the currency pairs that elicit keen interest whenever the session is opened include USD/JPY, GBP/CHF, and GBP/JPY.

The Best Hours To Trade Forex

While the market begins at 5 pm EST on Sunday and runs until 5 pm on Friday, not all hours present ideal trading conditions. The best time to pursue trading opportunities in the forex market is when the market is most active. The forex market is always a buzz of activity when more than one, of the four markets, is opened.

Likewise, the ideal time to trade is when more traders are active, which occurs when more than one market is opened. High liquidity levels make it easy to enter and exit positions at preferred price points.

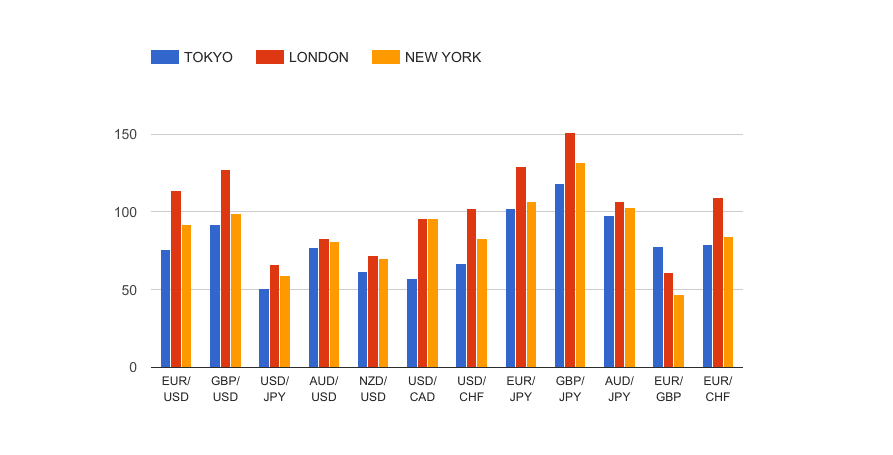

Forex trading is all about timing fluctuation in currency pairs. Currency pairs tend to fluctuate more due to high volatility when there are more participants in the markets. With high volatility and liquidity, levels, trading spreads tend to be low.

Whenever there is only one market, currency pairs offered by brokers tend to come with tight pip spreads of up to 30 movements, making it extremely difficult to profit from small price movements. In contrast, when two markets are opened and run concurrently, currency pairs can present price movements north of 70 pips.

The Best Market Overlaps for Forex Trading

The currency market is usually a buzz of activity whenever the U.S and London trading hours overlap. From 8 am to noon GMT. It is when most people trade, thus presenting perfect trading conditions.

More than 70% of the trading activity in the forex market occurs when the U.S and London session overlap. EUR/USD and GBP/USD pairs see the most activity in terms of volatility during this time.

Likewise, when the Sidney and Tokyo session overlap, the forex market also tends to be volatile, presenting an opportunity to profit from a higher pip fluctuation period. While the session is active, it does not elicit the same volume and trades as when the U.S and London session overlap.

When the London and Tokyo session overlaps, the forex market sees the least amount of trading activity. It is partly because the U.S dollar, which is the most traded currency, is usually not as active as it ought to be as traders in the U.S are asleep. Likewise, during this period, the lack of significant news events from the U.S also sees traders shun the session.

Best Days for Forex Trading

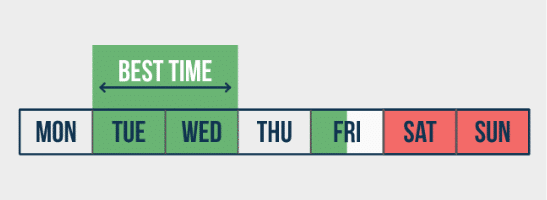

In addition to timing market overlaps, some days of the week give rise to profitable trading opportunities than others. The middle of the week, i.e., starting Tuesday to Thursday, are some of the best days to trade, given the increased trading activities.

Monday’s tend to be a little bit shaky and choppy as traders are yet to recover from the weekend craze. Fridays, on the other hand, tend to be busy until 12:00 pm EST. The markets tend to drop dead early as close traders shop for the weekend much early.

Bottom Line

Timing is crucial when it comes to forex trading. The best time to trade is when the U.S and London sessions overlap as this is when most traders are active worldwide. Market moving news and events also tend to hit the wires during this session, thereby giving rise to ideal trading conditions.

Likewise, it is essential to trade whenever the market is volatile as it enhances the ability to generate profits on currency pairs fluctuating rapidly. Trading spreads also tend to be low when the market is active, thereby allowing traders to create optimum returns on positions.