The FXDD is an independent Forex broker which has a head office on Malta and works since 2002. By the company’s identification registration number, C48817, it was possible to find out that its activities fully comply with the existing directive in the European Union. This is why the broker can work legally in the European Union and other regions. Services extend to Europeans and citizens of Asia, the CIS, Australia, and the United Kingdom. We should also emphasize the work of customer support service, which works in several languages (including English, Russian, Spanish).

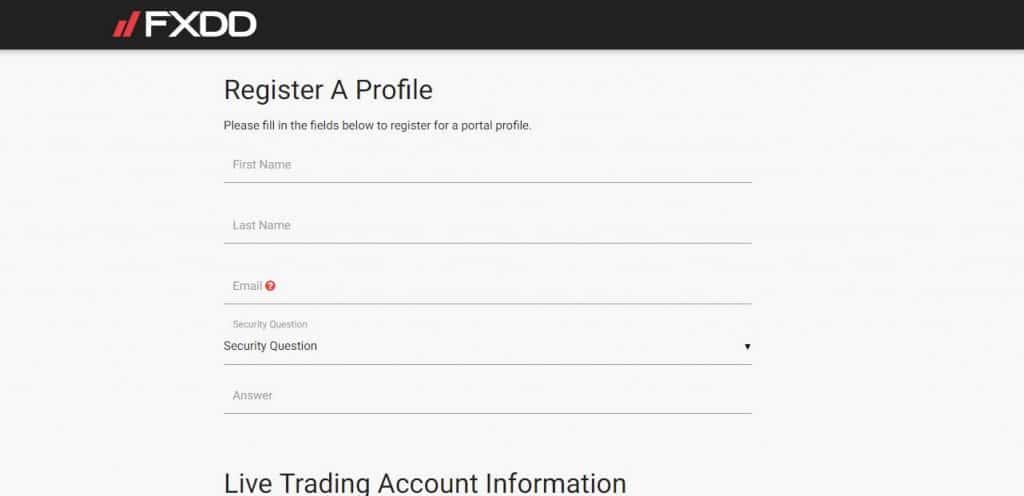

The opening of the trading account in the FXDD company

New user’s registration is going through the standard procedure by providing your basic data:

- Full name;

- Email address and contact number;

- Residential address.

The account will be officially registered after the procedure. But for further actions, you will need to go through verification. It means that moderators have to examine your scanned copies of users’ documents. You can send them directly through your personal account online.

The user has to examine users agreement and accept it after verification. But it is given in English without a translation.

Trading Account Types and Trading Conditions at FXDD Broker

It is recommended to view the trading conditions of the company on a demo account. In total the broker offered several types of accounts:

- Standard;

- ECN.

Other types of accounts are not provided. ECN means that transactions are conducted through the interbank market. Accordingly, the broker does not participate in the processing of orders and cannot in any way influence the final result. This is the best solution for those who want to engage in trading professionally.

Trading conditions of the company:

- Floating type of accrued spreads;

- Spreads size – from 1.3 points (in ECN accounts the fee is little higher);

- The size of the minimum deposit – $ 250;

- Maximum leverage – 1:200;

- Basic account currencies – USD or EUR.

The company has set the minimum size of the transaction at the level of 0.01 lots. Islamic accounts are not provided. In addition, some assets may accrue swap for transferring a transaction from one trading day to another. No additional fees for orders or for trading volume are charged. The company does not set limits on the use of automatic assistants. In the reviews, there are no accusations that the account was blocked due to the use of robots, scalping techniques or the Martingale method.

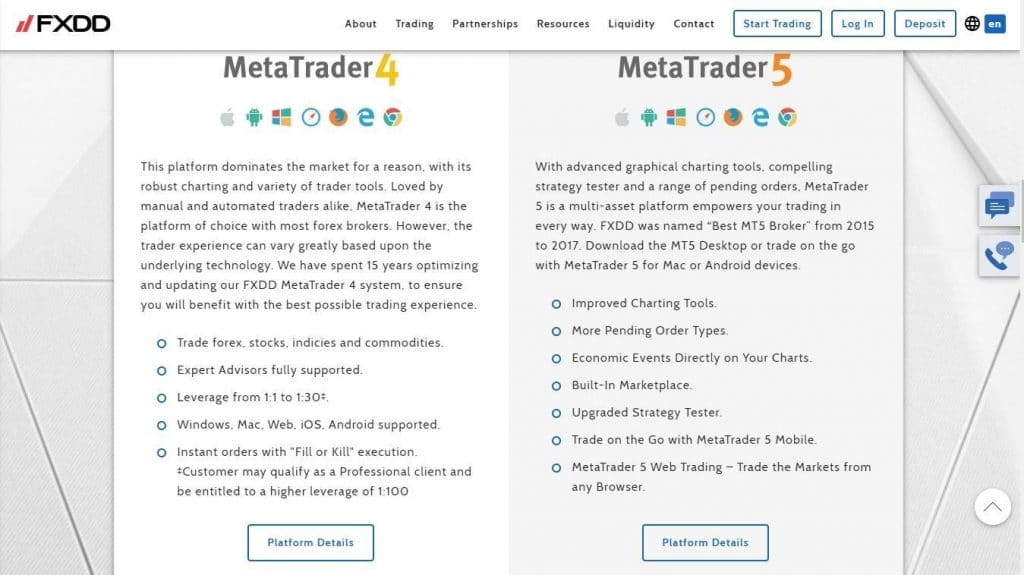

Trading platforms of the FXDD company

The main trading platform of the broker is Webtrader which is available online through a browser. It is customized by the company, therefore it has a number of features and a unique user interface. In particular, it provides access to all trading tools.

Additionally, access to the trading terminals Metatrader 4 and Metatrader 5 is open. These are also improved under the broker’s trading conditions. You can download a free trading terminal on the official website in the section https://www.fxdd.com/mt/en/trading/accounts.

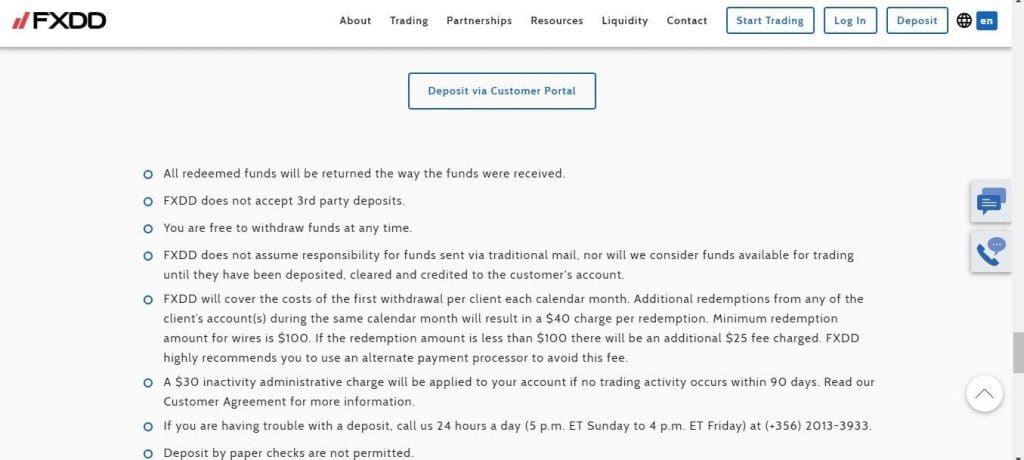

How to deposit and withdraw funds

The list of available payment systems for financial transactions is small. Only transfer by credit card is available, as well as transfer via Webmoney e-wallet. Without commission payments are made from an account in the amount of more than $ 100. If the withdrawal amount is less, the broker additionally charges a $ 25 fee which makes the payment unprofitable to the client.

Tariffing for payment processing is established directly by payment systems.

In terms of payment processing takes about 1-2 hours on weekdays during working hours. In another period of time, it may be delayed, since all operations are carried out manually, and the company does not have a large number of employees.

The FXDD broker training program

The company does not give online training through any courses. Instead, the site has a powerful pool of tools for effective market analysis. For example, a user may use an economic calendar, webinar and seminar records, read analytical material from partners. The company has its own analytical department.

Conclusion

The FXDD was able to create the conditions for stable trading partners. But the disadvantage is the lack of investment programs, the lack of Russification of the site (which excludes access to services for citizens of the CIS). In addition, trading conditions do not provide a choice for the client in terms of trading conditions, because only 2 types of accounts are available. But in favor of the company, it can be stated that they consistently fulfill their obligations, since there are very few negative reviews about the broker’s activities.