FOMO, is there such a thing in forex? The fear of missing out is a real emotion experienced by traders in the markets. This article will explain what causes this feeling and how traders can remove it.

While the FOMO (fear of missing out) phenomenon was discovered as far back as the mid-90s, the concept became more prevalent in the investing world during the 2010s.

Some traders may not consciously be aware they have FOMO, leaving them with negative emotions. Though it might seem like a situation that only occurs in a strictly social, non-trading setting, FOMO is real and difficult to overcome since it manifests itself in several forms.

Fortunately, with the proper knowledge of identifying and changing it, traders can start to experience the opposite, which is the joy of missing out (FOMO).

So, what is FOMO in forex trading?

The fear of missing out in trading is the unease of always believing one is missing out on a trading opportunity. FOMO occurs both in a personal and social capacity.

In the former, one example is when a trader somehow misses an entry into a set-up they intended to execute on, only to see the price move considerably in the direction they had predicted.

This scenario leaves them with a decision of either letting the trade go completely (missing out) or taking a much less favorable entry point, the latter of which necessitates a bigger stop and increases the risk of a retracement.

Within a social context, an instance of FOMO could be rumors spread on a social media platform about a potential move occurring in a specific market at a particular time. Traders will act upon it if they feel the event could be worth the risk, placing a bet even violating their rules and trading strategy.

Regardless of the circumstance, there will always be a feeling of losing out on a profitable opportunity, leading to impatience, irrational expectations, and confidence issues.

Personal catalysts FOMO in forex trading

At its core, FOMO is a psychological construct caused primarily by hindsight bias or the ‘knew-it-all-along phenomenon’ on a personal level. Psychologists describe this concept as the propensity for people to consider past events as being more predictable than they actually were.

Traders will overestimate the capability to predict events whose outcomes weren’t wholly foreseeable no matter the amount of past data study that was involved. We will only know whether a market will go up or down in hindsight.

Thus, the fear of missing out stems from traders believing they have missed out on a sure outcome. Below are the more specific occurrences of FOMO.

- Winning and losing streaks: Whether a trader has won or lost several positions consecutively, their emotions are likely to direct them towards looking for as many opportunities as possible to make up for lost money.

- Highly volatile markets: When an instrument moves above its normal volatility range, this increased trading activity might suggest a bigger rise or fall that could be too hard for some to miss.

Social catalysts for FOMO in forex trading

Let’s also remember how the fear of missing out can equally be a collective notion. On a social level, the concept of social proof causes FOMO. Social proof describes circumstances where people copy the actions of others to be liked or accepted.

If a particular society approves a seemingly successful style or behavior to be appropriate, it can create jealousy, anxiety, and greed for the FOMO trader.

Within a trading context, social media is also a major catalyst as many will post their analysis on such networks, making bold claims about where they firmly believe a price of an asset will go.

Even when a trader has some experience, it is not uncommon for them to follow this advice while disregarding their own methodology and opinions.

How to turn FOMO into JOMO

The joy of missing out (JOMO) is, of course, the opposite of FOMO. The most important concept for any trader is often not taking any position is a position too, as it results in no loss. There are 24 hours in a day and seven days in a week, yet it doesn’t mean there is always a time to go long or short.

Strategies are abundant in forex, and each presents opportunities at different periods. The job of any ambitious trader is to wait until the right conditions for that system are fully met and disregard any external influence.

This is one reason why several trading styles exist, from scalping, day trading, swing trading to position trading and algorithmic trading. Everyone has the same goal of making money, yet the point at which they arrive at this moment will not be the same. Below are some actionable tips that should prevent FOMO:

- Defining yourself by trading style and fully understanding your strategy: As briefly mentioned, one has to know the type of trader they are. Even if they see a trader on social media posting profits, they must appreciate it was another person’s opportunity and not theirs.

By understanding one’s strategy and having tested it thoroughly, there is no need to feel ‘left out.’ The point of a trading system or plan is a logical blueprint to find and exploit potentially profitable scenarios that occur at spontaneous moments.

- Understanding probabilities and limiting trade frequency: A probabilistic trader is aware that markets always produce random outcomes and that they’ll only know where price will go in hindsight. Taking more carefully planned positions focusing on quality than quantity is crucial.

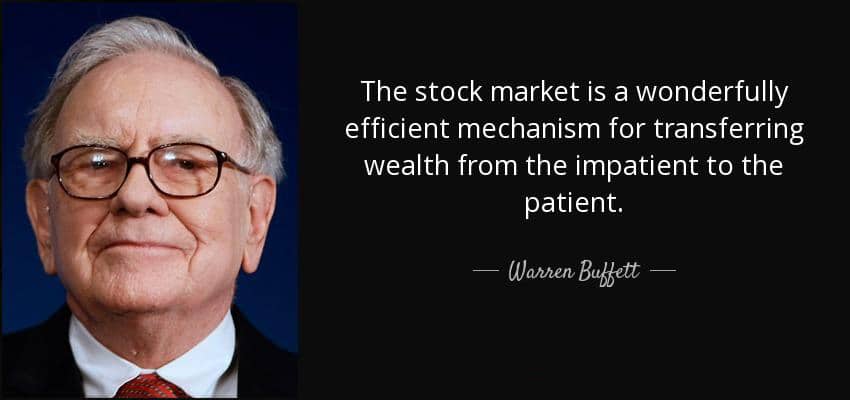

- Thinking long-term: A long-term outlook is a frequently disregarded ingredient. The amateur focuses on short-term, euphoric gains, while the professional appreciates long-term consistency is far more crucial. It doesn’t necessarily matter whether any position made money.

What should matter more is performance over months and years, as this is the true barometer for skill. This is, unfortunately, hard to achieve as humans are prone to errors.

- Mastering emotional discipline: Successful trading is not just about technical mastery but also controlling negative emotions such as greed, fear, hope, and regret.

Arguably, these four feelings are some of the causes for FOMO and rarely ever have any positive effects. If one can remove such emotions, they would have solved this challenge.

Final word

While some traders believe trading is binary, there is an overlooked middle ground where no position is typically the right decision – this is the joy of missing out. Patience is probably the single most important character trait in the markets.

Instead of having FOMO, an intelligent investor appreciates by not trading until their system tells them so precisely, they are saving money they could have easily lost through emotional impulses.

Having FOMO reduces trading probability as it increases the trade frequency and financial risk, while JOMO allows one to make well-thought decisions with a calm and unrushed mind.