GoodMorning EA trades on multiple currencies and comes with built-in risk management settings. There are numerous configurable settings within the EA, including stop-loss, filters, drawdown control, etc. Let us go through other vital details of this algorithm, such as live records, user reviews, and strategies to make our purchase decision.

Features

The robot has the following features:

- It trades on multiple currencies

- Trades various instruments from a single chart

- Works with a min deposit of $50

- There is built-in risk management

The developer states that the system does not use grid or martingale strategies. It has a smart stop loss and take profit for each position. The EA uses a night scalping approach, limiting the overall trading activity to two hours.

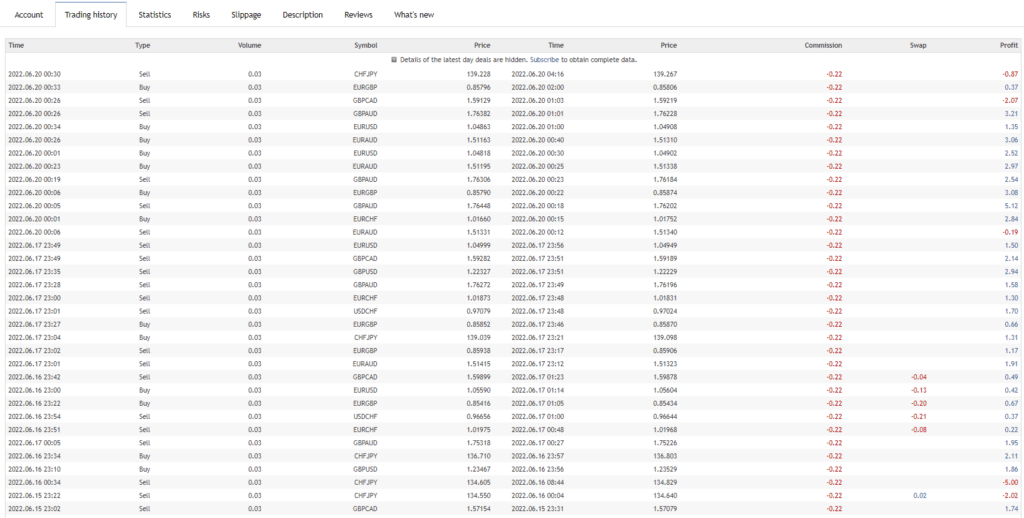

The history on MQL 5 records shows us that the robot trades at the end of the New York session. The average holding time of 6 hours contradicts the 2-hour trading constraint mentioned by the developer.

How to start trading with GoodMorning EA

To get the robot up and running, traders have to follow these steps:

- Pay for the robot on the MQL 5 website

- Download the EA on the MT 4 platform

- Attach it to the charts to start trading

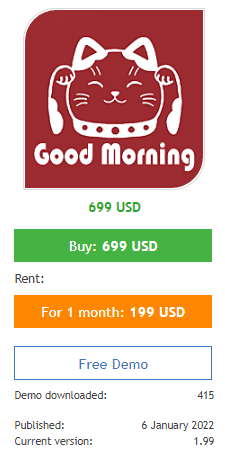

Price

GoodMorning EA is available with a one-time payment of $699. Traders can also rent it for one month at $199. There is no money-back guarantee per the MQL 5 marketplace rules.

Verified trading results of GoodMorning EA

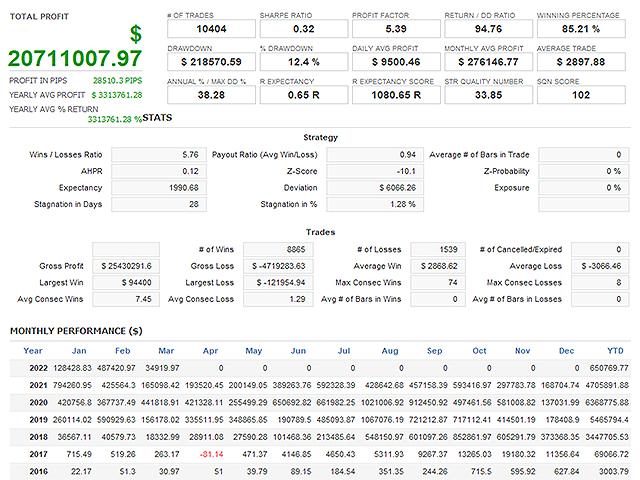

The developer shares the backtesting records as an image from Jan 2016 to March 2022. The robot placed a total of 587 trades and had a winning rate of 85.21%. The largest profitable trade was $94400, while the loss stood at -$121957.94. This shows us that the EA is trading with poor risk-reward ratios. The annual max drawdown value of 38.28% is also quite high.

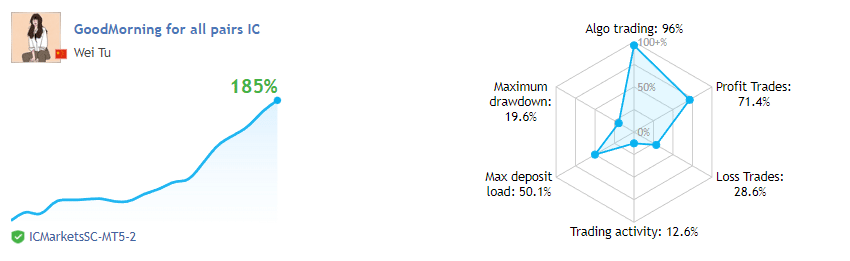

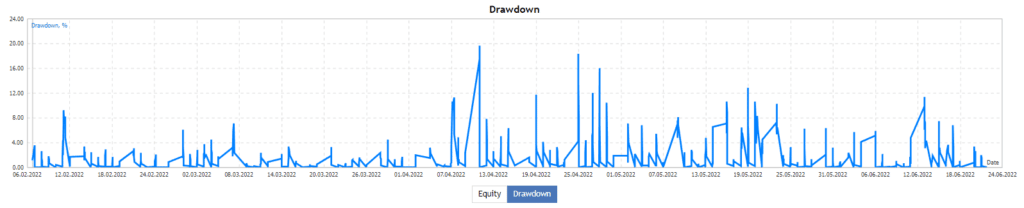

Verified trading records are available on MQL 5 that show performance from February 02, 2022, till the current date. The system made an average monthly gain of 30%, with a drawdown of 19.6%.

The winning rate stood at 71.4%, with a profit factor of 1.63. The developers trade with a small account value of $100. They might be afraid to make big deposits as the system is relatively new.

Customer reviews

There are only 5 reviews present for the EA on the MQL 5 marketplace that give it a rating of 4.4.

One angry customer comments that the algorithm is average and costly. The losers outweigh the winners. The developer uses deceptive techniques by replacing the losing live signals with the profitable ones.

Vendor transparency

Wei Tu is the author of the product who resides in China. He has a total rating of 4.7 from 14 reviews. The developer has two products published on the MQL 5 marketplace and has a total of 0 subscribers for his services. He has no trading experience, according to the website.

Is GoodMorning EA a viable option?

| Advantages | Disadvantages |

| Available for MT 4 and 5 | Live for a short duration |

| No proper backtesting reports | |

| Trades on specific brokers only |

Conclusion

GoodMorning EA is is not clear on its backtesting records. The algorithm has been live for a short duration which is not enough to judge its performance. There are few to no customer reviews on the MQL 5 marketplace, which could give us an idea of the robot’s performance.