What is a lot in forex? We express position sizing in forex as either nano, micro, mini or standard lots depending on our account balance and risk tolerance. Understanding the different lot sizes is the foundation of money management.

Overview

A lot in forex typically refers to 100,000 units of the base currency in a currency pair. However, this number can be different. Exposure in terms of lot sizes is the foundation of trading and the first thing one should learn when mastering trading basics. In forex, there are four main lot sizes, namely nano, micro, mini, and standard.

The importance of position sizing

Position sizing is the glue that puts it all together concerning money and risk management. There is no blanket approach to position sizing, nor is there a constant position size to use for every single pair due to mainly one’s account balance, risk tolerance, stop loss, and profit targets.

Regardless, a skilled trader has properly calculated their position sizes for the present and even for the potential future growth. Although having targets isn’t necessarily realistic, we can only realize a long-term monetary goal by hypothesizing different position sizing scenarios.

For example, if a trader had a goal to reach $2,000 starting with $1,000, they can map out a long-term plan of what position sizes they’d need to trade over time to obtain this target.

Position sizing unique to various trading metrics

From a more practical day-to-day perspective, position sizing is the foundation of risk management. Any slight variation in this regard can have a devastating impact. Because there isn’t a ‘one size fits all’ methodology, and a trader needs to know each unique position size for every single pair they are about to trade.

So, perhaps they could get away with a 0.1 lot size on EUR/USD, but they couldn’t say the same for a more liquid pair like GBP/AUD. Specific pairs, due to how much they move per day, naturally require slightly wider stop losses, necessitating lower position sizes.

Although we will go through the primary lot size allocations in forex, what’s equally important is for traders to accept the dollar amount (or native currency equivalent) they stand to lose based on a chosen position size, which is essentially the stop loss.

How we express lots in forex

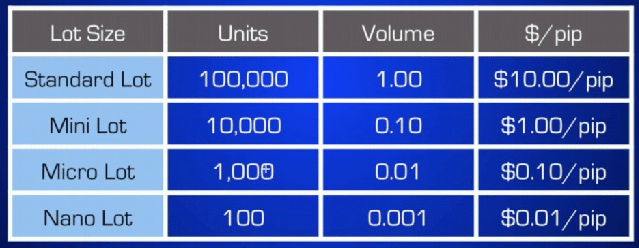

Although we shouldn’t bog ourselves down with the numbers since this is the job of a position size calculator, it helps to understand the principles. We express fractions of a tradeable currency pair in what is known as lots set according to that pair’s units:

- A standard lot size is 100,000 units of a currency pair (1 lot size).

- A mini lot size is 10,000 units of a currency pair (0.1 lot size).

- A micro lot size is 1,000 units of a currency pair (0.01 lot size).

- A nano lot size is 100 units of a currency pair (0.001 lot size).

A currency pair’s price typically has at least three places after the decimal. The smallest change in value between these points is known as a pip. What each pip is worth will vary across currency pairs:

- A standard lot size means each pip is worth $10.

- A mini lot size means each pip is worth $1.

- A micro lot size means each pip is worth $0.10.

- A nano lot size means each pip is worth $0.01.

Nano lots

Nano lots are not common in forex, only available with very few brokers. Nonetheless, they still represent a tradeable unit in the markets. Cent accounts use nano lots. A nano lot represents 100 units (0.001) of a currency pair where every pip is worth $0.01 or 1 cent.

Novice traders typically use such lots with little risk capital, and rightfully so. Either a trader testing a strategy or an expert advisor in a live setting can benefit from nano lots due to the tiny risk.

Micro lots

Micro lots are the standard for the majority of brokers globally. A micro lot represents 1,000 units (0.01) of a currency pair where each pip is worth $0.10 or 10 cents. Micro lots are still suitable for novice and intermediate traders with the right strategy and risk management.

Micro lots are at least ten times greater than nano lots, although a trader’s capital should ideally at least be 50 times higher than what they would have funded in the nano account.

For example, if a trader had $10 in the cent account, a trading account funded with at least $500 should allow trading micro lots comfortably without a high risk of losses.

Mini lots

Mini lots represent 10,000 units (0.10) of a currency pair where each pip is worth $1. What’s critical about any lot size, but particularly mini lots, is purely the size of a trader’s account and not necessarily a trader’s experience. This statement applies to all lots, but perhaps more significantly to bigger positions.

Skill and the stop loss size do indeed also play a factor where some can trade mini lots on much smaller accounts consistently. However, a bigger account (at least $1,500) is a buffer for preventing over-leveraging or margin calls.

Standard lots

The ‘granddaddy’ of all lot sizes, a standard lot represents 100,000 units (1.00) of a currency pair where each pip is worth $10. A standard lot size of any pair carries a more noticeable weight than the other lot sizes because not many traders can genuinely afford to trade positions this large safely.

If each pip is worth $10, a mere 50 pip move (which can often happen in one day) would be worth $500, which is considerable. As we’ve progressed through the different lots, we realize the required starting balance for a trading account also gradually becomes larger.

The grey area of position sizing

As with any position size, it’s challenging to recommend a universal starting balance since it boils down to a trader’s risk appetite, the varying stop loss sizes, how liquid a pair is, a trader’s skill and strategy.

All these categories of position sizing are just the accounting aspect of forex rather than a guide for how much a trader should have in their trading account for each lot.

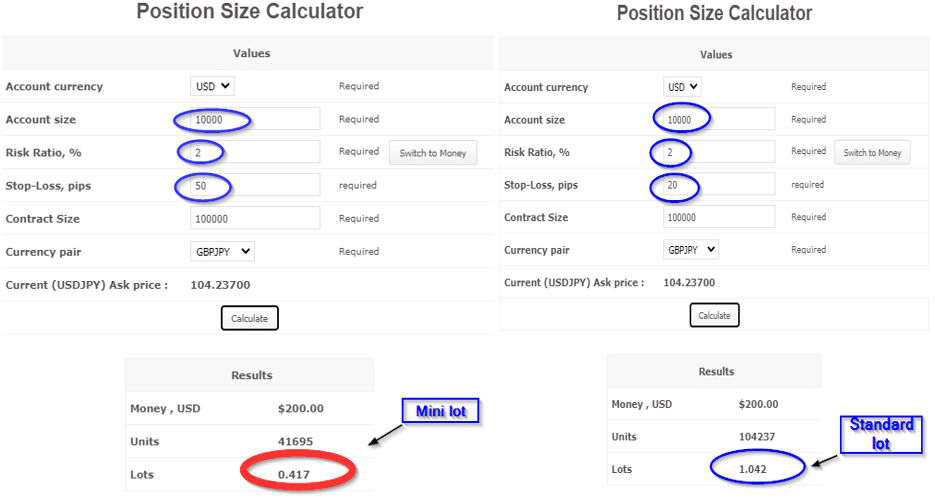

Let’s observe a scenario where a trader can have the same account balance but, because of the stop loss size, trade a micro lot in one instance and a standard lot in another.

In the image above, we can see two scenarios where a trader that hypothetically risks 2% of a $10,000 ($200) on a GBP/JPY position can trade 0.4 lots in one situation and just above a standard lot in another. The difference between the two is due to the stop loss distance.

This point emphasizes that position sizing totally depends on an individual’s risk tolerance, skill level, and strategy, which is why no one can universally prescribe or recommend lot sizes.

Conclusion

As we can observe, it’s necessary to always mind the numbers with position sizing on a trade by trade basis since this forms the foundation of money management. Fortunately, position size calculators have made this job a lot easier for traders.