In forex, the most experienced and successful consider the stop loss as their insurance, the only way to manage losses so that they do not get out of hand. The stop loss essentially accounts for much of our risk management. Understanding this basic premise is the simplest part, though there are nuances in setting a stop loss that we cannot neglect. Traders have to set the foundation about what exactly is the point of a stop loss and how they should place it beneficially.

As markets fluctuate every second of the day, we have to give a window period for our trade ideas to play out. Unfortunately, very rarely will we immediately know that we’re wrong until after some time. Hence, regardless of how far ‘in the red’ a position is, there is no logical reason to close it if the market has not yet breached our invalidation point.

The point of a stop loss is to define the invalidation point, which in itself is a loose term. Only through understanding your trading strategy by experience will one know what is the invalidation point of their trade set-ups. Therefore, there is no singular invalidation point as it varies drastically from strategy to strategy. Defining this point is a complex but necessary task.

Tens of methods exist that traders define this point by using the context of occurrences like recent highs and lows, support and resistance, pivot points, Fibonacci retracements, to name a few. How do you define the point at which you surrender and accept that a trade is not worth holding onto any longer? How do you quantify that into an exact and content price level? These are some of the questions that need answering. Getting a grip on stop losses also affects your risk to reward and how you should assess the different liquidity levels of specific pairs in the markets.

The main mistakes traders make with stop losses

Sticking with the same stop loss size irrespective of the pair and time-frame you’re trading, among other factors, can be detrimental. Regarding pairs, one cannot trade every pair with precisely the same stop loss distance for liquidity reasons, of which is continuously shifting. More liquid pairs such as GBP/USD and GBP/CAD typically require slightly wider stop losses as they tend to cover a greater distance in a shorter period. Because of this movement, the stop loss needs to be adjusted to withstand that movement. Also, if a trader is trading different set-ups, not all of them would benefit from the same stop loss distance.

With time-frames, lower time-frames generally only need small stop losses (in the region of fewer than 30 pips) as traders do not intend on holding their positions for very long. They are also only dealing with the intraday volatility, which results in them not wanting to have positions on for a lengthy time. It’s not unheard of for more long-term traders to use stop losses that are 100+ pips merely as they are dealing with a broad volatility range that requires an equally large stop.

In summary, scalpers and day traders should use tighter stop losses, while swing traders and position size traders should use wider stop losses. Knowing the type of trader that you are, does play a role in this regard.

Using the ATR to determine your stop loss

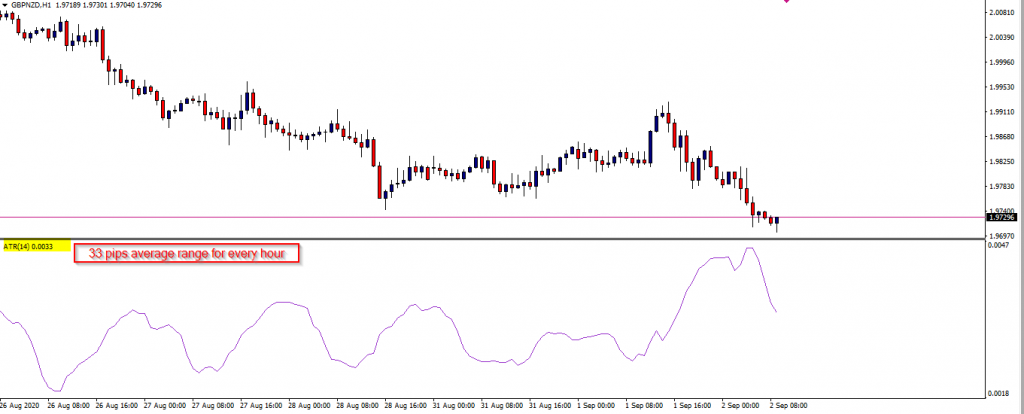

The ATR (Average True Range) is a useful volatility that calculates the average range at which a particular instrument has moved within a set period. So, in the above example, the ATR value (33 pips) means that this is the average range the pair has moved for every 1HR candle. Of course, this value is always changing, which is the reason why stop losses will differ according to this change.

Stop loss placement involves understanding the liquidity of each currency pair, and the ATR is a representation of these measures. Of course, the ATR is not an exhaustive method for stop loss placement, but it certainly is a strategic tool to improve your risk management.

Traders can use the ATR as a reference to set their stops with the time-frame they’re trading. If we’re in a fast trending market, we should expect more liquidity because the market would be moving faster in a short space of time (and vice versa). Hence, the amount of pip movement will be higher, and the ATR can guide us to position-size correctly. Setting your stop loss above the range to leave the position with enough ‘breathing space’ is the indicator’s general aim. Adjust it to your strategy, depending on the time-frame and pair.

If you’re trading off the 4H time-frame on highly liquid pairs such as GBP/CAD or EUR/NZD, using smaller stops (such as 30 or less) would not be recommended. These pairs can move this distance quickly. In contrast, 30 pips on a slower-moving pair like AUD/USD may be too wide. We can easily observe all these measurements of volatility on the ATR. In this sense, we begin to understand that stop loss is a deeper topic that massively affects both our risk and reward.

Conclusion

Understanding how to set a stop loss in forex requires one not to make some of the common mistakes that traders make. As an area of study in Forex, it should not be considered a simple idea. Liquidity, risk, and reward are areas that we need to reflect upon for every single trade.