The MetaTrader 4 (MT$) and MetaTrader 5 (MT5) are well-known pieces of trading software that are offered by most forex brokers. The two platforms have a similar appearance but are distinctly different when looked at closely. This article will look at how the software works, their similarities, and differences.

What is MetaQuotes

MetaQuotes is a leading fintech company that was started in 2000. The company builds and sells software to banks and online brokerages. Its first software was MetaTrader 4, which was launched in 2005.

The firm then launched MetaTrader 5 in 2010. The company has clients from around the world. Some of these clients are large forex brokers like IG, ATFX, OctaFX, and easyMarkets. MetaQuotes is responsible for developing and providing updates to the MT4 and MT5.

What are MT4 and MT5?

The MT4 and MT5 are software that helps traders to analyze and initiate trades on all types of assets like forex, commodities, stocks, exchange-traded funds (ETFs), and cryptocurrencies. The two are compatible on all types of computers, browsers, and smartphones.

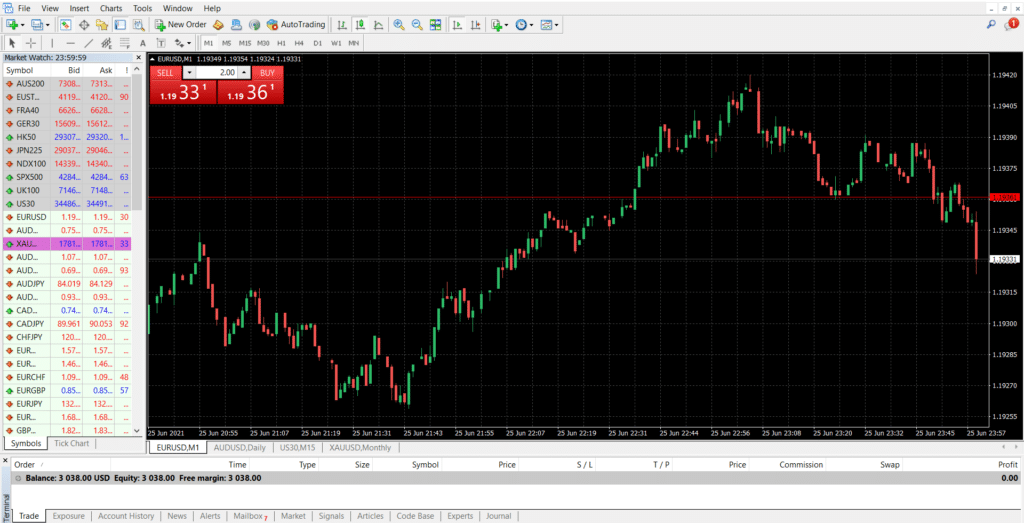

MT4 interface

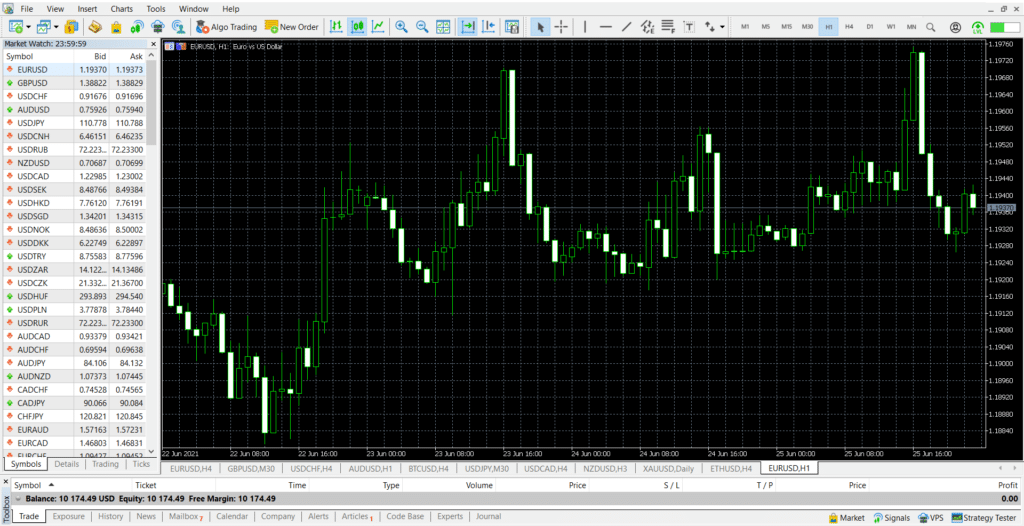

MT5 interface

The MT4 is more popular than the MT5. As seen above, the two platforms have a similarly-looking user interface.

How to use MT4 and MT5

There are four main ways of using the MT4 and MT5 platforms. First, you can download their mobile applications in Google’s Play Store or Apple’s App Store. After downloading the mobile apps, they will automatically create a demo account that you can use. As you will note, the mobile versions have less features than the desktop versions.

Second, you can download the desktop versions directly from MetaQuotes website. You can just do a Google search of either the MT5 or MT4, download it, and then install it on your computer. After installing, you can create a demo account or connect it with your live account.

Third, you can download the platforms directly from your broker. You do this by creating an account and finding the installation file in the downloads page. In most cases, the broker will guide you on how to download and install it.

Finally, you can use the web versions of the MT4 and MT5 platforms.

The functions of MT4 and MT5

The two platforms have most tools that you need as a forex trader. Let’s see what you can do through these trading platforms.

- Conduct technical analysis – They come loaded with tens of free technical indicators that you can use to analyze assets.

- Build and test robots – You can use the two platforms to build and test expert advisors. You would need coding skills in MQL4 and MQL5.

- Implement trades – You can buy and sell assets directly on their mobile, web, and desktop platforms.

- Check prices – The two have a marketwatch feature that displays prices of all assets provided by your broker.

- Conduct price action analysis – You can use the software to conduct price action analysis to identify chart patterns.

- Access news – The MT4 and MT5 have a feature where you can identify all the breaking news in the market.

- Buy robots – You can use the software to buy the robots directly in the marketplace.

MT4 and MT5: how are they different?

While the two platforms have a similar name and appearance, they are significantly different. Below are their top differences.

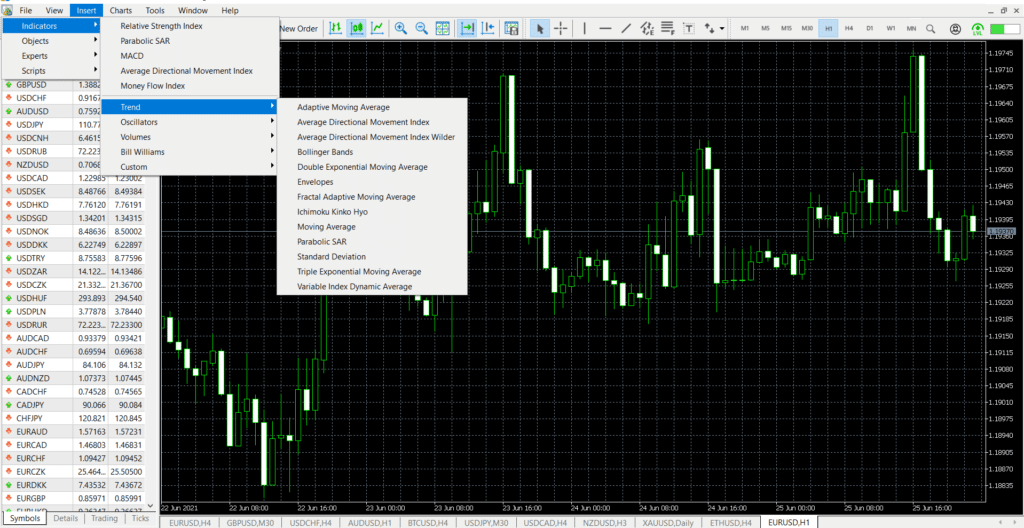

Built-in indicators

The MT4 and MT5 come with many built-in indicators to help traders do technical analysis. The MT5 has a bigger arsenal of indicators than the MT4.

MT5 has more built-in indicators

Some of the extra indicators in this platform are the Double Exponential Moving Average (DEMA), Triple Exponential Average, and the Variable Dynamic Index Average. Still, MT4 traders can access these indicators by downloading them directly from the MQL4 marketplace.

Built-in trading algorithms

The MT4 and MT5 allow traders to use expert advisors or robots to open and close trades. However, the MT5 comes loaded with several pre-built expert advisors. This simplicity makes MT5 a better platform for more advanced traders.

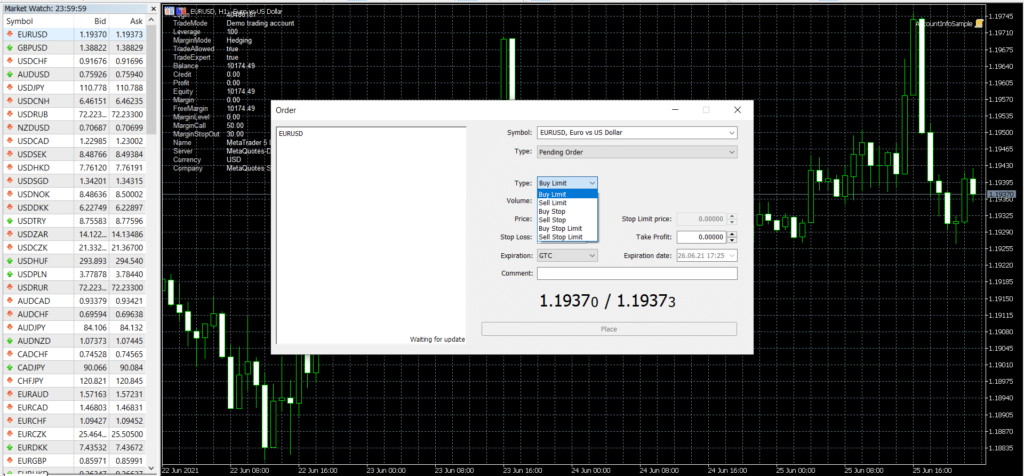

Order types

There are two primary types of orders in forex trading. In a market order, the trade is implemented immediately at the current price. On the other hand, pending orders are implemented only when a financial asset reaches a certain level.

For example, if the USD/JPY is trading at 110.00, you could place a buy-stop at 110.50. In this case, the buy trade will be implemented when the price rises to this level.

Order types in MT5

The MT4 has four order types: buy and sell limit and sell and buy stop. On the other hand, the MT5 has six order types, as shown above.

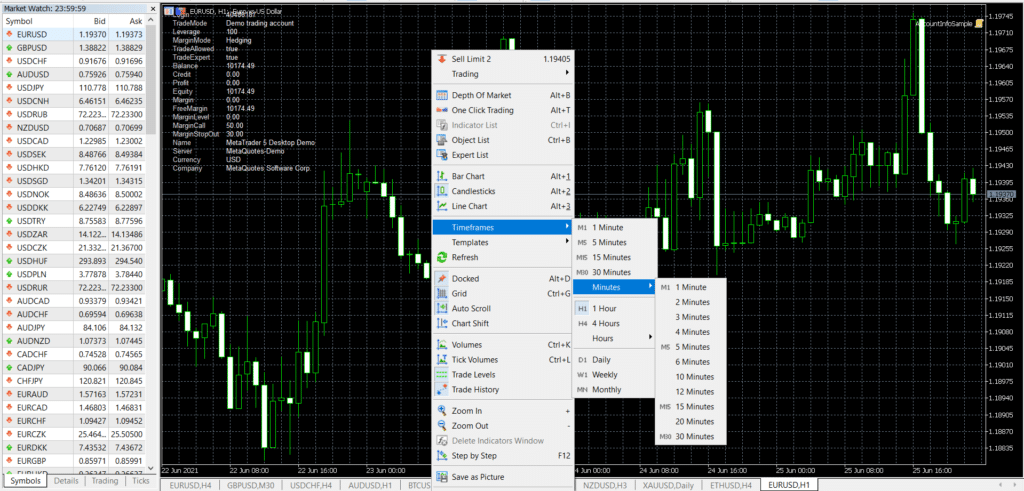

More timeframes

Timeframes are important since they help you do a better analysis. The MT4 comes with nine timeframes: 1, 5, 15, and 30 minutes, 1 and 4 hours, and daily, weekly, and monthly.

MT5 timeframes

On the other hand, the MT5 has more timeframes that stretch from 1 minute to monthly. This means that you can do analysis on a 3 minute or a 12-hour chart.

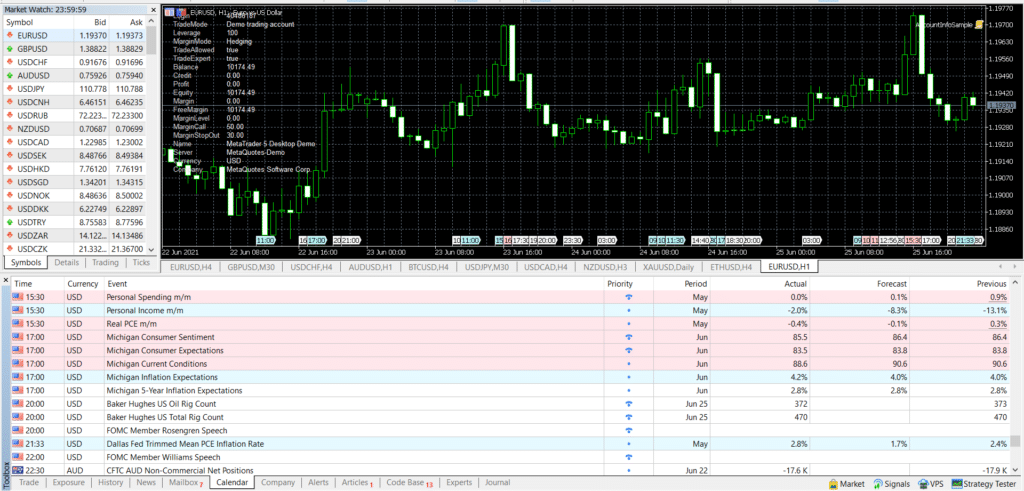

Economic calendar

An economic calendar is a useful tool when you are doing fundamental analysis. This calendar is provided for free by most online brokers and platforms like Investing.com and DailyFx.

MT5 economic calendar

The MT5 comes with an inbuilt calendar and notifications, meaning that you don’t need to use external ones.

So, which should you use?

Most forex brokers offer MT4 and MT5 platforms. Some, however, offer the MT4 only because of its popularity. At the same time, some brokers offer more assets in MT5 than in MT4. This is simply because the MT5 is seen as a better platform for advanced traders.

Therefore, for most traders, we believe that the MT4 is an adequate platform. However, for people looking for advanced features like in-depth technical analysis, the MT5 is a better platform.