What is a margin call in forex? A margin call occurs when a trader has utilized too much margin at the risk of their account being automatically liquidated. Fortunately, understanding your trading strategy, position-sizing, and money management are the keys to prevent this unfortunate event from happening.

The legendary American investor and hedge fund manager, Bruce Kovner, once alluded to the idea of novice traders trading ‘5 to 10 times too big, taking 5 to 10% risk on a trade’. What he’s referring to here usually causes margin calls in forex, which is an event that always precedes an account blow-up.

But what is a margin call in forex, and are there any actionable tips to prevent it from occurring? This article will explain what a margin call is, how it works, the importance of position sizing, and implementable ideas on how to never have a margin call again.

Defining a margin call

To understand margin call, we need a quick refresher on what margin is in forex. Any amount deposited in a trading account is known as the margin. Technically, the margin is the ‘collateral’ traders deposit to open a leveraged position.

Hence, some analysts often refer to ‘trading on margin’ since this allows for greater exposure to profits and losses (leverage) with a proportionally tinier investment. Fortunately, traders can decide precisely how much they risk for every position.

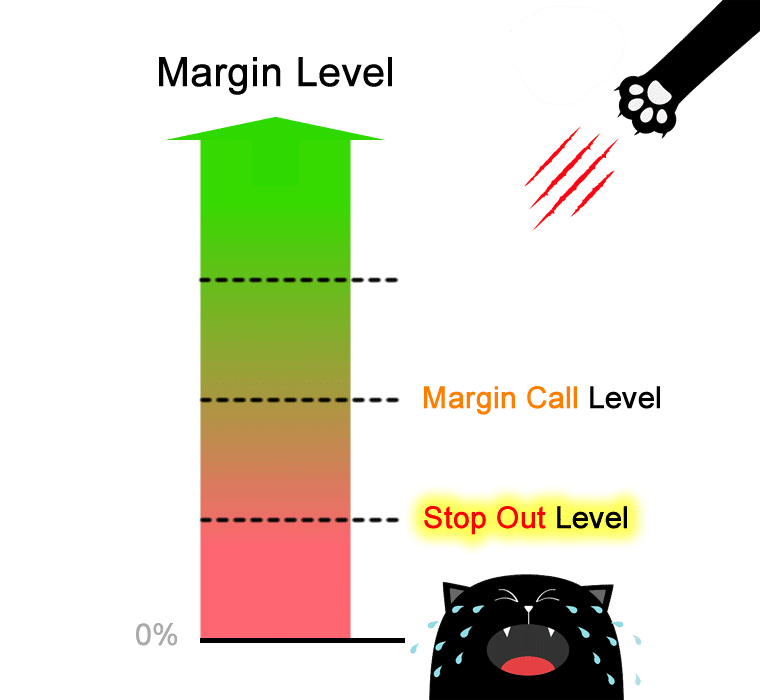

We can risk any part of our margin on a specific set of trades, though the more we use, the less the account can sustain based on the active price fluctuations. A margin call will occur when too much margin has been utilized below a specific level.

At this point, the entire account is at risk of being liquidated if no adequate deposit occurs in time to bring the balance back ‘above water’ or current positions are closed manually.

How does a margin call work?

In the old days before the digital revolution, brokers would call clients already in a margin call to deposit more funds or manually close their trades. Nowadays, trading platforms will automatically liquidate most or all positions below a specific threshold (known as the stop out level) without notice.

When choosing a broker, it’s handy to verify what their margin call and stop out level percentages are since these vary widely. The average margin call percentage is between 40% and 30% (some can be as high as 100%), where anything below this would be the stop out level.

Trading platforms will show in different ways when an account is in margin call territory. For example, on MetaTrader 4, the positions are highlighted in red. If a trader’s margin level falls below the predetermined percentage and into the stop out level, the software automatically closes most or all orders, causing a highly significant or near-zero reduction in equity.

The stop out feature is a protective measure from brokers to prevent an account from going negative (known as negative balance protection).

The first step of avoiding a margin call

Avoiding a margin call is not rocket science; it boils down to mastering your trading strategy and, more importantly, having a firm grip on position sizing and rock-solid money management.

Before understanding position sizing, one first needs to master their trading system through rigorous forward and backtesting, explicitly accounting for what they believe to be a comfortable monetary risk per trade.

Every trader must think ahead into the future about ensuring that even after the worst losing streak, they still have enough to continue trading. Unfortunately, as traders are unique, there is no universally accepted account percentage to risk for every position.

This argument has long been going on in trading communities, though the consensus seems to be between 0.5% and 3%. This percentage dramatically depends on the strategy, the type of trader one is, and their personal risk appetite.

The importance of position sizing

A mastery of the position sizing concept is one of the most critical ingredients to money management and ensuring one never blows their account. An inexperienced trader may use the same or irregular lot sizes regardless of the pair, which is quite dangerous.

For example, a 0.10 position on EUR/USD weighs differently on GBP/USD, of which the latter is a more liquid pair. The same size will use up significantly more margin on GBP/USD than on EUR/USD.

We need to treat every pair individually and realize the position size needs to reflect the monetary amount we are comfortable with losing. Fortunately, at our disposal, we can calculate the required margin for any traded pair and also the lot size for a specific trade using a margin and position size calculator.

Actionable tips to never have a margin call

Any trader experiencing a margin call shows signs of a lack of discipline, a lack of money management, a lack of knowledge, and greed. The following tips should form part of any trader’s risk management.

- Assuming one has thoroughly back and forward test their trading system, they must figure out a suitable per-risk percentage. Ideally, this number should account for the worst losing streak.

While the ‘2% per trade’ (or similar) rule sounds conservative, it may not apply to every trader. Generally, those trading frequently may need to risk less for every position, while those trading less might go as high as 3%.

However, the per-risk figure is a guide; the most crucial metric is knowing the actual dollar amount for every position.

- After this step, traders should precede every position using a position size calculator, taking into account the dollar amount at risk in line with the appropriate stop loss size. When entering a trade, traders should avoid using one-click trading and instead open an order to input the stop loss before execution.

The reason for doing so is in the rare but plausible case the markets are volatile. One may not have enough time to add a stop loss, meaning they might end up in a huge negative.

- Traders should generally avoid ‘scaling in’ very close to their initial entry for extra profits or mitigating an already losing trade. Most account blow-ups often occur from a single position with multiple orders made either from ‘scaling in’ for bigger profits or attempting to turn a losing trade into breakeven or a winner.

‘Scaling in’ refers to adding multiple positions on a trade to net significantly more profit. It is not advisable to add these orders almost at the same price as the initial entry since this is the quickest way to use up a vast portion of the margin.

An experienced and skilled trader can ‘scale in’ at logical places when their initial position is already in profit, provided they have strict rules of managing the risk.

The glue tying all these tips together is position sizing. Traders should act proactively. Even when an account is profitable, one must factor in future lot sizes accounting for any withdrawals since this will reduce the available margin.

Conclusion

Any margin call sets a trader back far financially. With experience, this is one mistake that should be permanently eradicated. Ultimately, traders need to be honest with themselves and always seriously consider money management with every engagement in the markets.