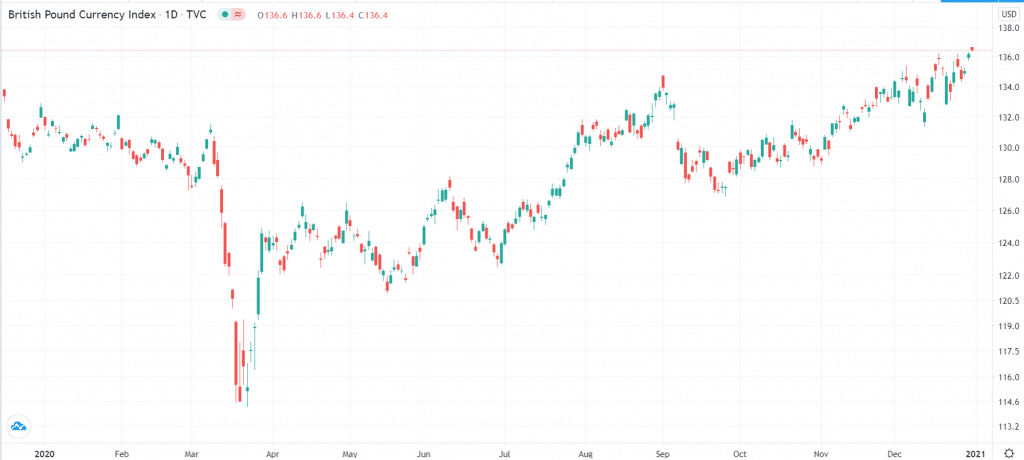

The British pound had a relatively successful year in 2020. The pound index, which tracks its performance against a basket of peer currencies, rose by more than 4% during the year. It rose by about 19% from its year-to-date low of £114.

British pound index 2020 performance

In general, this performance was because of the 4% increase against the US dollar. The pound lost against most of its peers, including the Australian dollar, euro, and the Japanese yen. In this article, we’ll look at the key movers of the sterling in 2020 and what we should expect in 2021.

Brexit was a major theme

Brexit was one of the most important movers of the British pound in 2020. While the country completely moved from the European Union in March, nothing much changed between the UK and the European Union.

That’s because, as part of the Brexit agreement, the UK had until December 31st to have free access to the common EU market. As such, most of the year was all about negotiations for a new deal between the two sides.

The two sides reached a deal a day before Christmas. This deal means that the UK will continue having access to the EU market without new tariffs. Without a deal, the two sides would have put a physical border and introduced checks. That would have affected the free flow of goods and services between the EU and the UK.

Looking ahead, the new deal is a good thing for the UK economy and the British pound because a no-deal would have led to vast job cuts, deterioration of the economy, and possible negative interest rates.

However, it is worth noting that some key issues were not included in the deal. For example, the two sides agreed to continue negotiations on financial services until March 2021.

Bank of England decisions

The Bank of England (BOE), like all central banks, had a relatively busy year in 2020. That’s because the UK was one of the worst-affected countries in the coronavirus pandemic. In total, the country confirmed more than 2.31 million cases and more than 77,000 deaths. It was also the source of the new variant of the virus.

In its response, the BOE slashed interest rates to a record low and kept hinting that negative rates were possible. At some point, the bank asked the country’s banks to prepare for such rates.

The bank also launched an ambitious quantitative easing program. It is now purchasing government bonds worth more than £875 billion. The most recent addition to QE was in November when it increased the ceiling of its purchases by £150 billion. Notably, the BOE now holds more than 40% of all Gilts (UK government bonds). The bank also created facilities to help finance the country’s companies.

Its policies were similar to that of the Federal Reserve, which brought interest rates to zero and launched an open-ended quantitative easing policy. This policy led to a sharp increase in its balance sheet to more than $7.7 trillion.

With a Brexit deal done and with the country vaccinating its residents, the are analysts believe that the BOE will not implement negative rates in 2021. Also, they believe that the bank will start talking about tightening its policies, which could include tapering of the asset purchases. This could lead to a relatively stronger pound.

Risks for the British pound

The British pound has several risks in 2021. First, as I mentioned above, the UK and the EU are yet to complete key sections of their divorce agreement. Therefore, as talks continue, there is a possibility that the two sides will be at odds about these specific issues. This could lead to volatility of the pound index.

Second, the unemployment rate in the United Kingdom has been rising. The latest numbers showed that the rate rose to 4.9% in November. While this number is better than in most countries like the United States and Australia, it is so because of the furlough program.

In this, the UK government is paying salaries to most UK employees. Therefore, since the program has three more months to go, we will possibly see a sharp increase in the unemployment rate. Indeed, the Bank of England believes that the rate will rise to more than 7% in 2021. If the situation worsens, the BOE could be pressured to shift rates negatively.

Third, another risk to the British pound is the ballooning public debt in the country. The latest economic numbers from the UK showed that the total debt rose to more than £2 trillion. The total debt rose by more than £200 billion in 2020. And the situation will continue getting worse in the coming year. Indeed, the country’s debt has already been downgraded by major rating agencies like Fitch and Moody’s.

Finally, the biggest risk for the British pound is a shift from risk-on sentiment to risk-off. As mentioned above, the biggest contributor to the strengthening of the sterling was the weakening dollar. This happened as the overall risks in the market eased.

There was a possibility of a Brexit deal, pharmaceutical companies were developing their coronavirus vaccine, and Joe Biden won the American election. Therefore, investors rushed from the safe dollar and moved to other currencies.

British pound index technical outlook

Looking at the daily chart, we see that the pound index has been in a strong upward trend. It managed to move above the vital resistance at £134.8 in December and is at the highest level in several years. The price also moved closer to the upper side of the ascending channel. It is also above the 50-day and 200-day moving averages. Therefore, the index will possibly continue rising as bulls aim for the upper side of the channel at £137.6 before having a pullback.

Final thoughts

The British pound had a relatively strong year in 2020 as its price rose by more than 4%. This performance was mostly due to the weaker US dollar. In 2021, the trend will likely continue rising as optimism of the Brexit deal rises. However, we also believe that a pullback will also be possible in the near term.