What is the Axi Order Flow Sentiment Indicator, and how can traders take advantage of this tool? Axi, the Australian-based broker, has fortunately provided a tool where users can see the live order flow of at least 23,000 of their clients trading several forex and indices markets.

Useful sentiment indicators in forex are few and far between. The Order Flow Sentiment Indicator (OFSI), provided by the Australian-based broker, Axi, is an excellent tool for analyzing sentiment.

Fortunately, by merely opening a live account with Axi (no funding necessary) and connecting it through PsyQuation, their native trade analytics platform, traders gain access to this discreetly powerful tool.

When used correctly, analyzing sentiment can be one of the best methods to decide on long-term trends. This article will cover the role of order flow in sentiment, how to navigate the OFSI, the two approaches traders can use the OFSI, and the drawbacks.

What is the Axi Order Flow Sentiment Indicator?

The Order Flow Sentiment Indicator, created by Axi, displays the order flow of at least 23 000 traders on its platform. Using this data reflects the client positions of numerous well-liked forex and indices markets like EUR/USD, NZD/USD, USD/CHF, GER30, and S&P 500.

Before understanding how this indicator could be of use, we need to briefly unpack the concept of sentiment as it relates to order flow.

Understanding sentiment

Sentiment attempts to figure out how many people are going (or going to be) long against those going (or going to be) short. In this sense, we could consider sentiment somewhat of a leading indicator because it relies on the data of real forex participants instead of a chart pattern or economic news release.

However, the critical distinction of any sentiment tool is its use as a contrarian indicator. For example, if the order flow reflected that on the NZD/USD pair, 30% of clients were long and 70% were short, the natural assumption would suggest a down-trending market (or a market that is about to fall).

Now sentiment works in reverse. In the above example, smart traders should consider this market to continue trending higher despite there actually being overwhelmingly more sell orders than buy. Why?

There is a proven belief retail traders often go against the trend by ‘picking tops and bottoms.’ We have to remember retail speculators only make up a small portion of market participants who have any significant bearing on volume.

So, which group makes up the majority? Institutional traders or ‘smart money.’ When viewing sentiment, we view it through the lens of the ‘big boys’ who often trade against retail traders and are largely responsible for virtually all trends that occur.

Thus in the previous example, the bias should be more bullish than bearish because this group often continually moves the price in the direction of the bigger trend even if the order flow suggests otherwise.

How to navigate the Axi Order Flow Sentiment Indicator?

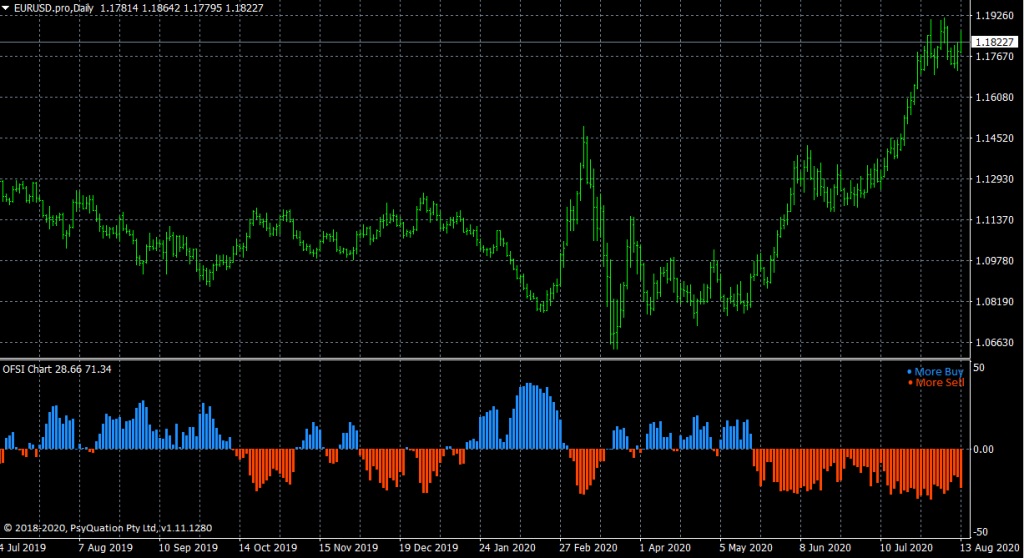

There are two methods traders can use this indicator, either through PsyQuation on a web browser (in the second image below) or via a custom MT4 indicator exclusively built by Axi reflecting each instrument’s data individually (see first image below).

If viewing the data on the web, the broker reflects the order flow of selected instruments on the 1M, 5M, 1H, 6H, and 1D time-frames.

Regardless, the information is updated hourly, which is presented in table and chart form. One of several unique features of this indicator is that clients can view the real number of trades on a specific instrument, the total lot size of those trades, and the number of actual traders.

The table essentially summarizes this data through percentages, though it’s interesting to note how Axi creates it.

How to use the Axi Order Flow Sentiment Indicator

Now that we’ve briefly explained order flow as it relates to sentiment, we can begin to understand how this indicator can be valuable to traders. The first premise of any sentiment tool is it should not be used as a ‘timing indicator.’

Traders need to appreciate order flow changes frequently, and attempting to time entries through this is futile and inconsistent.

Confirming an existing trend

The main job of a sentiment indicator is to simply provide a directional bias. It should not be the only reason for making a trading decision. Still, if one desires to know the real long-trend before approaching any market, a sentiment indicator is one of the most under-utilized yet powerful methods of doing so. Let’s look at an example below:

On the daily chart, the data suggest an overwhelming number of buy orders (indicated in blue), 80.28% (at the time of writing). However, it’s easy to conclude by looking at the actual daily chart above this that the movement is downwards, reinforcing the idea retail traders tend to ‘pick bottoms’ (buying at the bottom of the downtrend in this case) or ‘pick tops.’

Thus, the safer bias to pick in this scenario is looking for selling opportunities.

Confirming the possibility of a trend change

Now, what if the situation was in reverse? If the data now suggested that around the current price of EUR/NZD, there were more sell orders than buy orders, this could indicate an imminent trend change (if we think in a contrarian manner, more sell orders could mean an uptrend).

Traders may decide not to act on this information, although it can be the first reference to finding other clues that may support this idea. Overall, this indicator can give valuable insights into the strength and presence of an existing trend and also the possibility of a new one.

Pros and cons of the Axi Order Flow Sentiment Indicator

However, as alluded to before, Axi only provides the sentiment of only a couple tens of thousands, a stark contrast to the real millions trading. Also, price is extremely dynamic, and sentiment can change at the drop of a hat. Nonetheless, traders can and should use the OFSI as the first or last point of reference after conducting their own analysis.

Pros

- This tool reflects the order flow (updated hourly) of actual live client positions. Users can also segment the data according to various performance metrics on PsyQuation.

- The OFSI covers a decent number of popular forex and indices markets.

- Assuming a trader understands the contrarian nature of sentiment, this tool (and others like it) is subtly powerful in confirming an existing trend (especially long-term), the likelihood of it continuing, and whether there could be a reversal in the future.

Cons

Much like any sentiment indicator, Axi’s order flow reflects only a minuscule portion of the actual participants (at least 23,000 clients) in forex. Other sentiment tools from larger brokers such as IG reflect significantly more clients.

To add to the previous point, unlike the IG Client Sentiment Indicator, for example, the Axi OFSI does not provide a directional bias. Therefore, traders should conclude on their own the result without a guide.

Although this tool is free of charge, one needs to have a registered live account (it does not require funding) with the broker and connect that to PsyQuation.

Conclusion

Sentiment analysis is a topic rarely discussed in forex communities, although it is a powerful concept once we understand the role of retail and institutional traders. Price moves primarily because of the volume generated by the ‘big boys.’ Therefore, by understanding their behavior, we can align our trading decisions accordingly.