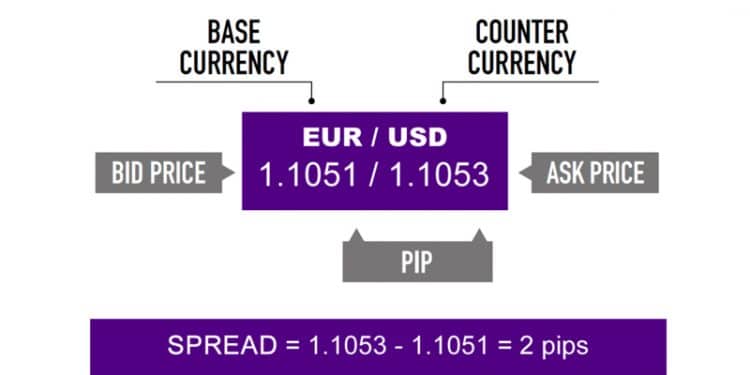

Traders understand the spread in forex is the difference between the bid and ask prices. In simpler terms, we can also think of the spread as the primary trading cost we incur per trade levied by brokers for connecting us to the markets.

Variable spreads and fixed spreads

We classify spreads are described by two categories: variable or fixed. Let us see what they mean.

Variable spreads

A variable spread means the spread fluctuates variably in line with market dynamics. Commonly, we expect that during times of volatility (such as during high-impact news releases or the start of new trading sessions), spreads can widen.

This unpredictability is said to be the main disadvantage with variable spreads. Also, during quieter times, spreads can widen erratically. The issue of variable spreads affects the high-frequency traders whose systems need predictable trading costs more than others.

Another noted problem with variable spreads is slippage. Slippage typically occurs during hectic periods where the broker cannot acquire the best spread from their liquidity providers, causing a ‘slip’ in the requested price that can either be better or worse than expected.

However, variable spreads are generally preferred because they reflect real-time price changes in the market, which offers transparency.

Fixed spreads

Fixed spreads are more like fixed commissions levied per trade. This method tends to be frowned upon by most trading communities due to a lack of transparency and possible conflict of interests, although one distinct advantage exists.

Regardless of the market conditions, a trader always knows the cost of every position consistently, unlike variable spreads that can fluctuate at different times. The technical disadvantage with fixed spreads, aside from those already mentioned, is the occurrence of requotes.

Requotes are similar to slippage because they tend to occur during busy periods. Although the spreads are fixed, there isn’t always a guarantee a trader will get an order at their requested price.

Since the broker wouldn’t be allowed to widen the spread in line with market dynamics, they may do a requote where they offer a new price, which is, in most cases, not optimal.

Overall, no spread type is better than another because it largely depends on different trading metrics that vary from one person to another.

How spreads vary between different kinds of brokers

When choosing a broker, the spread can tell us information on the likely brokerage model a broker uses. Brokers mainly use either the STP (straight-through processing) or market maker model to process trades.

Observing the spreads can give one an idea rather than exact answers. By understanding this aspect, traders can make a more weighted decision that aligns with their trading experience, style, and strategy.

Traders generally consider STP brokers superior to market maker brokers mainly because of the spread. Most of them utilize multiple liquidity providers, meaning they can provide competition and usually offer reduced spreads to their clients.

These brokers continually establish an extensive network of liquidity providers, meaning their pricing reflects even the minutest of price changes. In contrast, market maker brokers don’t have this luxury as they’re usually their own liquidity provider, and they typically offer higher spreads.

How the spread affects different kinds of traders

Any kind of trader, especially scalpers, day traders, and those who trade news, are likely to opt for an STP broker for the lower spreads. Many strategies used by these types of traders need very tight spreads, as this does have a noticeable bearing on profitability.

The disadvantage here is as spreads from these brokers are variable, slippage can occur more often, increasing the risk of unfavorable entries. So on the other hand, these traders could also consider fixed spreads offered by market maker brokers to ensure their trading costs are predictable, despite the risk of conflict of interest and requotes.

Longer-term and more experienced traders would be okay trading with a market maker broker primarily as the higher spreads won’t severely affect their profitability. By holding positions for long periods, the spread would only account for a tiny fraction of the profits.

Longer-term and more experienced traders can fare equally well with variable spreads due to trading less frequently, meaning their trading costs aren’t a massive factor compared to their counterparts.

Methods to minimize spreads

There is no foolproof technique to utterly get rid of spreads. Even when a broker claims a zero spread account, there’s still a commission charged for every trade, just like a normal spread. Rightfully so, brokers have to charge a trading cost for acting as a brokerage between clients and liquidity providers.

Referring back to a zero spread account, this is one method to minimize the impact of spreads because the costs are fixed regardless of market conditions. These benefits are useful for all traders, but especially short-term traders who don’t have to worry about fluctuating spreads.

Other means to minimize these costs depend entirely on the type of trader one is and the pairs they trade. In forex, major pairs are the cheapest pairs tradeable, with minor pairs or crosses being the second cheapest and exotic pairs being the most expensive.

The latter is generally avoided for this very reason, although it doesn’t make a difference to longer-term speculators. Commonly, most traders engage with major and minor pairs for the cheaper spreads, while long-term traders are still comfortable with exotics since the higher spreads don’t make a noticeable difference to their profits.

Conclusion

Spreads are an essential aspect to understand for all kinds of traders since they are the most recurring trading cost. In this article, we can observe how the spread’s prevalence affects one’s trading style, strategy, and decision in choosing the most suitable broker.