Backtesting in MetaTrader 4

You have probably learned that backtesting is a very important part of every EA’s development life-cycle. It is a stage where you will get the first insight into your forex robot’s performance, and you will learn what can be expected on live trading. If you are using MetaTrader 4, a leading Forex trading platform, you can backtest in its built-in Strategy Tester tool. To do it correctly, you need to download historical data. You can do so from the official platform’s repository.

The quality of historical data is crucial for the relevance of the backtesting process. The modeling quality has to be at least 90 percent to consider the process as relevant.

However, the better the number is, the more reliable backtesting will be, more similar to the result that you can expect on live trading. MT4 uses randomly generated prices from bar data.

Using interpolation, it takes the bar price data with the tick count to generate the prices for each bar. It ensures that the price starts at the open price, touches the bar high and low, and ends at the close price. So, if the position has a stop loss and a take profit within the bar, a tester will randomly hit one of these two levels.

What is Tick Data Suite?

The Tick Data Suite uses actual price ticks, and in that manner, it ensures modeling quality at 99 percent. It is almost a perfect model, and a backtesting process will use prices that were actually traded. Tick Data Suite can be found at www.eareview.net, and it can be purchased on a subscription basis.

The package includes a tick data service, a license key, support, and updates. The price of a monthly subscription is $11.9, while a yearly Tick Data Suite price is $113.9. A lifetime subscription costs $539. A free trial is available for a period of 14 days. It is a plugin for a MetaTrader 4 Strategy Tester that allows the usage of tick data. It is compatible with all MT4 builds above version 940.

The installation process is straightforward. After you have installed the product using the Tick Data Manager is the application in which you can select the tick data you want to download from the server. Downloaded data can be used for backtesting in all your MetaTrader 4 instances.

The Tick Data Suite allows traders to easily download free historical data from Dukascopy pertaining to various instruments, including stocks, forex indices, and commodities.

Other Dukascopy alternatives Tick Data Suite data sources include Alpari, Forex.com, IBFX, Pepperstone, FXCM, FXDD, etc. Depending on the source, the data goes back to 2005. It includes all the majors, minors and crosses, and even some exotic pairs and CFDs. The data also includes broker spread and swap variations.

After you have installed the suite and downloaded data, you can start the backtesting with tick data precision. To do so, run your MT4 instance and open the Strategy Tester tool, where you will find the ‘Use tick data’ checkbox. Mark it and select the expert, the trading instrument (make sure it is the one you have downloaded previously), and the period.

If you want, you may use the visual mode to see how the expert is performing. Generally, backtesting using tick data will be slower but much more reliable. The suite also allows Renko bar backtesting, and it is achievable only in a few clicks.

Tick Data Suite advantages

To understand the importance of backtesting data quality, I did a simple test. For the same expert advisor using the same entry parameters, the same period, and the same trading instrument, I ran the trial with Tick Data Suite and with historical data downloaded from the official MetaTrader 4 repository.

I was surprised when I found out that the difference was significant. My testing period was one year (the whole of 2018), and the difference was around 15 percent. I did not expect it to be that high since the standard platform data modeling quality was 90 percent. It just tells you how crucial it is to have the correct data to consider the backtesting process as relevant. Looking at the Tick Downloader vs. Tick Data Suite, we won’t get different backtesting quality as both services source price data from Dukascopy.

Tick Data Suite disadvantages

One of the most significant downsides to using Tick Data Suite to backtest a trading strategy is the need for a strong internet connection. An internet connection is a must to access real and detailed data recorded tick by tick.

While the software comes with a trial version that is free to use, once 14 days have elapsed, one must pay a monthly charge to be able to use it. A monthly subscription of $97 or a lifetime subscription of $499 might be quite expensive, especially for retail traders with small trading accounts.

The continuous monthly subscription is an added cost of trading that one must cater for to be able to enjoy the full benefits of the Tick Data Suite.

Where can I get free tick data?

Forex Tick Data Suite is a highly sophisticated trading tool that provides the most accurate forex tick data based on real trading information. The software downloads all free historical tick data depending on the financial instruments one is looking to trade.

Consequently, the free tick data is stored in a centralized database for fast and simple access while one is carrying out backtesting. The centralized data system makes configuring the program easy and running backtests without manually handling data files.

Additionally, the Tick Data Suite is designed to ensure one gets the most accurate backtesting conditions.

Can I get MT4 99% modeling quality?

Tick Data Suite 2 is the latest upgrade that offers the fastest and most convenient way to reach a 99% modeling quality, almost the same as real trading. It uses real tick data, thus making it easy to use expert advisors in the MetaTrader 4 Strategy Tester.

Tick Data Suite 2 offers the fastest and most convenient testing method. Additionally, users don’t have to resort to third-party services that offer quotes as all data is downloaded from the Tick Data Manager application.

As it stands, MetaTrader does not store the actual ticks from the broker’s server. Therefore, it can only support backtesting using fixed spread instead of variable spread, as is the case with Tick Data Suite. Therefore, using estimated ticks can pose significant challenges if you have a scalping strategy that takes a profit at 10 to 20 pips.

Tick Data Suite bypasses all these bottlenecks by using variable spread. In this case, one can use the real bid and ask spreads as they were used at a particular time to backtest a given trading strategy. Additionally, real bid and ask prices make it possible to challenge expert advisors with conditions encountered on live servers.

How to use Tick Data Suite?

The Tick Data Suite is a must-have tool for anyone looking to backtest any strategy or expert advisor on the MetaTrader. The software program must be installed into the same directory as the MT4 one is trading on. The installation is designed to ensure free forex tick data is not overwritten and helps avert MT4 size limitations.

Tick Data Suite is programmed to download all historical tick data. It is this information that traders use to analyze a trading strategy. The information is stored in a centralized data system whereby it can be accessed for backtesting. Advanced settings on the tool make it possible to backtest without manually handling any files or multiple processes.

In addition, one can set tick data using real historical spreads (ask-bid) to implement slippage. The tool ensures one gets the most accurate data and conditions for backtesting a strategy or trying out an expert advisor.

Additionally, Tick Data Suite makes it easy to take a second look at a strategy while evaluating it before taking it live.

What are the Tick Data Suite packages?

Tick Data Suite comes in different packages designed to address the financial needs of each trader. A yearly plan is on offer going for $211.9. With the package, one is guaranteed a license key and one year of support plus updates.

A monthly Tick Data Suite plan is also available for those who are not able to cater to the cost of a yearly plan. The plan goes for $109 and comes with a license key and one month’s worth of support and updates.

A lifetime plan is also available to those who do not wish to contend with monthly or yearly plans. The plan goes for $549 and comes with a license key and a lifetime worth of support and updates.

Tick Data Suite alternatives

Forex Tester 3

Forex Tester 3 casts itself as professional software for developing trading strategies. The software program is designed to enable detailed analysis. It comes with 5+ built-in Expert advisors and 118 symbols.

Forex Tester 3 vs. Tick Data Suite: Advantages

- It makes it easy and fast to backtest manual trading strategies using historical data.

- Possible to test combined manual and automatic strategies, i.e., can enter trades manually and exit automatically.

- Possible to see how a strategy works in real-time.

- You can test multi-currency and multi-timeframe EAs.

- Allows the testing of more than one expert adviser at the same time.

Forex Tester 3 vs. Tick Data Suite: Disadvantages

- It is a costly backtesting tool going for as much as $300

- Requires a lot of learning to get a feel of how it works

- Works only on Windows operating systems

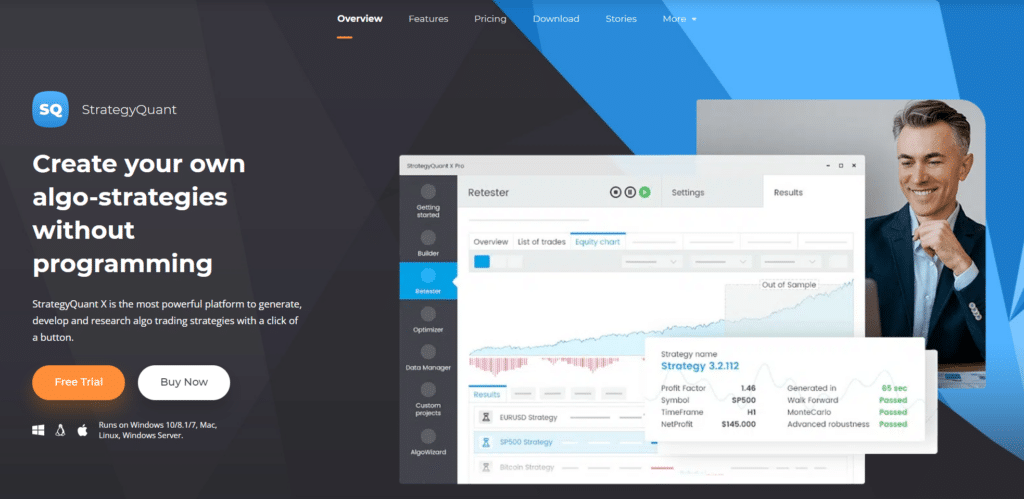

StrategyQuant

StrategyQuant is a powerful program for anyone looking to develop a trading strategy online. The software uses advanced techniques, thus ensuring tried and tested strategies are robust and capable of having an edge in the market. If we compare the popular Birt’s Tick Data Suite vs. Strategy Quant, the lifetime license of the latter is significantly more expensive.

StrategyQuant vs. Tick Data Suite: Advantages

- It comes with an easy-to-use interface.

- It comes with lots of options and building blocks.

- Compatible with MetaTrader and TradeStation.

- Updated regularly with new features designed to enhance the backtesting experience.

- It has a two-week free trial.

StrategyQuant vs. Tick Data Suite: Disadvantages

- Quite costly with an ultimate package going for $2900

- It is mostly suited for Forex trading

- Limited support

- Has a small community

Tickstory

Tickstory is an ultimate application for backtesting tick data. It is designed to make it easier to backtest MetaTrader 4 Expert advisors with reliable and accurate data. With this application, you can download historical tick data from any trading application.

Tickstory allows traders to perform 99% of modeling using historical tick data. Currently, there is a free product for anyone looking to get a feel of how it works. If impressed with the trial version, it is possible to upgrade to Tickstory standard product with additional features and curated to offer more technical support.

Tick Data Suite vs. Tickstory: Advantages

- Tickstory offers easy access to quality historical trading data from free data sources.

- With Tickstory, you can store and manage data from one place for quick access.

- The charts and data inspector feature you can view and analyze with ease.

- Tickstory has made it easy to export data to chosen trading systems.

Tick Data Suite vs. Tickstory: Disadvantages

- Quite expensive with a standard monthly package going for $59.

- Mostly useful in forex trading.

- Not ideal for novice traders as it requires lots of learning.

How can I use tick data in backtesting?

Using tick data in backtesting is essential as it enables robust and granular backtesting. The use of real and accurate data also makes it easy to understand how a trading strategy is likely to perform in the future. Additionally, the use of tick data covers many different strategies, including day trading to high-frequency trading and intraday.

There are different sets of tick data that one can use to backtest a trading strategy. For starters, there is executed and derived data. Additionally, there are tick data derived from executable quotes and data from actual trades.

Depending on the data set, one can get varying results while testing a given trading strategy. Therefore, it is important to backtest a strategy on the various tick data sets to get a feel of how a given strategy is likely to perform in the live market.

While backtesting using tick data won’t tell how a strategy would do in the future, it can provide valuable insights. Consequently, if a given strategy performs poorly in a backtest, it might be wise to shelve it and look for another strategy. In addition, if the returns in a live account deviate significantly from historical backtested returns, it might signal a strategy is not behaving as expected.

Final thoughts

So, Tick Data Suite is MetaTrader 4 plugin that ensures tick data precision for the backtesting process in Strategy Tester. The data is available for download for all majors, minors, crosses, exotics, and CFDs dating back to 2005. It is available for different brokers, and it also includes variations in spreads and swaps. It ensures the modeling quality of the process to be at 99 percent, almost as real trading. The tool is important to consider the MT4 backtesting process as the relevant one.