Dozens of myths and misconceptions plague forex trading. It doesn’t matter whether you are an established trader or a newbie, but you have faced these misconceptions anyway. This post is going to look at ten of the most popular forex trading myths. Most of which concern unrealistic revenue returns, regulations, trading brokers, trading strategies, and starting capital investments.

1. It would be best if you had a lot of money to trade Forex

A misconception runs around that forex trading requires extraneous amounts of capital to begin. It is a big lie; even those who start with hefty sums of money usually employ money management principles that take only a 3% risk on their money. Therefore, this strategy alone lays a possibility to start trading with a few hundred dollars.

Trading well and employing money management principles will help a small investment grow and avoid blowing up the entire amount. A small amount is advisable, to begin with. Because it sets a perfect pace for practicing, and one gets ahead at trading while the amount continues to grow.

2. All you need is a strategy

One of the biggest myths you will find out there. Con artists employ this to fool traders into believing their trading strategies are superior and promise 100% returns. Most of these free scams could also guarantee thousands of dollars for hourly trades. Commonly referred to as the perfect system, it has been used by many forex scammers to blind newbie traders into believing in such a thing, such as an ideal trading strategy.

The truth is that you need to have a strategy and stick to it firmly. At the same time, being able to adapt to a rapidly changing trading environment and financial markets is also a must. And this is when your strategies could change significantly.

3. Trading is easy

Popularized marketing of forex trading has fooled many into thinking the venture is easy and often lauded it as a get-rich-quick scheme. Many people, therefore, believe it is an easy thing to trade and make money. It is sadly not true and indeed sporadic for a forex trader to get rich quickly. The venture takes patience and lots of risks. Hence it is not a way for traders to make money and close business.

Even the most seasoned traders could make losses and sometimes take huge profits. What is needed is consistency, patience, and the urge to keep learning. Nonetheless, it is relatively easy to open and download computer software for trading. However, succeeding in consistently making money is complicated. Some talented traders learn very fast. However, it is worth it given enough time to learn, practice, and develop their trading strategies.

4. Don’t Pay for Education and Trading Tools

Traders have to be willing to pay for quality. Relying on free learning resources is a poverty mindset and has resulted in many traders opting for low-quality tools and education to remain afloat. An important metric to consider these resources and tools is that their creators take a considerable amount of time. Therefore they require to be compensated in one way.

Nonetheless, there are numerous learning resources on several authority blogs for forex trading. One can also take advantage of this as they understand the ins and outs of the venture. However, at some point, an individual should be willing to pay for high-value resources.

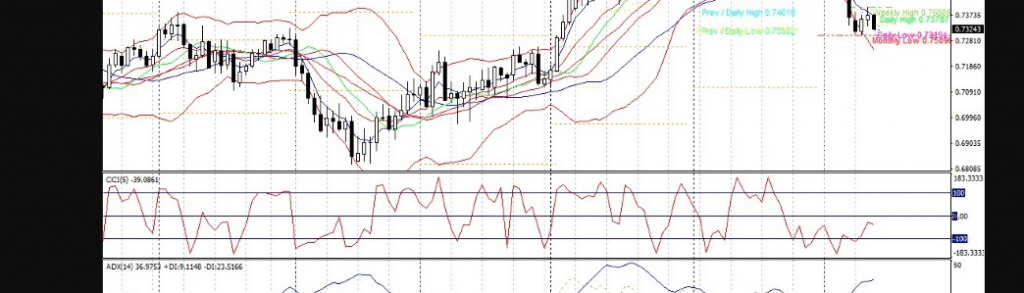

5. More confirmation signals – the better results

A guarantee in trading is infinitely in-existence. Some traders opt for more confirmation signals with the hope of getting better results.

However, this notion is untrue since a trader chart will look cluttered and confusing to identify the price. Furthermore, little to no possibility exists of the indicators lining up at the same time.

6. Trading more Instruments more often leads to more Profits

Trading more instruments or holding more positions does not necessarily grant traders more profits. It is hectic managing a new active account, and this can easily harm performance.

An overloaded account is uncertain and poses a higher risk for the forex trader. Meanwhile, at times these currencies and digital assets will hedge against each automatically as one move up across their prices. Multiple instruments are, therefore, not the holy grail of successful forex trading.

7. You have to know precisely why and where the price is moving

It is almost impossible to have a 100% guarantee on the direction a trade will take. Even market insiders alone do not have such information, and it’s useless to claim an individual trader will have 100% knowledge of the market. There are dozens of reasons why a market movement takes place. The true key to success is managing your risk/reward ratio.

However, successful traders usually exploit essential market information to connect the puzzles. Traders can employ and practice these critical pieces of information through in-depth technical and fundamental analysis.

8. Money managers can easily make you rich

Seasoned forex trading professionals could come in handy in providing aid to newbie traders. However, relying on this information alone is suicidal and should be understood and filtered through-oily.

The internet is full of advice on how to trade successfully and several money managers who guarantee traders with perfect trading strategies. However, since the trader is the sole recipient of any losses or profits, it is worth their time to learn their skills.

9. Successful traders predict price moves

There is a perception out there that the best traders predict market movements. However, this is untrue because it is nearly impossible to have a 100% guarantee on the evolution of a financial instrument.

Good traders take advantage of the best market conditions to execute a trade, and where there is no market advantage, they sit on the fence. Traders who attempt to predict market patterns usually fail and blow out their investments to zero balance.

10. The market maker is hunting for your stop orders

It is important to control and manage your risks. But relying on stop loss as the sole saving grace is a misconception. There are trading scenarios that do not require stop losses and some which require mental stops while watching overtrades.

Conclusion

Most newbie forex traders believe in these myths because they all float around on the internet. In many cases, however, these myths are untrue and extremely limiting for the beginners.