The rise of cryptos has sparked a surge in trading. Crypto traders can execute trades at any time of day, which is one of the main advantages of crypto trading over conventional forms of trading. To get the most out of their investments, traders need to use cryptocurrency trading strategies. High-frequency trading is one approach that has gained popularity due to its effectiveness. HFT was first developed in the early 1980s after NASDAQ introduced a purely electronic form of trading. As computer processing power improved in the twenty-first century, the market saw increasing rivalry in the creation of HFT methods. HFT traders are increasingly conducting transactions based on microsecond differences.

Definition

HTF seeks to profit from market price inefficiencies by employing algorithms, supercomputing power, and low-latency trading technologies. HFT is a good target for market instability since it necessitates large-scale trading and is most profitable in volatile markets. It is an extension of algorithmic trading. It manages the sending of small trading orders to the market at high speeds, often in milliseconds or microseconds.

HFT has gained traction in the cryptocurrency world, largely because of the multiple trades per second that can offer plenty of benefits. Of course, there are specialized firms that provide HFT platforms for institutional investors in order to help them profit from cryptocurrency’s extreme volatility. One example is the Bitsgap platform.

How does HFT work?

HFT is mainly automated. Computers are designed with advanced algorithms that continuously analyze all cryptos across various exchanges millisecond by millisecond.

Trading professionals develop algorithms designed to detect trends and other trading triggers that other traders are unable to detect. The programs open a huge number of positions at a rapid pace based on analysis. The main objective is to be the first to benefit from the algorithm’s detection of emerging trends.

HFT algorithms usually involve two-sided order placements, buy-low and sell-high, in an attempt to benefit from bid-ask spreads. HFT algorithms also try to “detect” any pending large-size orders by sending several small-size orders and evaluating trade execution trends and time. HFT algorithms strive to profit from big pending orders by modifying prices to fill them and make profits if they detect an opportunity.

Strategies

Arbitrage trading

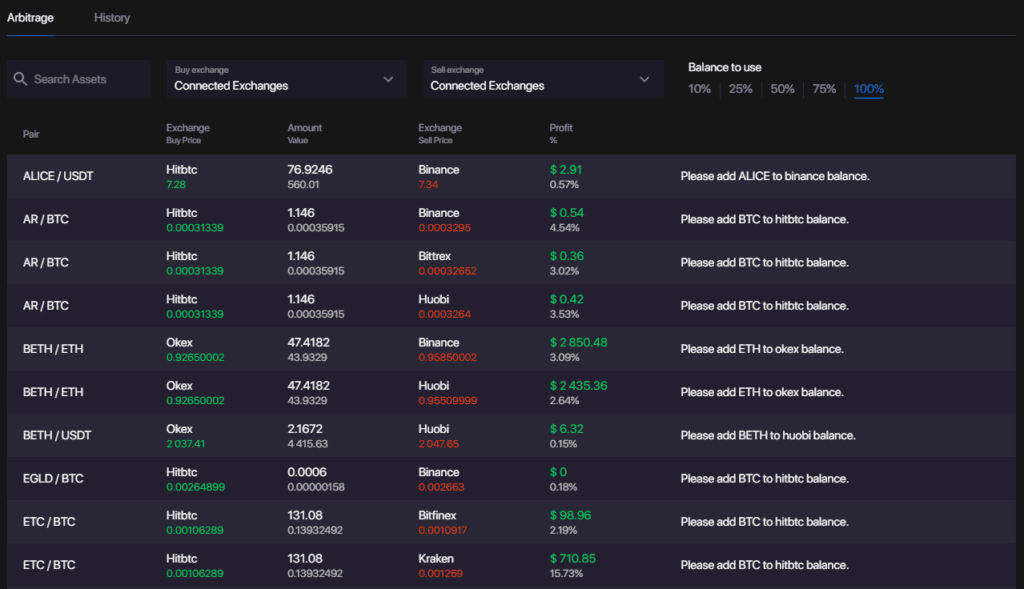

Arbitrage seeks to make a profit by making simultaneous purchases and sales of the same assets but in different markets. Manual execution may seem hard, but Bitsgap makes it look simple by combining the capabilities of its automated and AI-powered solution.

Scanning all available markets for arbitrage opportunities is difficult. Fortunately, Bitsgap can scan all markets on any exchange it supports, identifying even the tiniest price differences and arbitrage opportunities.

At Bitsgap, the potential of arbitrage is calculated based on your account balance. You also have the option of choosing between crypto-to-crypto and crypto-to-fiat arbitrage. Bitsgap will factor in the various fees and charges charged by competing exchanges when calculating its expected profit percentage. This speeds up the process and allows you to proceed with an arbitrage deal if the numbers are in your favor.

Market-making opportunities

Market making entails submitting both bid and ask limit orders on a cryptocurrency exchange in order to provide liquidity on that cryptocurrency. Market makers earn from the bid-ask spread by accumulating it across numerous trades. You’ll need fast and stable technology as well as effective risk management to succeed in market making.

Market making is typically done by large corporations and is considered a beneficial strategy for keeping important markets liquid. A market maker gives other market participants “enough leeway to maneuver” by placing huge buy and sell orders. They can always buy or sell it fast and without having a significant impact on the asset’s price. Some exchanges even strike deals with market makers to allow them to trade on their platform so as to provide liquidity.

Pinging strategy

Pinging refers to the strategy of entering small marketable orders in order to learn about large hidden orders in dark pools or exchanges. Verification cycles take a fraction of a second, and HFT traders may perform hundreds of these “traces” per minute, thanks to advanced software. The trader already has a substantial advantage after determining the “places” on the chart where the most frequent selling or buying of an item occurs. Pinging is mostly used in dark pools and is directed at large market makers. These are either private exchanges or forums where the order book is not displayed in real-time.

Advantages of HFT

- The procedure can be automated. Algorithms can spot market opportunities and open hundreds of positions in minutes or seconds without the need for human interaction. Price patterns are usually detected by HFT trading platforms before anyone else.

- HFT provides liquidity to sustain the trading markets. Even if it’s short-term, it minimizes bid-ask spreads by bringing greater liquidity.

- HFT algorithms assess markets and execute trades using complex mathematical processes; thus, it eliminates human error. There’s a lower risk of making poor decisions due to fear and emotion, which are frequently to blame for manual traders’ losses.

Disadvantages of HFT

- Compared to traditional trading strategies, HFT has a relatively high risk-to-reward ratio. A high-frequency trader’s profit potential is limited to a few cents per position.

- Many defective algorithms or scam platforms exist to lure traders into paying in advance for a service that has yet to be demonstrated to operate.

- HFT has been criticized for assisting a privileged set of traders in profiting at the expense of smaller participants who do not have the same access to costly algorithms.

- Because the various orders placed by traders endure for a few seconds or minutes, it only provides “ghost liquidity.” This also causes market manipulations and unnecessary volatility, for instance, flash crashes.

Summary

HFT is better suited to institutional investors who have a thorough understanding of the market and are prepared to deal with unexpected outcomes. There are trading bots used to automate the process, which makes it easy. The main strategies include arbitrage trading, market-making opportunities, and pinging strategy. Bitsgap is one of the best platforms for HFT, particularly during arbitrage trading.