As with any business, forex comes with transaction costs. Fortunately, as a currency speculator, the expenses to participate in the markets are minimal. However, the one constant cost to deal with is the spread.

The concept is pretty simple. Forex brokers perform an excellent and complex job of offering us access to the markets. To compensate for their efforts, such organizations add a markup in prices between those sourced from liquidity providers and the values we ultimately see on the charts.

One advantage is that forex is still an incredibly cheap market to trade, meaning transaction costs are affordable. However, spreads are still a big deal for many traders, especially day traders and scalpers.

So, this article will cover the significance of this ideology and the top 5 low-spread forex pairs to follow.

The importance of low spreads

While it may seem insignificant, a mere variation can make a big difference. Let’s assume you paid, on average, a one pip spread on EURUSD. Assuming you traded a standard lot on this pair (where every pip is usually worth $10), it would cost you $10 to execute this position.

If you opened two orders daily for 30 days, that would total $600 in transaction costs. Considering that the average investor trades far more often, this example is quite conservative.

So, this tells us that a reduction in execution fees is highly beneficial, particularly if you trade frequently. Low spreads are also associated with stability and high liquidity. More people can place orders smoothly and regularly when a pair is cheap to trade.

The sheer volume essentially ‘stabilizes’ price movements. For instance, major or US-based pairs offer the lowest spreads and are less volatile. Although some level of volatility is crucial, too much volatility can be a bad thing as well.

Let’s consider more volatile markets, most notably exotic pairs. Although these instruments can offer unique opportunities, they are more volatile, meaning higher spreads. You’ll see that such markets tend to be ‘choppy’ or erratic in many cases since they are thinly traded.

The other reason traders desire tight spreads is for finer entries and profit targets. It’s not uncommon for scalpers to target as low as five pips or less for a position. Therefore, if a pair incurs even a two pip spread, the price would need to travel further to book profits.

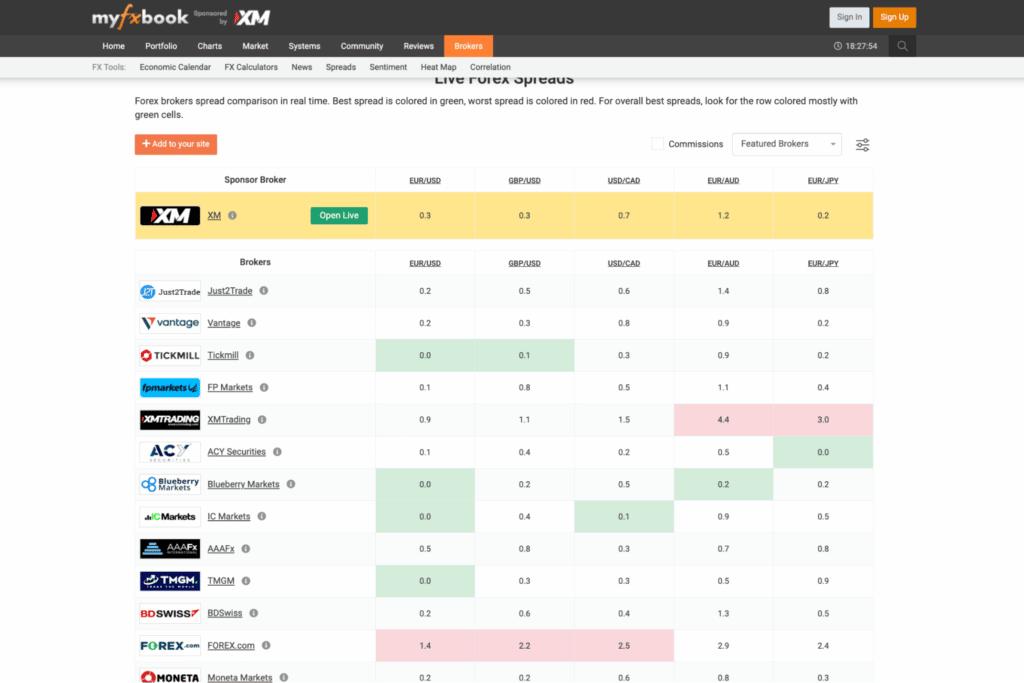

The table above is from Myfxbook, collated from thousands of live accounts provided by several popular brokers. It details the typical pips to pay for each of the top 5 low spread pairs we’ll review.

EURUSD

Many scalpers may only follow this pair as it’s attractive to trade for several reasons. Firstly, it’s the cheapest as you generally won’t pay above a pip spread with most brokers much of the time.

Secondly, as the most traded currency pair in forex, the euro is far less volatile, with a reasonable daily range. Due to the enormous liquidity, you are less likely to experience any slippage or execution issues.

Moreover, due to the amount of interest given to major pairs, you can find the latest and most historical data, whether you’re performing technical or fundamental analysis.

GBPUSD

GBPUSD (or ‘Cable’) also frequently ranks highly in the most traded currency markets as it represents two of the most dominant economies, the United Kingdom and America. Typically, you shouldn’t pay above a two-pip spread with this pair.

However, this market is distinct in its high volatility, habitually the highest among major pairs. It’s unsurprising seeing this instrument move several hundreds of pips for weeks or months in one direction.

Yet, at the same time, Cable is still relatively stable and liquid, hence why it offers affordable transaction costs.

USDCAD

Like the pound, USDCAD (or ‘Loonie’) doesn’t generally incur more than a two-pip spread. This pair is normally the second-most volatile major market after GBPUSD since it’s regarded as a commodity currency.

Because Canada is a substantial oil exporter, CAD’s price strongly correlates to the ‘Brent Crude.’ Therefore, USDCAD is an interesting market to follow if you’re looking for a pair driven less by US economics.

Similar to GBPUSD, Loonie’s volatility is not excessive like other non-USD instruments (although, in extreme cases, it can).

EURJPY

While EURJPY (or the ‘Yuppy’) has an average spread of about three pips with your run-of-the-mill broker, it’s still not overly expensive for most traders. Alternatively, you may consider a zero-spread account.

Overall, EURJPY is an excellent pair to have on your watchlist. Firstly, it shares little correlation to the ‘greenback.’. Therefore, this market will not greatly expose you to American events. More significantly, Yen-based pairs are more volatile than USD-based pairs.

Therefore, you can experience more extensive daily ranges than the latter. As a minor pair, EURJPY is more sensitive to any fundamental events, especially relating to Japan, being that it has a smaller economy than the US or the EU.

EURAUD

EURAUD has slightly higher spreads than the four previously mentioned markets (usually not above five pips). However, similar to EURJPY, it can produce equally pronounced movements than US-focused securities.

While not a major pair, the euro Aussie still enjoys substantial interest from speculators as it represents European Union and Australia, which are vastly different in size and scope.

The Australian dollar is usually deemed a commodity currency as Australia is a massive gold exporter. Overall, EURAUD is a suitable minor pair with reasonable spreads providing you some diversification away from American fundamentals.

Curtain thoughts

It’s worth noting that most of the pairs we’ve highlighted here are tied to the US dollar. Therefore, you should understand the correlations and ensure you’re not unintentionally doubling your risk by taking the same position (i.e., buying USDCAD and selling GBPUSD).

Nonetheless, transaction costs can undoubtedly impact your bottom line, particularly if you’re a short-term chartist. Although spreads tend to be stable for most trading sessions, they can widen erratically during high-impact news releases and illiquid periods.

Therefore, you must understand any factors that increase spreads to keep them as low as possible.