Forex is a 24-hour marketplace. While one can place trades whenever the marketplace is opened, it is good practice to focus on specific hours while trading various securities. EURUSD being the most liquid gives rise to profitable opportunities throughout the week. However, when is it appropriate to trade it?

Understanding the EURUSD

The pair denotes the exchange rate between the euro representing the European Union trading bloc and the USD, denoting the US dollar for the United States. In simple terms, it signals the number of dollars required to purchase the common currency. For instance, when denoted as EURUSD 1.1200, it simply means one needs 1.1200 dollars to buy one euro.

It is important to note that this pairing represents some of the biggest economies in the world; on one corner, it is the US and, on the other one, the EU. Consequently, it is the most traded and the most liquid currency pair.

EURUSD boasts of a daily turnover of about $1.17 trillion, accounting for almost a fifth of the total value of transactions placed in the currency market on any given day.

Understanding volatility

By virtue of being the most liquid, EURUSD is the most traded, attracting the most trades on any given day. Consequently, it tends to be active whenever the markets are open. However, that does not mean the exchange rate fluctuates rapidly throughout the day.

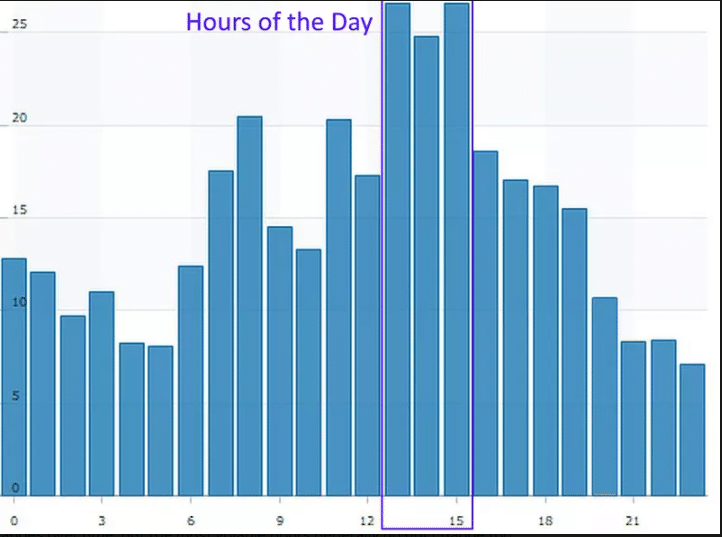

The fact that volatility fluctuates throughout the day means some periods are better for trading than others. To be able to capture some of the largest movements perfect for generating significant returns, it is important to time the market.

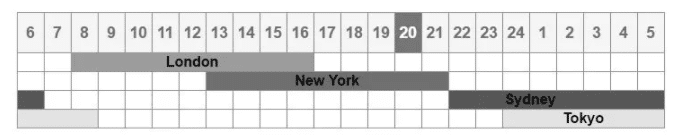

The pair enjoys heightened levels of volatility and the most trades whenever the European session is open, running between 0800 GMT and 1600 GMT. During the period, some of the largest markets in the EU are opened, resulting in more participants betting on the euro and the British pound.

Additionally, the number of trades on the pair increases when North American bazaars come online from 1300 GMT to 2100 GMT. When the New York session is up and running, traders in the US and other forex participants pay close watch to the buck, consequently influencing the common currency price action.

The best trading hours

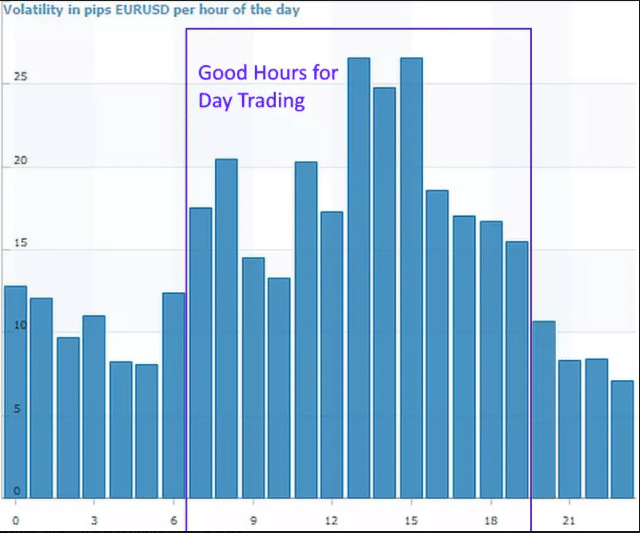

The best time to trade the EURUSD is when the European and North Americas sessions overlap, that is, when both are opened. Between 1300 GMT and 1500 GMT, the pair tends to see the most action given the increased number of participants speculating on it.

With elevated levels of volatility during this period, opening and closing positions are pretty easy and at the desired prices. Additionally, spreads are usually at their lowest level, making it possible to generate optimum profits.

According to the chart above, it is clear that volatility in the pair tends to increase starting at 0700 GMT when the EU session comes online to 2000 GMT. In addition, it tends to peak between 1200 GMT and 1500 GMT when the New York and London sessions overlap.

Consequently, day traders should look to open trades between 1200 GMT and 1500 GMT as its exchange rate fluctuates rapidly, making it easy to profit from short-term price movements. The overlapping times are usually the best given the increased levels of liquidity and wide pip range movements.

The worst times to trade

Despite being the most liquid, EURUSD offers ideal trading opportunities only when both the New York and London sessions overlap. Even though the pair can still be traded even when the two sessions are closed, it is not advisable given the reduced liquidity and widened spreads.

Between 2200 GMT and 0700 GMT, markets in the US and Europe are closed. During this period, the price might fluctuate but on thin margins. The thin margins translate to more spreads when opening trades, consequently reducing the prospects of generating optimum returns on small price movements.

Additionally, between 2200 GMT and 0700 GMT, the security does not fluctuate rapidly. Therefore it becomes increasingly difficult to generate maximum profits while banking on minor price movements.

News release

In addition to watching market overlaps, it is also important to focus on when economic releases, affecting people’s sentiments. News releases are the heart of the soul of the trillion-dollar marketplace that powers sentiments, consequently causing wild fluctuations.

A big news release such as Gross Domestic Product in the EU or the United States has the potential to enhance a slow trading period by triggering wild swings. While a dozen economic releases happen each day, it is important to only focus on those that inspire euro and US dollar sentiments.

Interest rate decisions by the European Central Bank and the Federal Reserve, Consumer Price index data, and Trade deficits are some of the major economic data that affect EURUSD action. The Non-Farm Payroll report released the first Friday of each month is also a significant market mover of the security.

Bottom line

EURUSD is one of the best for day traders looking to take advantage of heightened levels of liquidity and rapid movements. Such conditions make it easy to hit desired targets more regularly. Additionally, it makes it easy to open and close positions at the desired price points.

However, it should not be traded throughout the day as some hours provide better profit opportunities than others. The pair is most active and volatile when the European and North American sessions overlap. During this period, it experiences significant swings that make it easy to generate optimum returns from slight movements.

Additionally, ideal trading opportunities crop up whenever economic data are released. Therefore, traders should always be on the lookout for key data likely to sway trader’s sentiments and trigger significant swings.