Talk of the US dollar is like music that never stops, no matter the season. When the global economy seems to be teetering on the brink of annihilation, investors talk up the US dollar. The same happens when global trade is booming because, well, the greenback is the oil that lubricates the gears of the world economy.

To put the significance of the US currency in perspective, there are investment funds whose strategy is to bet that the dollar will strengthen over a given period – often called dollar-bull funds. The opposite (dollar bear fund) also exists. A currency has to carry some serious clout to attract this kind of attention.

Introduction to the concept of dollar-bull

During the daily operations in the market, the US dollar value either falls or climbs, depending on several factors. For example, signs of economic growth in the US could induce more traders to seek dollar bills. This is because a strong US economy underwrites a strong dollar in the currency markets.

However, the dollar might not be strong today, perhaps due to political instability at home or the presence of risk-on sentiments in the market – where investors’ appetite for risk is elevated. If the current trend of the dollar against other major rival currencies is going down and somebody elects to go long in favor of the greenback, such a person can be described as a dollar-bull.

How dollar-bulls define their views

In another sense, a dollar-bull is a trading strategy that one adopts, much like a dollar-bear or so. Like any other strategy, therefore, there are certain factors one considers before adopting a given view. Here are some of the factors that go into dollar bulls consideration:

- Strength of the economy

When the economy performs at full employment and inflation is just right, a currency tends to strengthen in the market. For example, the US economy experienced fast growth between 2018 and 2020 (just before coronavirus struck). US equities reached multiple record peaks in this period. Simultaneously, the trade-weighted US dollar index registered expanded in value for two straight years, as the figure below shows.

Figure 1: Trade Weighted US Dollar Index

- Commodity prices in the global economy

The US dollar accounts for the lion’s share of global trade. The preference for the currency in trade stems from the Bretton Woods System era when all major currencies were convertible to gold via the US dollar. As time went by, the US continued to increase the prominence of the greenback in global trade by expanding its military might.

For this reason, the dollar is in great demand when commodity prices fall. Lower commodity prices induce more buying as countries and companies race to stock up before prices shooting up again. Therefore, a dollar-bull sees an opportunity for the dollar’s value to go up in the event of low commodity prices.

- Economic crises

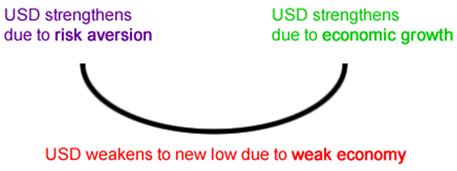

As mentioned in the opening paragraph of this piece, the US dollar is the currency for all seasons. The dollar smile theory best captures this scenario. This theory is the brainchild of Stephen Jen, an economist, and former banker. It says risk aversion strengthens the dollar, so does economic growth. The figure below gives a vivid explanation.

During an economic crisis such as the one wrought by the coronavirus pandemic, investors rush to the dollar to protect the value of their wealth. Let us go back to the trade-weighted US dollar index chart to see what happened. As economies begin to lock down to control the spread of the disease, the value of the dollar notches higher. The flight to the dollar begins to wane as central banks initiate radical measures to buoy their domestic economies.

Figure 2: Trade Weighted US Dollar Index

- Geopolitical instability

Since WWII ended, the US dollar has been enjoying something called “The Dollar Privilege.” This means that other countries rely on the dollar as their reserve currency and that the reserve currency status allows the US to influence geopolitics disproportionately.

In the event of geopolitical instability, investors swarm the dollar market because they believe the military might of the US is capable of defending the value of the greenback.

Dollar-bull versus dollar-bear

Similarly, some investors have confidence in the dollar’s potential to strengthen in the future, and some believe the dollar will drop. These are what the market calls dollar-bears. Similarly, some market players developed dollar-bear funds in which investors can put money and earn a profit in case the dollar market tanks.

Dollar-bears are, by principle, pessimistic about the future of the dollar. They believe other currencies have the potential and ability to take over the dollar’s privilege. As such, the core strategy of these traders is taking short positions on the USD in each currency pair that they trade.

Why would someone take a pessimistic view of the dollar? Some factors that influence this position include a belief that the burgeoning US national debt threatens to clobber the US economy into smithereens. If the US reneges on the debt, the economy might take a bad hit. Also, the US could try to print more dollar bills to pay the debt, resulting in hyperinflation.

Conclusion

Whether you are a dollar-bull or a dollar-bear, this could be a lucrative trading strategy, especially if strong fundamentals and technicals back your position. However, one should make sure to do extensive research before assuming a certain position.

For example, many analysts have been predicting the collapse of the dollar, but that has not happened yet. Others have been predicting a more powerful dollar as the trade continues to globalize and supply chains become more efficient. Presently, the dollar’s future is difficult to predict because of many factors, some of them being the rise of cryptocurrencies.