One may be wondering what the Monte Carlo casino has to do with forex. It may be quite surprising to know gambling and trading forex share many similarities. One somewhat unexplored technique for testing the future robustness of a trading strategy is by running a Monte Carlo simulation.

This article will explore what Monte Carlo is in forex with a few examples, why it can be highly beneficial, and some of the pros and cons of this approach.

What is a Monte Carlo simulation?

The concept of Monte Carlo sees its use in many diverse fields like mathematics, engineering, science, insurance, finance, or just any sector dealing with physical, mathematical, and forecasting problems.

A Monte Carlo simulation is simply a system predicting various outcomes through the application of random variables. For instance, let’s assume a trader was profitable for one month with a particular strategy but was concerned about its long-term consistency.

If they took 50 positions within this time frame, based on their current results, they can run a simulation of 300 trades and see whether the strategy is generally profitable or not through several equity curves.

If they were interested in seeing how their system performs if they missed a certain number of trades, the simulation would also produce a new equity curve where they can observe if there’s profit or not.

Other variables traders could change, depending on the simulation, are entries, exits, the order that trades were executed, etc.

As the term suggests, ‘Monte Carlo’ comes from the famous eponymous French casino destination. Gambling shares many similarities with forex in terms of random chances or outcomes.

Stanislaw Ulam, a Polish-American scientist, and John von Neumann, a Hungarian-American scientist, collaborated in the late 1940s during a nuclear weapons project. They found that Monte Carlo simulations were necessary to predict the likelihood of different atomic collisions.

An example of a Monte Carlo simulation

A manual method of employing Monte Carlo exists primarily through the use of an Excel spreadsheet, but, of course, this can be a little complex and time-consuming. Fortunately, there are software packages, some free and some at cost, that can efficiently run these simulations automatically.

The software will link to a trading account to read its data. Each platform should have its own parameters over the formulas it implements for the Monte Carlo as this can vary slightly according to the various probability distributions.

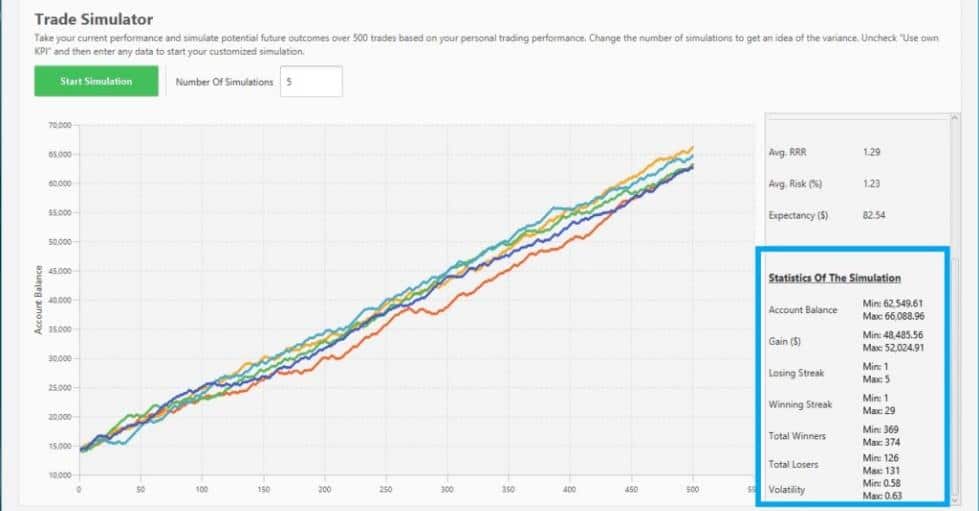

The image above is from Edgewonk, an excellent trading journal with a simulation feature. We should observe there are five simulations over 500 trades and the crucial performance data on the right-hand side.

The most vital part about this picture is the slope of the equity curves, which is clearly depicting an upward direction. This shows us the strategy is likely to be profitable over the next 500 trades assuming the performance remained consistent.

What is the use of a Monte Carlo simulation?

By its very nature, trading results are quite random because of probabilities. Randomness is rooted in Monte Carlo simulations as it utilizes this attribute to provide a range of probabilistic outcomes over time.

In other words, Monte Carlo is one beneficial tool providing an approximation about the future of someone’s trading strategy. It’s a method of ‘stress testing’ a strategy and can expose any potential weaknesses in the present moment that someone might encounter later on.

It is difficult and time-consuming to test the robustness of a system without any simulation because humans cannot manually create sufficiently randomized situations.

Pros of Monte Carlo simulations

Running this kind of simulation instills confidence with solid, quantifiable data rather than just claims. Running a Monte Carlo simulation can provide traders with the maximum drawdown, risk of ruin, and losing streaks their strategy could have over hundreds of positions.

All these metrics are paramount when it comes to risk management. Very few traders are truly mentally prepared for losses, resulting in system-hopping or losing faith in their strategy altogether.

If someone knows to expect a losing streak of six positions sometime in the future, this wouldn’t be challenging to deal with. Of course, we cannot exclude all the information about the upside the simulations also offer.

Cons of Monte Carlo simulations

The main disadvantage with Monte Carlo is the trader needs to already have a profitable trading strategy, preferably for at least six months. One would not be able to benefit from these simulations if their equity is negative, even if they are technically using a profitable strategy.

If traders were to employ Monte Carlo in the latter scenario, the calculations would likely show a losing account. Therefore, acquiring profitable data for the best simulation could be a time-consuming challenge initially for some. Another critical factor is the outcomes have to come from one single and consistent strategy.

Analysts also argue Monte Carlo cannot incorporate rare fundamental changes that could affect someone’s trading system. For instance, political instability might result in highly volatile markets, which will affect the trader’s results.

If the simulations run prior by someone do not include these conditions, the Monte Carlo data will not correlate if the current performance is severely affected by unexpected situations.

The point above relates to the importance of having as much data for the Monte Carlo simulation as possible. If a trader can collate trading results even during the bad times, their Monte Carlo statistics will be more effective. Lastly, there seems to be no recommended number of simulations traders should be running.

Final word

Monte Carlo is by no means a perfect tool, but it provides confidence to a trader with actual quantifiable data. Many traders can claim various statistics such as ‘this strategy has a 75% win rate’, though very rarely is there solid proof over this statement beyond the current outcomes.

Even if a system has a relatively high win rate, this is no indication of how well it can perform far into the future without some form of random simulation. Monte Carlo helps traders have more confirmation about the profitability of their trading strategies over a lifetime.

If they run into a losing streak, they will better understand that it’s normal. By following all the rules of their system, they will not change any strategy because the data offers them much-needed faith.