The USD/JPY currency pair has had a long history of trading and exchange. JPY is the official currency of Japan while USD is the official currency of the United States. In this article, we look into the USD/JPY currency pair and find out some of the drivers of the Japanese Yen in relation to the US dollar.

What is USD/JPY?

Being one of the largest currency pairs in the world, the USD/JPY currency pair accounts for a huge volume of the forex market exchange and international trade. This is why it is a major forex pair. Japan is also one of the biggest world economies in terms of GDP and a big exporter in dollar terms.

The Bank of Japan (BoJ) is the central bank for the Japanese Yen. As is the case with the central banks of most developed nations, BoJ acts to facilitate growth and minimize inflation. But, it is deflation that has been the cause of real concern for many years in the case of Japan. Over the years, BoJ has mandated extremely low rates in order to stimulate economic growth and demand. In fact, the actual rates in Japan in 2010 were in the negative.

Let us investigate how these policies have an effect on the Japanese Yen in the forex currency market.

Carry trade in JPY

The low-interest rates set by BoJ makes it a major source of capital for traders for carry trading. It is a trading strategy in which traders borrow money in an economic environment with low-interest rates and then reinvest that money in assets that can have higher yield from other countries.

As mentioned, since Japan has a policy of almost no interest rates, JPY becomes a major source of capital for such a trade. At the same time, any changes to this setup, such as an increase in the interest rates in Japan, can lead to major consequences in the currency market, especially for the JPY/USD currency pair. Furthermore, given how loose the monetary policy is, the benefit of a strategy, such as carry trading, may be disappearing quickly.

What moves USD/JPY

No two currency pairs function the same way as there are multiple factors that influence each pair. The USD/JPY pair is no different. In the following sections, we take a look at some of the factors that can influence this important currency pair.

1. Market risk appetite

Market risk appetite is used in order to describe the general market sentiment or investor behavior. A positive risk appetite shows that the economic outlook is upbeat and the levels of volatility are normal, while a negative risk appetite shows the volatility to be high and the economic data disappointing and negative.

Market risk appetite is important for Yen as it is considered to be a ‘safe-haven’ asset. During a downturn or panic, preserving capital in JPY among a few other assets (USD and gold) is seen to be the best course of action.

Downturns in other financial markets due to crisis or some bad news in the global markets will certainly lead to an appreciation of JPY. The predictability is so strong with JPY in the past five decades that every single economic downturn has been preceded by an appreciation of JPY. Such a high level of sensitivity of JPY can be quite a problem for Japan since more than half of all the Japanese companies thrive on profits from global sales. But, when JPY gets stronger, the earnings don’t translate into a lot of yen.

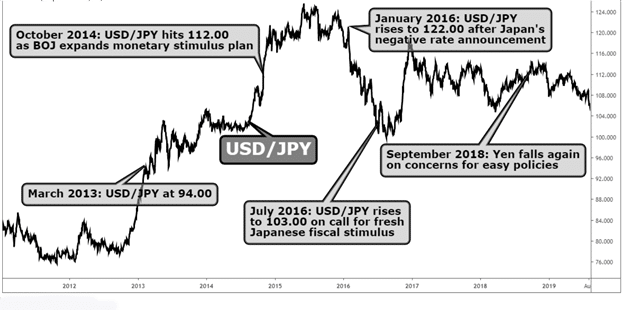

2. Bank of Japan

The Bank of Japan (BoJ), as mentioned before, has been trying to tackle slow growth and deflation over the last two decades quite aggressively. BoJ is also involved in currency interventions as it sells yen to make Japanese export more competitive. However, such intervention has had political consequences in the past, which has made the bank reluctant to intervene in the forex market.

Given the predictability of the USD/JPY currency pair, the devaluation of the USD, and the safe-haven status of the JPY, the latter have become quite strong and threaten the trade surpluses that made yen attractive in the first place.

In a bid to boost economic growth and tackle deflation, the interest rates have reached an all-time low. The latest period of loose monetary policy has seen the JPY lose 20% of its value that has led to resurgence in the stock market.

3. Economic data, Tankan survey and debt

The major economic data that a trader must be aware of when looking to trade USD/JPY should include the release of retail sales, industrial production, GDP, and trade balances. Furthermore, any information on employment rates and new government policies also has a significant impact on the exchange rate of the currency pair.

The Bank of Japan publishes the quarterly Tankan report, which reveals the information on business confidence. It is considered to be a very important report that even moves trading in the JPY and Japanese stock.

The USD/JPY currency is also affected by Japan’s trade balance. Historically, Japan has had huge trade surpluses but they also have an aging population and a large public debt. However, traders tend to be comfortable with the debt that is held domestically and are willing to accept low rates of returns.

Another piece of data that traders should be on the lookout for is the Tokyo Area CPI as inflation is a big issue for the Japanese economy. The government’s economic initiatives to bolster the strength of the yen should also be looked at since they can lead to an effect on the USD/JPY currency rate.

The Conclusion

The USD/JPY currency is affected by multiple factors that potentially influence its exchange rate. The Japanese yen is one of the most traded currencies in the world as Japan is one of the biggest economies in the world.

The yen is a great currency to trade in because of its trending properties. Furthermore, the USD/JPY currency pair is considered to be the most predictable of all forex pairs. There are multitudes of factors that affect Yen, including its status as a ‘safe-haven,’ the low-interest rates set by the Bank of Japan, and the loose monetary policies.

Those who are looking to trade the USD/JPY currency pair would do well to stay in touch with the news about Japan’s economy, its fiscal policies, and the reports that come out of the Bank of Japan.