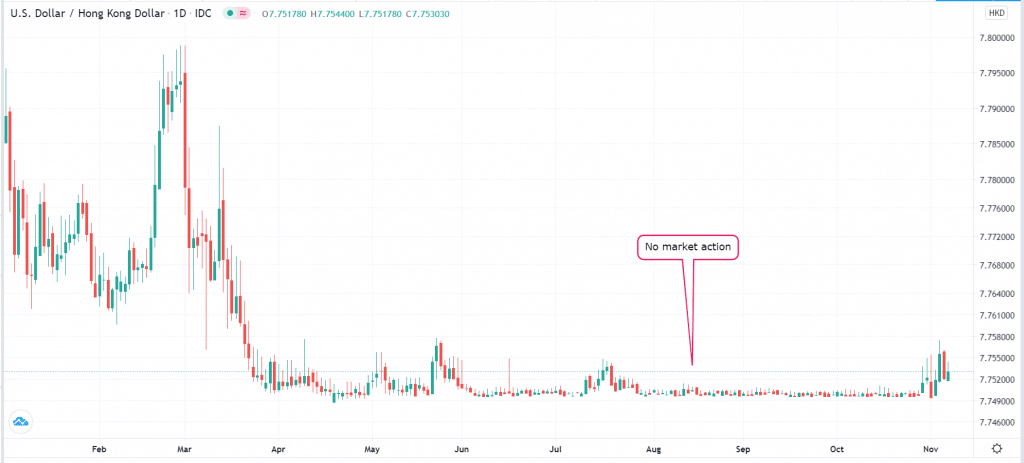

There are hundreds of currency pairs in the forex market. But not all these pairs will make you a lot of money. For example, a pair like USD/HKD tends to have few movements because of the Hong Kong dollar’s peg to the US dollar. In this report, we will look at the best currency pairs you should consider trading in.

USD/HKD is not a good currency to trade-in

Types of currency pairs in forex

Broadly, there are three types of currency pairs in the forex market:

- Forex majors – these are currency pairs consisting of the US dollar and the currency of the biggest Western countries. They include EUR/USD, GBP/USD, and AUD/USD.

- Forex minors – these are currency pairs made up of the major Western currencies without including the US dollar. They include the EUR/GBP, GBP/CAD, and AUD/GBP, among others.

- Exotics – these pairs are made up of a major western currency and one from an emerging market. Examples of these are EUR/TRY, GBP/ZAR, and USD/TRY.

EUR/USD

The EUR/USD is one of the best currency pairs you can trade in the forex market. For one, it is the most liquid pair because of the trade volume of the United States and the European Union. For example, in 2019, the two countries made trade worth more than $720 billion. That helps increase the demand and supply of the pair.

In addition, most countries hold the euro and the dollar as their reserve currencies, which also helps increase their liquidity.

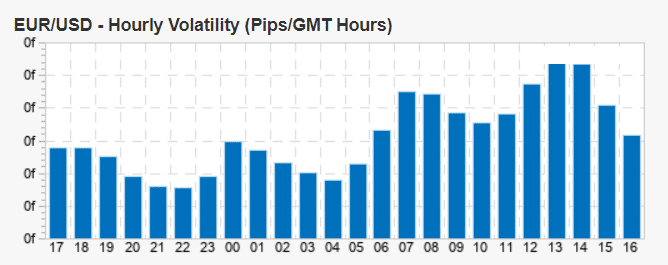

At the same time, the pair tends to be extremely volatile, which is a good thing for day traders. That is because this volatility usually creates trading opportunities. The chart below shows the average volatility for the pair on the hourly chart in the past few days.

EUR/USD hourly volatility

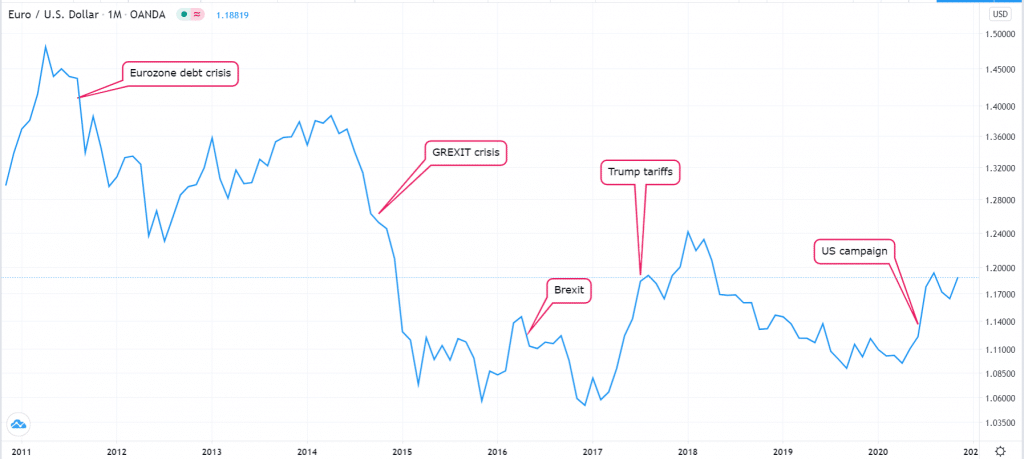

As a currency trader, you want to trade a currency pair with vast economic data and news. The EUR/USD has it all. For example, the currency pair tends to react to the Fed and ECB interest rate decisions that happen every month. It also reacts to the US nonfarm payrolls that come out on the first Friday of the month and PMI numbers that come out in the first week of the month.

Additionally, the EUR/USD is offered by most day trading companies. Therefore, that helps you understand how it trades, especially when you tend to move from one broker to another. Finally, the political situations in the two regions tend to change often, which has a tendency to boost volatility. This is shown in the chart below.

GBP/USD

The GBP/USD is the second-most traded currency pair in the forex. According to a survey conducted in April 2019, the average daily volume of GBP/USD traded every day in London is worth more than $431 billion.

There are several reasons why the pair makes a good investment:

Like the previous pair, the UK and the United States make the trade worth billions of dollars every year. That helps boost the demand and supply of the two countries. In addition, the two currencies are used as a medium of exchange in most countries.

The US and the UK have some of the most powerful central banks in the world – the Bank of England and the Fed. These two banks usually meet every month, which tends to boost volatility.

The two countries usually have significant news and economic data. In the UK, the Office of National Statistics (ONS) releases important numbers like retail sales, inflation, and household spending every month. Similarly, in the US, the statistics agencies release these numbers every month, which tends to lead to volatility.

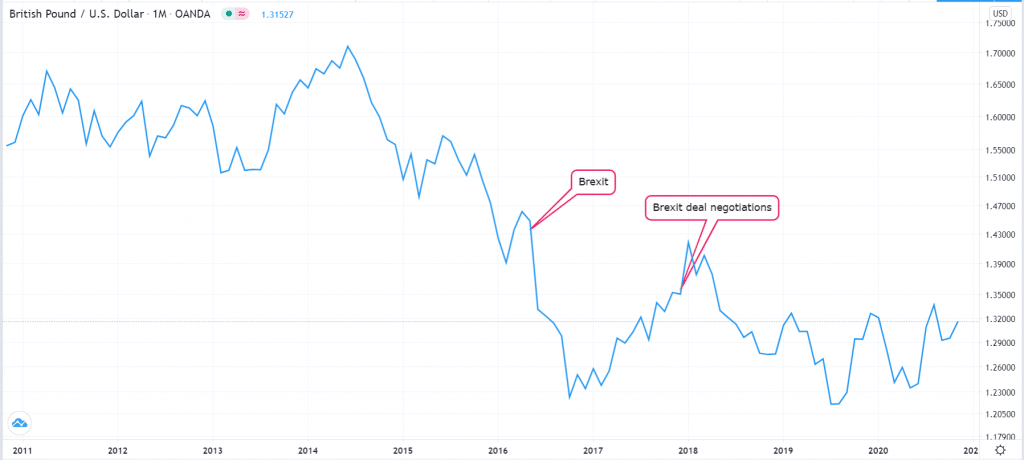

Further, the political situation in the UK tends to lead to volatility on the sterling, as shown below.

GBP/USD volatility in the past decade

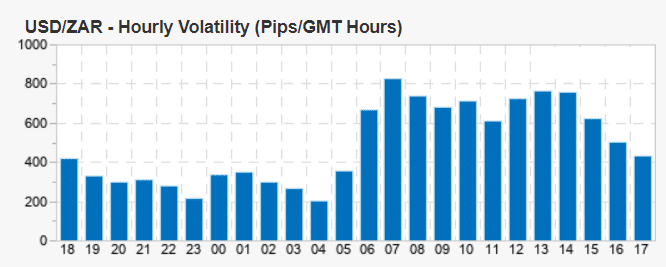

USD/ZAR

The US dollar to South African rand is also one of the best currency minors to trade in the forex market. That is despite the fact that the volume of trade between the United States and South Africa is relatively low by all standards.

Also, unlike the other pairs mentioned above, South Africa’s statistics bureaus do not release as many economic numbers.

The pair tends to be volatile because of how different the two countries are. While one is a superpower, the other one is a relatively small emerging market with significant economic and political issues. For example, in recent years, South Africa has gone through various problems like debt downgrades, power cuts, and political issues.

Another reason why the USD/ZAR is usually volatile is because of its natural resource industry. The country is one of the biggest producers of gold, platinum, and palladium. As such, the currency usually reacts to price changes in these commodities. At the same time, it reacts to the happenings in the United States.

The chart below shows the average volatility on the pair in the past ten weeks.

USD/ZAR volatility

Trading opportunities on USD/ZAR

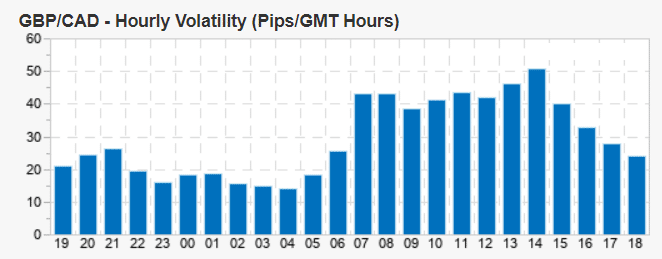

GBP/CAD

The British pound to Canadian dollar (GBP/USD) is another popular cross to trade in the forex market. That is partly because the UK and Canada have a close trading relationship, trading goods worth more than $21 billion every year.

Like the British pound, Canada has strong statistics agencies that release important economic numbers every month. For example, like the Bureau of Labour Statistics in the US, the Canadian statistics agency releases the monthly job numbers on the first Friday of the month. The agency also sends updates on employment and inflation numbers every month. These numbers usually lead to volatility on the pair.

The GBP/CAD is also popular because of the stability of the UK and Canadian economies. Most importantly, the pair is popular because of the price of crude oil. As the fifth-biggest oil exporter in the world, the Canadian dollar reacts to the overall movement of oil prices. It rises when the oil price rises, and vice versa. Finally, like the other three, it is provided by most forex brokers.

GBP/CAD volatility

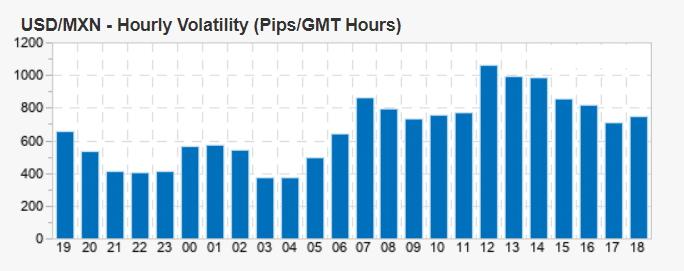

USD/MXN

The United States and Canada have a strong trading relationship. The two countries are part of the United States Mexico and Canada Agreement (USMCA), formerly known as NAFTA. According to the US government, the two countries trade goods worth more than $677 billion. Therefore, the Mexican peso tends to react to the ongoings in the United States. As shown below, the currency rallied after the US election.

USD/MXN reacts to US events

Like the Canadian dollar, the peso also reacts to other external factors like crude oil prices since Mexico is a leading exporter. Therefore, at times, its price usually rises when oil prices rise and falls when the price of oil declines.

The only major con for trading the USD/MXN is that it is not offered by most brokers.

USD/MXN volatility

Final thoughts

The forex industry is a large universe with hundreds of currency pairs. However, not all of them are worth it, as shown on the USD/HKD pair above. Some of the other volatile currency pairs to trade are USD/CAD, EUR/GBP, and EUR/CAD.