In most financial markets, the most straightforward strategy involves buying an asset when its price is low, then selling it at a profit after it rallies. However, if you only follow this technique, you will not be making money when the markets are in a downturn. Originally designed for stock traders, shorting was introduced to allow investors to bet on a price decline, enabling them to profit from bear markets. Nowadays, you can short practically any speculative financial asset.

How shorting currencies works

In stocks, short-sellers typically do not own the stock they are betting against. Instead, they borrow the shares from someone else who does. They then sell the stock at market price, wait for the price decline, then buy it back for a fraction of the original cost. This means they can then return the stocks they borrowed and make the remainder in profits, less any interest and trading costs.

In forex, every transaction inherently incorporates shorting. This is because forex trades always involve two currencies, a base, and a quote currency. By longing the pair, you are essentially buying the base currency and shorting the quote currency. Similarly, when you short a pair, you are selling the base currency and purchasing the quote currency.

Best currencies to short in 2022

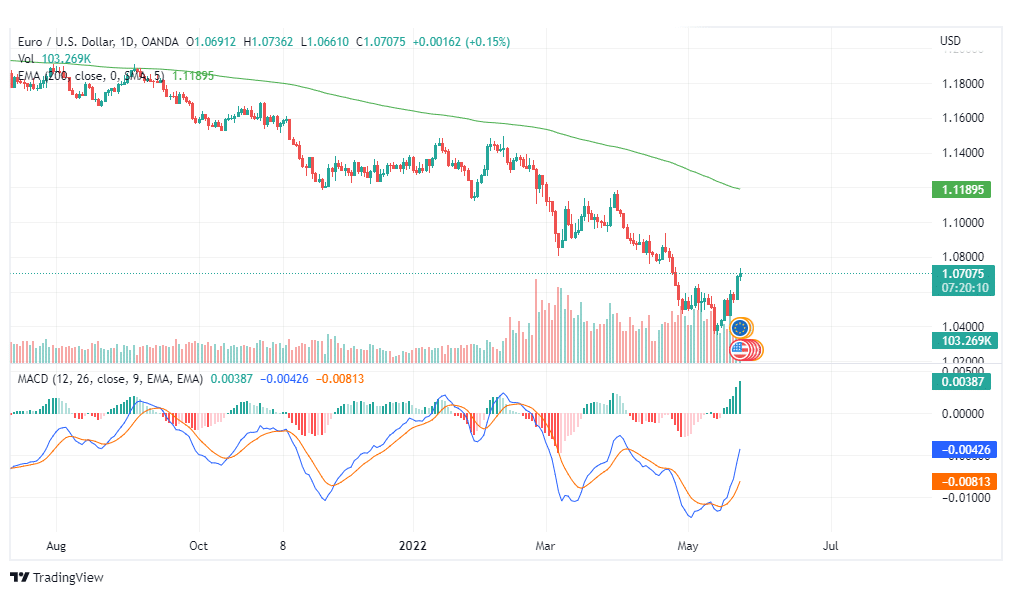

EURUSD

At the moment, the majority of the world is facing inflation pressures, and analysts predict we may well be headed into recession. This has caused investors to flock towards safe-haven currencies such as the USD. What’s more, the Fed has begun scheduled rate hikes in 2022 and is projected to affect even more hikes as the year progresses. This is another factor that attracts investors to the greenback.

In Europe, the Russia-Ukraine war has caused supply chain issues, which, coupled with the rampant inflation, have been bearish for the euro. All these factors make the EURUSD an ideal candidate for short selling.

From the pair’s daily chart above, the pair has been trending below its 200-day Moving Average, confirming its bearish trend. A trader looking to short it could wait for the MACD bearish cross when the blue MACD line crosses below its red signal line. The exit should be marked by a bullish cross of the MACD line above its signal line.

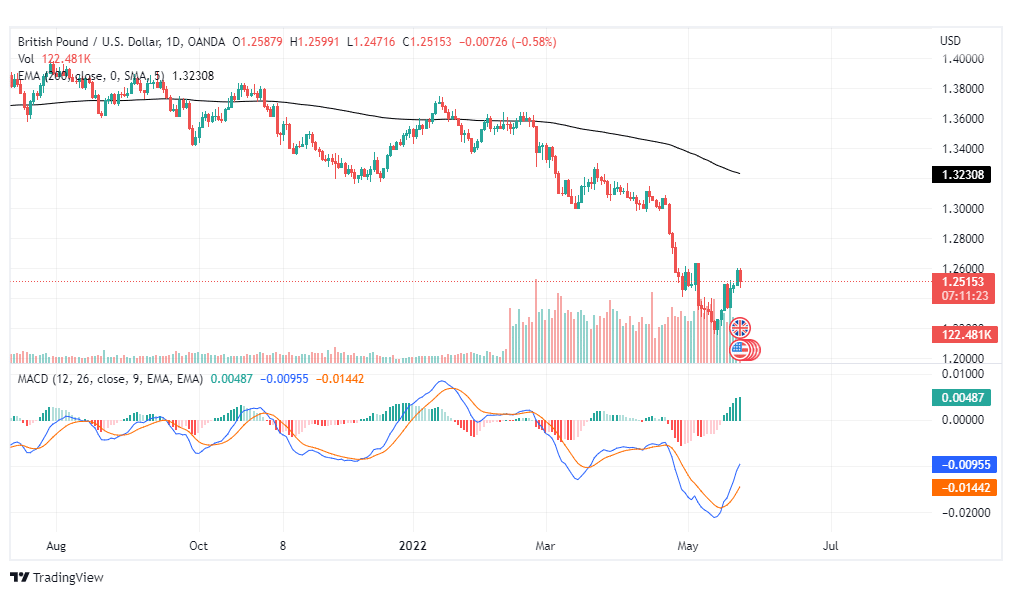

GBPUSD

The UK, along with the rest of the world, has not been immune to the rising commodity prices. The giant economy is experiencing slow growth, whereas analysts predict the Bank of England will not be as aggressive in affecting rate hikes as the hawkish Fed. Coupled with investor migration to the dollar safe haven, the USD will likely outperform the pound this year. This makes the Cable a perfect candidate for shorting.

From the illustration above, the Cable has been trending below its 200-period Moving Average for the majority of the year. This prevailing bearish trend presents traders with a trading bias leaning towards shorting the pair. To better time their entries, they could use the bearish MACD cross. The same indicator’s bullish cross would be instrumental in timing their exits.

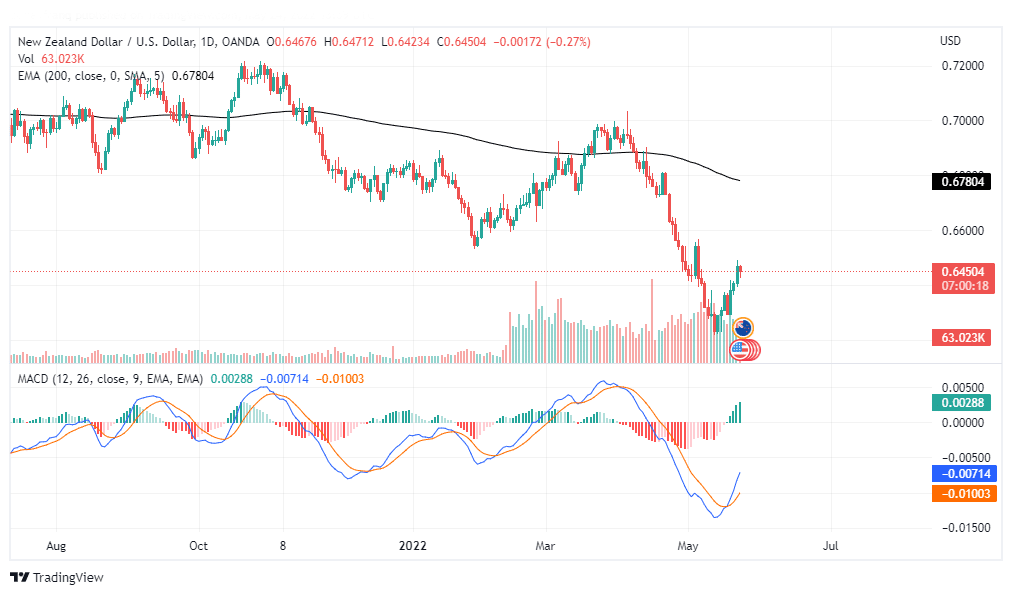

NZDUSD

New Zealand is majorly an agricultural economy. This means it’s been hard hit by the rising global prices of oil and other commodities such as fertilizers. To curb this inflation, the RBNZ has been increasing interest rates. However, this has done little to negate the gains of the dollar against the Kiwi. Therefore, the pair is still suitable for short trading.

The pair has been trending below its 200-period MA for most of 2022, looking at its daily chart above. To short it, regardless of the timeframe chosen, one could use the bearish MACD cross for entry signals and its bullish cross for exit signals.

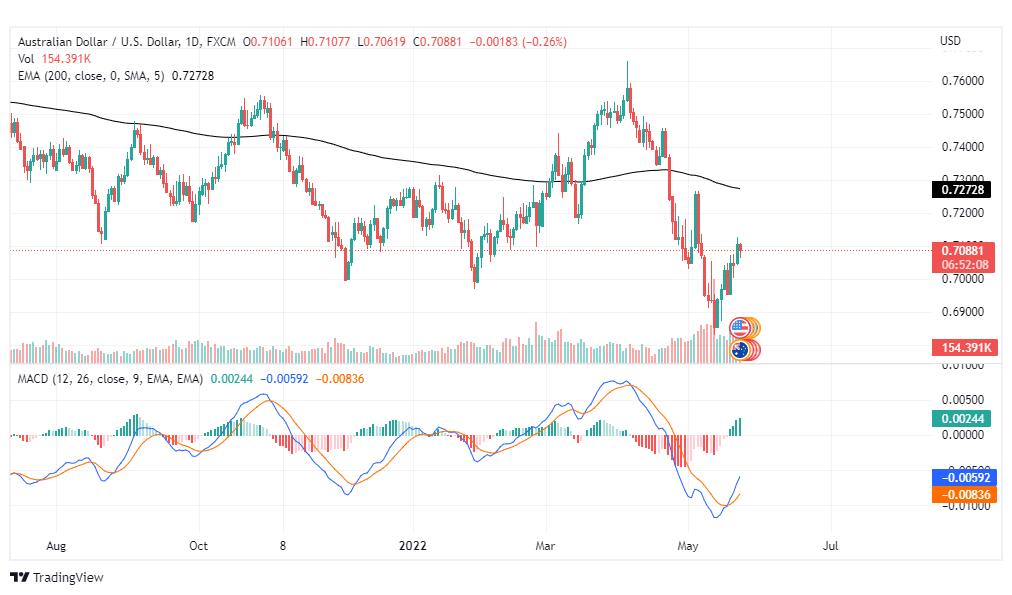

AUDUSD

The AUD’s health is heavily dependent on the state of China’s economy, the biggest client for their exports. At the moment, there is uncertainty around China’s economic health, largely due to the government’s zero-COVID-19 policy. This policy has curtailed the effectiveness of fiscal and monetary stimulus measures to cushion the economy against the rising global inflation. At the moment, the Aussie is an ideal candidate for short selling.

According to the Aussie’s daily chart above, the pair is in a downtrend, as evidenced by the price action hovering below the 200-period EMA. Similar to the aforementioned pairs, the MACD can be used to generate entry and exit signals for anyone looking to short the pair.

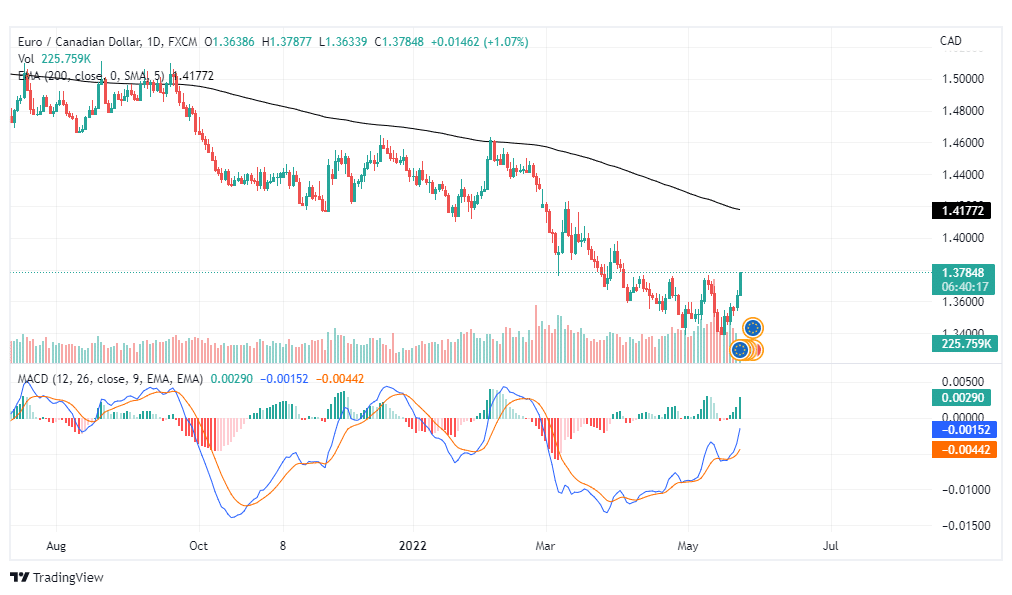

EURCAD

Amidst the rising inflation, the world is also facing growing oil prices. This can be attributed to the rise in demand since the pandemic, as well as supply chain issues. Canada, being one of the largest oil exporters, has enjoyed plenty of revenue from these high prices of oil. This has directly translated into increased strength of the Canadian dollar, especially against the euro, making the EURCAD pair a suitable candidate for short selling.

From the illustration above, the pair’s prices have been trending below its 200-period EMA for most of 2022. This prevalent bearish trend has made the pair ideal for short trades. To better time these, traders can utilize bullish MACD crosses for entries and bearish crosses for exits.

Summary

Shorting is a trading technique that aims to profit from bear markets. To do so, traders sell a currency pair whose quote currency they expect to outperform the base currency. At the moment, the world is facing increased inflationary pressures, which has driven investors towards safe-haven currencies such as the USD. This means that most major pairs quoted in USD could be ideal candidates for short selling.