People leverage various strategies to mitigate risks while trading currencies in the forex market. The butterfly spread is commonly used to protect capital from uncertain events in the trillion-dollar marketplace.

The risk management strategy finds excellent use in the options market, mostly exploited to shield traders against currency rate fluctuations. The strategy relies on bull and bear spreads to mitigate risk and at the same time increase chances of generating optimum profits.

It also offers a way of enjoying fixed risk exposure even though the profit is caped. Traders enter as many as four options while trading currencies. The strategy sees traders open different option contracts. The contracts come with the same expiration date. However, the strike price varies.

How it works

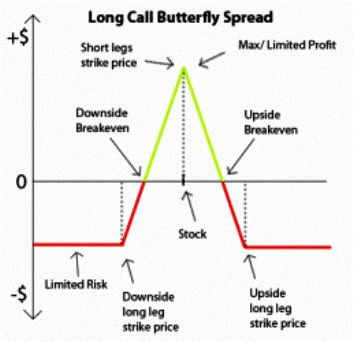

As part of the strategy, the first call option is placed at a specified price. The next two call options are placed at slightly higher prices. The fourth contract, on the other hand, is triggered at a much higher price than the second and third option.

In the case of a bear spread, the first put option is triggered at a specific price. The next two are triggered at a slightly lower price. The fourth and final put is triggered at a much lower price than the second and third contracts.

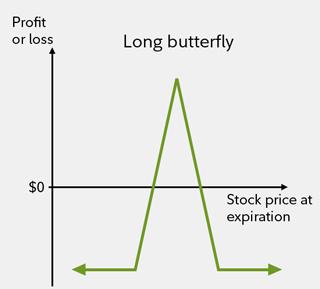

By triggering options at different strikes, the prices ensure profit is realized at different price points given the ranges created. These types of positions reduce the risk exposure given the type of trades placed and ranges.

The risk that one has to contend with upon placing the four trades is down to the cost of the put or call option. Risk and profits are capped. Profit is realized whenever the final price is between the strike price and the final price.

Mitigating risks

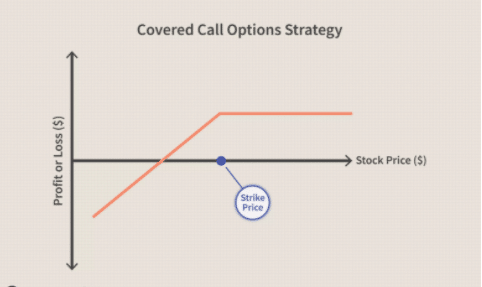

The butterfly spread strategy consists of either a bull spread or a bear spread of either a call or a put option. Similarly, the use of call and put option limits profit on each position in addition to keeping loss at the bare minimum.

Optimum profit occurs whenever the price increases to the middle strike price upon contract expiry. On the other hand, the breakeven point comes into play on an upside call between the strike price and the high side option. The delta must come in between.

In a bear butterfly, optimum profits emerge when the total premium is paid for the options. Maximum profit might come into play whenever the price trades way above the upper and lower strike prices.

On the other hand break even occurs when the delta appears between the strike price and the highest option. In contrast, the breakeven point of a short on a butterfly spread is the sum of the lowest option’s strike price and the total credit received.

Butterfly spread strategy example

Consider EUR/USD going for EUR 1.00 to $1.20. One can decide to open a long call butterfly by placing a May call at $1.10 for $1,000. The trade would be followed by the writing of two May calls at $1.20 for $300 each; the final $100 call option is triggered at $1.30.

Computing all the trades, the trader will have a net debt of $300 +300-$1,000-$100 =-$500, which is essentially the loss. Should the option expire with the EUR/USD pair still averaging between EUR 1 to $1.20, the calls at $1.30 and $1.40 will be worthless.

The May call will still have an actual value of $1,000-$100 = $900. Once the amount is subtracted from the cost incurred to trigger the options the net profit ends up being $400, which is the optimum possible profit.

The maximum loss will occur on the EUR/USD price tanking below the $1.10 level or climbs above the $1.30 level. Price dropping below the $1.10 will result in all the options expiring worthless, with the net debt being the cost taken to enter the long call butterfly.

Bottom line

While leveraging the butterfly spread to try and keep risks low, the idea is to ensure that the price of the currency pair is as near the middle strike price as possible. This is especially the case when dealing with less volatile currency pairs.

Likewise the risk mitigating strategy is ideal for traders who don’t have the time to continuously monitor price fluctuations in the volatile marketplace. However, while being a low risk play, it is important to note that it offers limited profit and is designed to generate profits at different volatility levels.