Overview

An exclusively utilized tool by forex traders, the CoT (Commitment of Traders) report is a weekly publication that reflects the net long and net short positions of investors in the US futures market. The Commodity Futures Traders Commission (CFTC) regulate this market and publish the positions every Friday at 15h30 ET. The CoT report is often considered a leading indicator for long-term trends in forex, which particularly suits position size traders rather than short-term traders.

Types of COT reports and the main bodies involved

The four main types of reports in COT are:

- Legacy

- Supplemental

- Disaggregated

- Traders in Financial Futures

While all of these respective reports serve different functions, the only report pertaining to forex is Legacy.

The report above is an example of the Legacy report that forex traders are familiar with. The first two sections of the data denote the net long and net short contracts of non-commercial and commercial traders as collated by the CFTC.

Open interest denotes the contracts that traders have not yet done.

The number of traders are those collated by the CFTC to report their futures contracts.

Commercial traders are known to purely hedge against currency swings or other risk as defined in CFTC regulation. These are typically large multinational corporations with established businesses in many parts of the world. Because of this fact, they partake in numerous currencies that each carries some form of exchange risk. For example, an Australian gold mining company may hedge the price of gold by buying or selling Australian dollar futures. Because Australia is a massive gold producer and the price of gold fluctuates, taking these futures contracts would offset any risk for the company.

Non-commercial players include large financial institutions, commodity trading advisors, hedge funds, etc. who all speculate on futures markets for profit instead of hedging. Such players are very similar to retail traders who also speculate for the same reason.

Non-reportable traders are too small to have a requirement to report their positions to the CFTC. Hence, they only form a small portion of the total number of traders in the report. These could include individual speculators or retail traders.

The forex-related markets (nearly of all which are the major currencies) that have Legacy reports are:

- Australian dollar.

- British pound sterling.

- Canadian dollar.

- Euro.

- Japanese yen.

- Mexican peso.

New Zealand dollar.

- Swiss franc.

- US dollar index/United States dollar.

The benefits of the COT report

To understand the COT report is to understand the relationship between futures and forex. As the name suggests, futures are contracts for future forex prices. The forex market that is most popular nowadays is known as spot FX or spot forex because the trade execution happens immediately.

There are bigger players in futures who, unlike their forex counterparts, don’t necessarily trade for immediate profit. Commercial traders in the CoT report trade futures for hedging against currency risk. Such participants hold far more significance than retail traders, meaning that any decisions one can gauge from them influence forex prices.

The challenge with spot FX is its highly decentralized framework. To this day, many traders attempt to look at ways of gauging order flow, though this is often fruitless. Futures, on the other hand, are centralized and traded on the Chicago Mercantile Exchange (CME). The CFTC publishes what we could think of as the ‘order flow’ of the futures markets. For a very long time, forex traders have appreciated the relationship with futures and that the COT, in theory, is the closest thing they have to an order book.

An example of the COT report playing out in forex

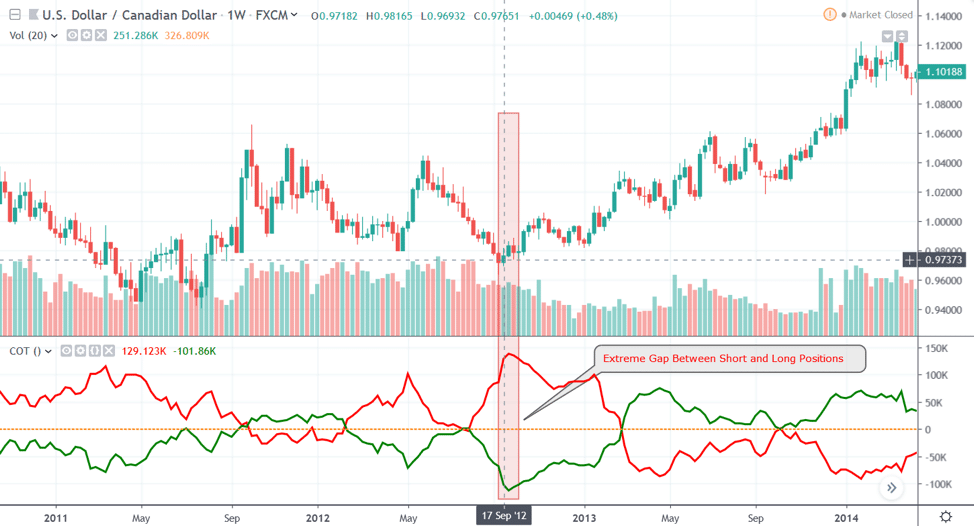

Since this report is published weekly, analysts recommend its use to be beneficial for position size traders who hold positions for several months at least or longer. While the number of contracts in a currency indicates trend strength, the most popular technique for using the report is exploiting trend changes in forex. More specifically, traders look for tops and bottoms on bigger time-frames like the W1 (weekly) and MN (monthly).

The trick here is looking at extreme gaps between the net long and net short positions. This positioning works a little counterintuitive because, for example, if there are more net short than net long positions, the natural inclination leans towards a bearish market.

The chart below shows something different. Here, there were roughly 129K short positions and 101K long positions. However, after a few weeks, the price of USD/CAD resumed an uptrend. We can clearly see this was a market bottom caused by a large gap between net short and net long positions.

Unfortunately, getting easy access to a COT report indicator to input on your charts is a little complicated, though there are resources such as TradingView and Oanda. Some traders also prefer to create their own report indicator as well. Traditionally, the COT report only focuses on a singular currency than a pair. Any of the available indicators attempt to average out the figures of different currencies and input that data into one individual pair.

Conclusion

Knowing how to interpret the COT data properly can certainly help position size traders to forecast new trends starting from scratch, which is the ultimate benefit of the report. As with any indicator, there should be other confirmation factors that come along with it to provide better trading opportunities.