Financial leverage is a powerful and commonly used tool in asset purchases. Simply put, the money borrowed to finance asset purchases in the hope that income generated in the long run will exceed the cost of borrowing.

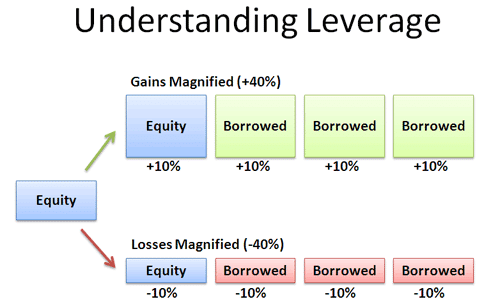

It is often used whenever there is a need to control a more considerable amount of assets using a small amount of available capital or collateral. Likewise, the use of leverage to control a greater amount of assets will often lead to an amplified return in invested cash.

However, leverage is a double-edged sword that also causes losses to increase exponentially whenever they start to pile up. Conversely, a decrease in the value of assets will often result in an exponential increase in loss when dealing with financial leverage.

In the forex market, financial leverage is the loan issued by brokers that allow traders to buy stock currencies, among other securities. The debt provider puts a limit on the amount of risk that they would take, conversely indicating the extent to which leverage can cover.

The collateral in financial leverage is the assets purchased using the leveraged capital. The asset will act as collateral until the borrower can repay the loan in full.

How Financial Leverage Works

Consider Peter, who has $500,000 and wishes to purchase 40 acres of land at a total of $500,000. Peter buys the asset outright without using any financial leverage.

Jackson, on the other hand, intends to purchase 120 acres but has $500,000 in cash. To complete the transaction, Jackson borrows $1,000,000 to supplement the $500,000 in cash, bringing his total cash holdings to $1.5 million. In this case, Jackson will purchase the 120 acres using his cash and financial leverage.

If, after one year, the two pieces of land increased by 20%, the two will be able to sell their pieces of land at a profit. For Peter, he would end up selling the 40 acres for $600,000 conversely, pocketing a cool $100,000 in profit.

For Jackson, his piece will go for $1.8 million due to the 20% increase in value. Subtracting $1.5 million the buying price and $50,000 in interest payment on the amount borrowed, he would end up with $250,000 in profits.

The $250,000 profit on an investment of $550,000 represents a 45% gain as opposed to the 20% gain garnered by Peter.

Financial leverage a double Edged Sword

Let’s assume that after one year, the two pieces of land depreciated by 20% in value

Peter’s piece of land would end up selling for $400,000, translating a loss of $100,000. The $100,000 loss, in this case, represents a 20% loss on the initial $500,000 invested in purchasing the 40-acre piece of land.

For Jackson, 20% depreciation will result in the 120-acre land going for $1.2 million, translating to a net loss of $350,000 inclusive of a $50,000 in interest payments on the $1 million loans borrowed.

The $350,000 loss translates to a 63.6% loss in Jackson’s initial investment of $550,000 in the 120-acre land.

In the two examples above, it is clear that as the financial leverage increased the net earnings on the piece of land appreciating, it also resulted in a substantial increase in a net loss as the pieces of land depreciated. Therefore, it is clear that as financial leverage amplifies profits, it magnifies losses in equal measure.

What is the company’s leverage?

The same way people use financial leverage to purchase an asset so companies also carry out purchases using leverage. Financial leverage in a company’s setting comes in the form of a company taking out a loan to purchase another company or asset, giving rise to a leveraged buyout.

A company primarily uses its underlying assets as collateral to purchase for the loan. Another company might use collateral from the target company to seal a deal for financial leverage.

Financial leverage has many, at times, allowed smaller companies to purchase much bigger companies. In the end, the debt is normally put in the target company, thus putting the acquiring company risk-free.

What is Leverage: Trading Account Perspective

Leverage is borrowed capital that increases the purchasing power of a trading account. The debt borrowed from brokers allows traders to purchase financial instruments that they would not be able to buy outright using underlying capital. Leverage also makes it possible to profit from small price changes, given the tool’s magnifying aspect.

The loan is normally borrowed from a broker and comes in different sizes, i.e., 1:100, 1:200, and 1:400. With 1:100 leverage, it means that for every dollar, a trader can place trades worth $100. Therefore, with an initial capital of about $1,000, a trader can place trades worth $100,000.

Leverage Pros

Leverage can up stakes when buying assets or financial instruments. Conversely, it can allow an entity to earn a disproportionate amount on assets or financial instruments, increasing in value.

Leverage is an essential tool for magnifying the available capital, allowing a trader to purchase the most expensive financial instruments or assets that underlying capital cannot buy. With as little as $1,000 in a trading account, a leverage of up to 1:100 can allow a trader to trade financial tools worth $100,000.

Financial leverage enjoys favorable tax treatment as interest expense in most jurisdictions is tax-deductible, conversely reducing the net cost to a borrower.

Borrowers only have to make a small upfront investment.

Financial leverage Cons

Financial leverage is a double-edged sword that increases the risk of exponential losses on an asset depreciating.

The interest expense may overwhelm a borrower should the purchased asset fail to earn sufficient returns.

Abuse of financial leverage can force companies out of business.