The difference between netting and hedging is an important factor to consider when choosing a trading account: depending on the broker, regulations, and trading platform, some will only allow hedging while others enable netting exclusively.

What is hedging in forex?

The concepts of hedging and netting aren’t necessarily related to each other because the latter was only introduced for better trade management of multiple positions. Hedging existed long before and continues to be a practice in virtually all financial markets.

Hedging is a protective strategy involving the simultaneous buying and selling of one or multiple instruments to minimize or mitigate losses and exposure risk. So, for example, one may initially decide to buy EUR/USD and then also sell the same pair so that in the event their long position fails, the short order will offset their losses.

Depending on a few parameters, the trader may end up closing both for a reduced loss overall or even at a profit. Before trading software became more advanced, a forex trader naturally had to open two positions, and this is what their trading terminal would reflect.

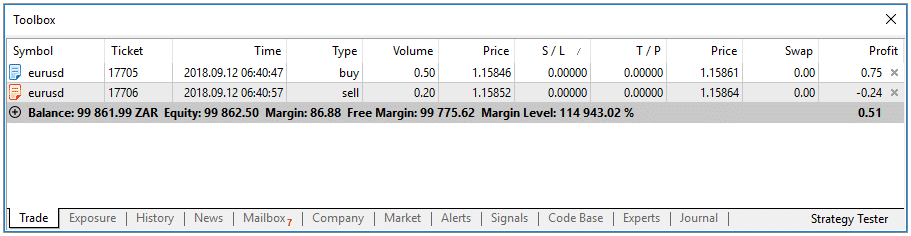

In this accounting system, any subsequent positions after the original order reflect as a new trade, each with their own volume, stop loss and take profit parameters.

For those who hedge, it’s necessary to know what their broker permits or not, depending on their regulation and trading platform. Most brokers will allow either hedging or netting.

What is netting in forex?

The MetaTrader 5 and cTrader trading platforms (released in 2010 and 2011, respectively) were one of the first to include netting. Not all trading software contains this feature even presently. Netting consolidates different positions to ‘net,’ or create, a single traded value.

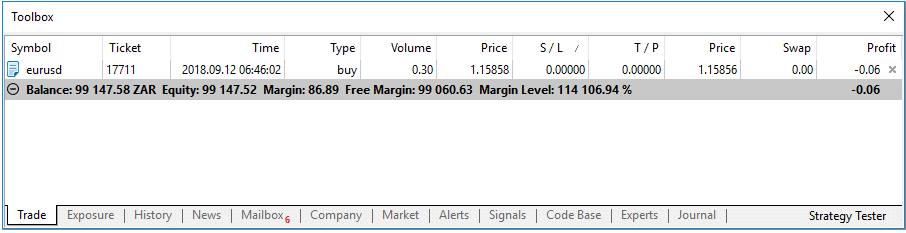

So, with hedging, a trader can open opposing orders in the same instrument where a trading terminal will account for each. With netting, it is only one position consolidating them all. In the transaction history, it will only show a single trade with the total volume (next to it, it usually shows the sum of any other orders made prior).

The only distinction is opposing orders of the same lot size will cancel each other. For instance, if a trader opens a long and short position, each worth 0.10, the platform closes them out automatically.

Netting will consider the highest lot when executing buy and sell trades that aren’t worth the same position size.

Let’s look at the examples of two scenarios reflecting both hedging and netting to understand these concepts better.

Hedging and netting examples

The image below shows hedging where we see a 0.50 buy trade and a 0.20 sell trade opened concurrently on EUR/USD.

On the same EUR/USD pair, the second image below shows us how a netting account would reflect if the trade opened the same two positions as previously. Note that the resulting individual order of the 0.30 buy is the difference (buy 0.50 subtracted from the sell 0.20).

The netting system will have partially closed any profit or loss of the 0.20 sell (which immediately shows in the transaction history) before reflecting the final 0.30.

Pros and cons of hedging

Some traders may still be okay with hedging for a few reasons, though this does not exclude the few drawbacks of this approach. From a graphical standpoint, unlike netting, the trader can see each individual entry, making it easier to change any of the parameters one-by-one.

They can add multiple stop loss and take profits for each. There is more afforded flexibility for the trader.

Of course, the main disadvantage is if there are too many hedged positions, the trader’s terminal will look clustered, making it hard to do the accounting of volume, profits, and losses.

Furthermore, it takes a lot of time-consuming manual calculations to know the ‘breakeven point’ of all orders.

Pros and cons of netting

Netting is a better accounting system primarily for ‘scaling in’ (opening multiple positions on the same pair in the same direction). A trader only needs to manage a single order for every market in terms of stop loss and take profit parameters, which is a time and energy-saving attribute.

Unlike hedging, it’s much simpler to know the ‘breakeven point’ considering all the volumes that a trader has executed in a pair. The disadvantage of netting is the opposite of the advantages in hedging.

For one, you cannot set the stop loss and take profit levels of separate positions if they have accumulated into one. Technically, you can’t hedge in the traditional sense with netting by opening buy and sell orders of the same size, and there is no flexibility when using different volumes.

Also, one can only potentially gain from one outcome rather than two. For example, if someone opens a 0.10 sell trade and a 0.08 buy trade, only the sell position will remain at 0.20. If the market went against the short trade, they would have to close it.

If they were using the traditional hedging system, they could close the sell order and let the buy position run.

Final word

Overall, hedging and netting in forex differ in their accounting system. While the former notes many separate positions on the trading terminal, the latter consolidates all of these into an individual order.

No approach is necessarily better than the other because they serve different purposes. Despite being somewhat messier, hedging is more flexible and is still a better method to perform traditional hedged trades.

Netting is inflexible in this regard but is much more suitable for traders who ‘scale in’ with their positions. Rather than opening and managing 5 0.1 lot orders, the system will simply count these as a single 0.5.