Central bank decisions are some of the most-watched events by forex traders because of their overall impacts on their respective currencies. However, in recent years, because of the forward guidance, most banks have adapted. In this article, we will look at how central banks work and how you can trade their actions.

How central banks work

Central banks are independent institutions that have the mandate to set the monetary policy of a country. In most countries, they are the only institutions that can authorize the printing of money.

Central banks operate through a dual mandate, which refers to the process of ensuring low unemployment rate and price stability. They achieve these through several tools like interest rates and quantitative easing.

Ideally, central banks slash interest rates when they believe that the economy is facing significant headwinds. They do this to stimulate spending by eliminating the incentive for people to save. Also, by lowering rates, they make it easier for people and companies to borrow.

In extreme situations, like during the Global Financial Crisis of 2008 and the coronavirus pandemic, central banks use quantitative easing. This is the process of creating money from thin air and buying assets like government bonds and mortgage-backed securities (MBS). This helps to stimulate the economy by lowering the cost of government borrowing.

Other options that central banks use are yield curve control, offering term lending facilities, and entering swap deals with other central banks.

Top central banks

Central banks don’t have equal power. Forex traders tend to focus on banks from key countries. Among the most important ones are:

- Federal Reserve – This is the central bank of the US. It meets eight times a year – this number, however, can change in times of financial crisis.

- European Central Bank (ECB) – This is the central bank for the European Union that meets eight times per year.

- Bank of England (BOE) – This is the UK central bank that also meets eight times per year.

- Bank of Japan (BOJ) – This is the central bank of Japan.

- Bank of Canada (BOC) – This is the Canadian central bank.

- Reserve Bank of Australia – This is the Australian central bank.

Other popular central banks are the Reserve Bank of New Zealand, South Africa Reserve Bank (SARB), Riksbank, and the Norges Bank. The Riksbank is the oldest central bank in the world.

How to day trade central bank decisions

There is no well-defined formula for trading central bank decisions. However, as a forex trader, there are several steps you can take to make money when these decisions come out.

Use the economic calendar

First, you need to use the economic calendar. This is a tool that gives you a schedule of the main economic events. Other key events found in the calendar are manufacturing and services PMIs, retail sales, industrial and manufacturing production, and inflation. You can find a comprehensive calendar in Investing.com, DailyFx, and MetaTrader 5.

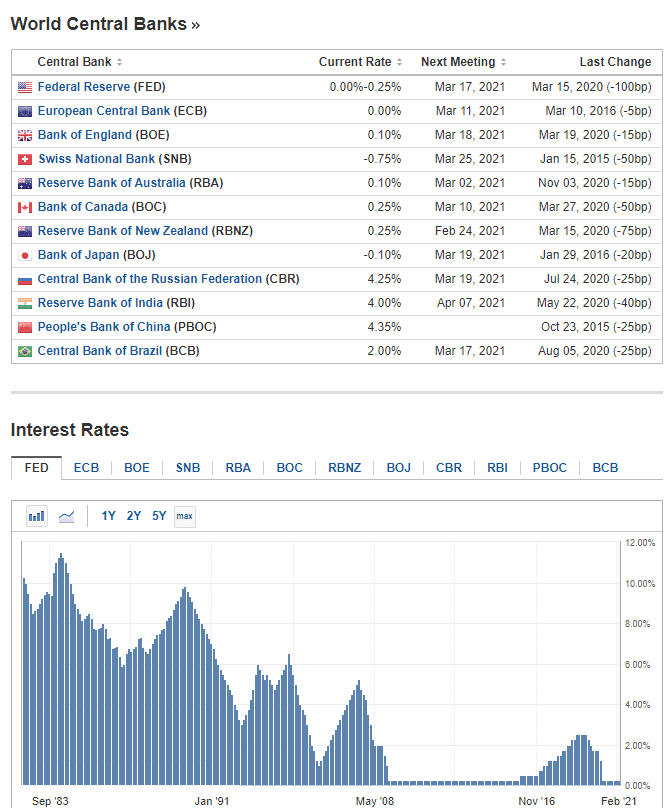

Investing has a good widget that shows you the schedule of these decisions, as shown below.

Investing.com Central Banks Calendar

We recommend that you check the calendar in advance, as this will help you plan your trading. You can check the following week’s calendar every Friday evening or during the weekend. You can also check it on Monday when you are starting your trading.

Know the expectations

A common mistake many traders make is reacting to the interest rate decision without having the full information. For example, they will rush to buy the US dollar when the Fed hikes interest rates and vice versa. That is a mistake.

Instead, heading into the rate decision, you should have all the information about what the central bank did in the past meeting and what analysts expect it to do.

After the Global Financial Crisis, most central banks adopted forward guidance strategies to prevent shocks when they deliver their decisions. Forward guidance is a situation where they hint at what they will do in the future.

For example, during the coronavirus pandemic, the Fed hinted that it would not increase interest rates until the unemployment rate fell to about 3.9% and inflation rose above 2%. Investors interpreted this to mean that the bank will not hike for at least two to three years.

A key consequence of forward guidance is that currency pairs don’t move as violently as they did before.

There are two main ways of knowing what a central bank will do. The simplest is to read market commentary from credible publications like Bloomberg and Financial Times. In my experience, I find their central bank previews being adequate.

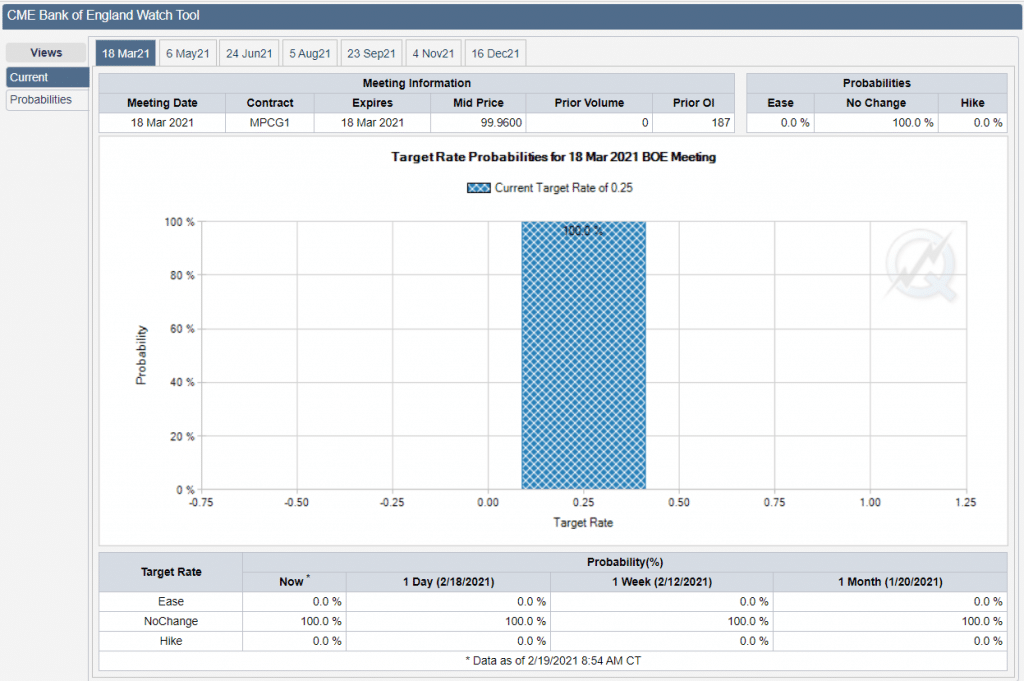

Another way is to use tools provided by Chicago Mercantile Exchange (CME). It has a CME watch tool that shows what analysts expect. You can find it by just Googling Fed, ECB, or BOE watch tool. For example, in the chart below, we see that 100% of analysts don’t expect any rate cut or hike in the next BOE interest rate decision.

CME BOE watch tool

In line with this, you should also focus on statements by key central bank officials and economic data. For example, at times, a central bank governor can hint what the bank will do in the future when making speeches. Also, looking at the latest data can give you hints of what the bank will do.

Using pending orders

Another important strategy when trading central bank decisions is to use pending orders like buy and sell limit and buy and sell stops. These orders are important because, in most cases, you don’t know the impact of a central bank decision.

For example, if the EUR/USD is trading at 1.1200 heading into the decision, you can place a buy stop at 1.1225 and a stop loss at 1.1260. You can also simultaneously place a sell-stop order at 1.1185 and a stop loss at 1.1140.

In this case, if the central bank’s decision pushes the pair higher, the buy stop trade will be triggered and vice versa.

Final thoughts

Central bank decisions are important events that tend to cause significant volatility in the financial market. As a day trader, you need to know when the decision will come out, key expectations, and use pending orders. Also, we recommend that you read the monetary policy statement and listen to the governor’s speech.