Any luck JTI robots are good to go?

Today, we have a Just Trade It signal provider at the plate.

So, we don’t know what strategies are behind the robot.

What exactly are “revolutionary” behind the algorithm?

It was so hard to find on the site this intel: “Algorithmic trading is trading in the capital market based on computer programs. The algorithm creates and places trades, among them buy and sell orders. A trading algorithm is based on numerous parameters and its orders are executed without human intervention or additional human discretion,” devs said. “The software companies we work with do not deal with high-frequency trading, which entails high risk. They focus on low-frequency trading that offers a range of tracks with various risk levels, based on technical analysis, Fibonacci levels and Martingale and Anti-Martingale trading methods, involving accurate formulas, execution speed, and correlations, that combine updated fundamental data transmitted directly to the systems.”

The devs provide investor access to their live accounts.

More descriptions we could get from FAQ about Golden and Silver robots.

- Golden robot. The algorithm scans the market to identify ideal times for trading and to filter out problematic trading times. EA collects intel from several sources and indicators: Moving Averages, ATR, StdDev. All the collected information is converted into a unique formula. The robot operates on 12 currencies-pairs, and in each currency-pair, it operates on several time frames, so that we have additional dispersion on the investment portfolio.

- Silver robot. The feature of “Silver Robot” is that it doesn’t work on indicators that react with a big delay. EA scans and measures the market constantly to detect improper movement in the market. When the robot detects improper movement, it starts to enter the trend direction in small quantities, in case the trend continues the robot adds quantities. The position management is done in a clever manner, it includes a combination of several different algorithms for managing the position and determining the stop and the profit.

Trading results

The devs provided links at five accounts.

The first real USD account on AvaTrade ended with a loss of $11891. Frankly say, looking at the chart, the robot has never traded well. There were endless ups and downs.

Increasing lots, having traded in the wrong direction zeroed the account for 4 hours.

Then the devs understood that the robot is dead and has withdrawn the leftovers.

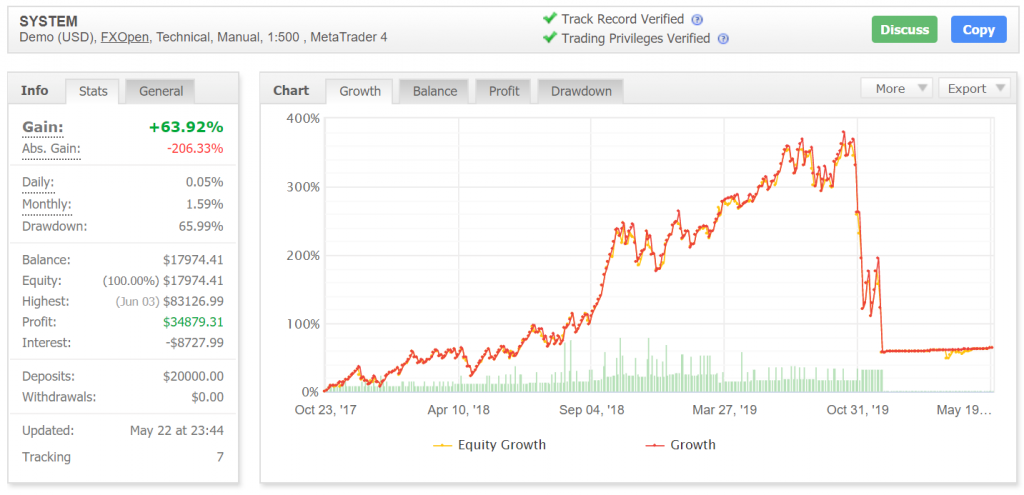

The second one looks the same. It’s a demo USD account on FXOpen with 1:500 leverage.

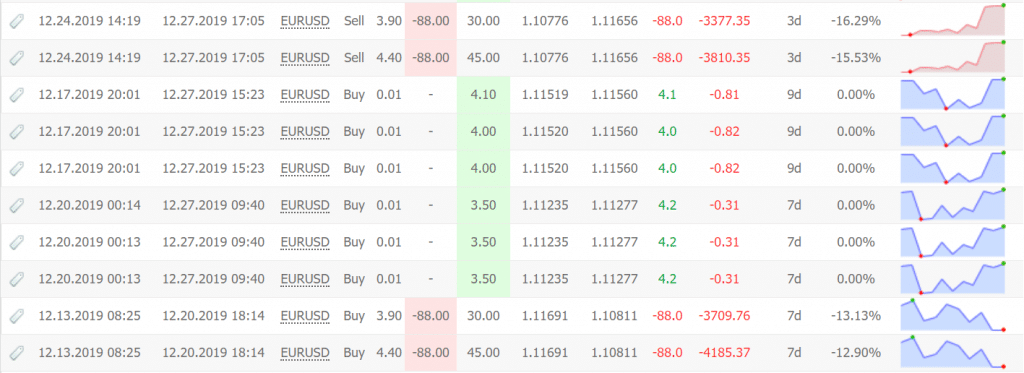

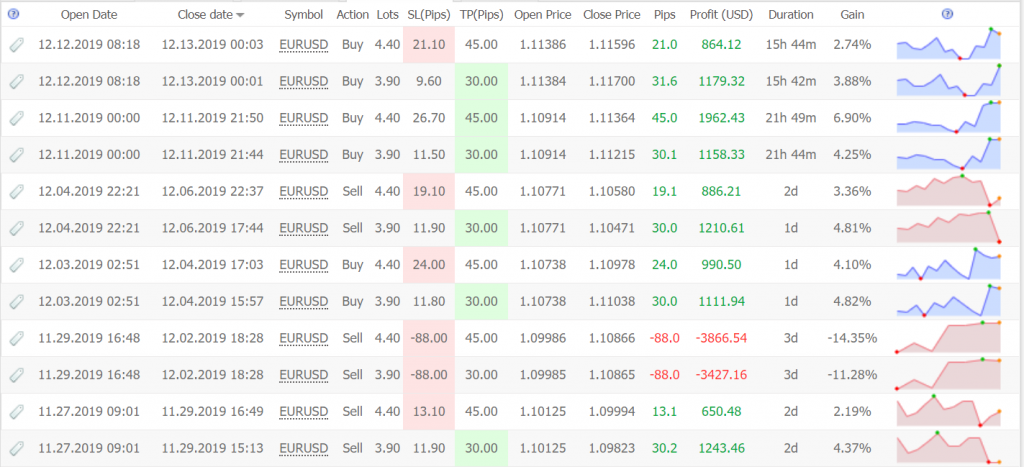

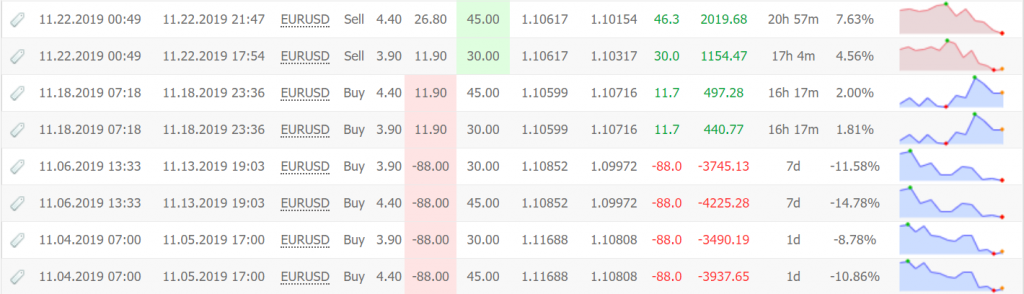

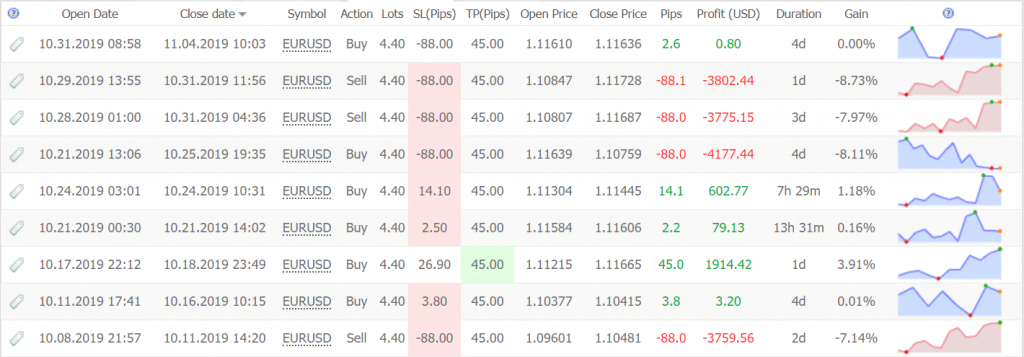

As you can see, there was a period when the devs decided that their system is great and it’s time to trade with an increased lot size. It was a silly decision. After the first closed trades at the end of October 2019, they had to stop, but they kept doing.

It went to this.

Now, the robot trades perfectly well, but the trust to it was gone.

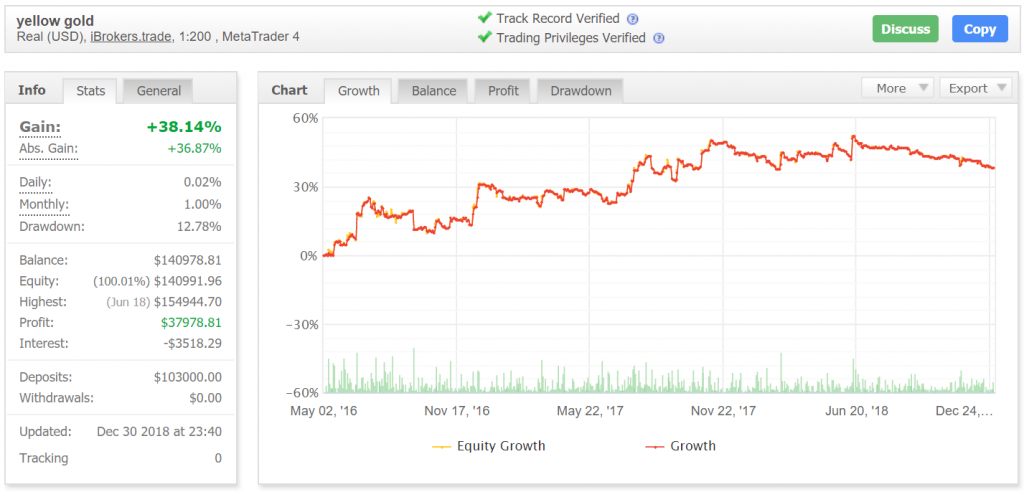

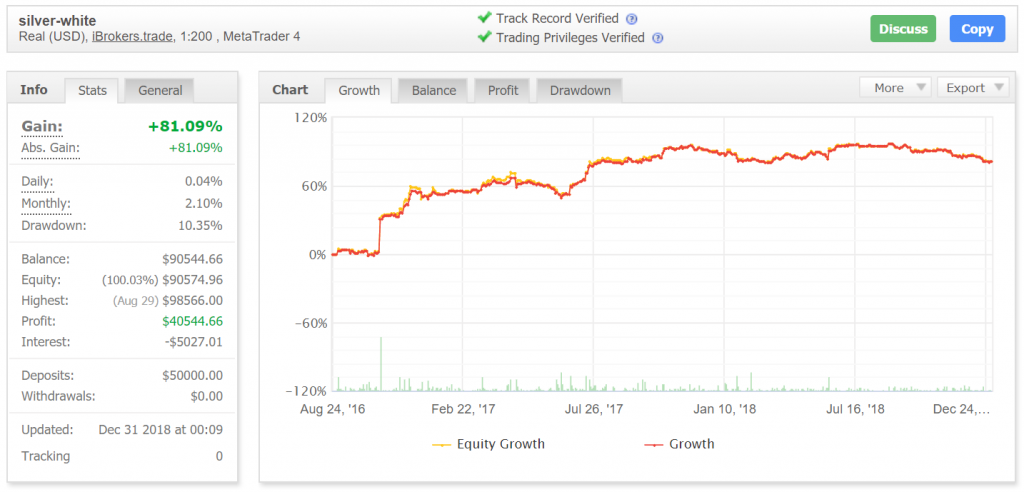

There’s an account like this with a $103K deposit. It’s a real USD account on iBrokers.trade with 1:200 leverage on the MetaTrader 4 platform.

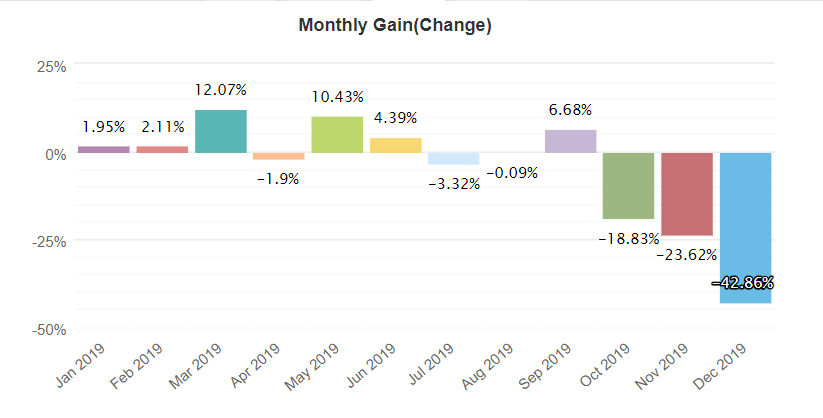

During two years of running, the EA provided +38.14% of the total gain. The monthly gain was 1%. The max drawdown was 12.78%.

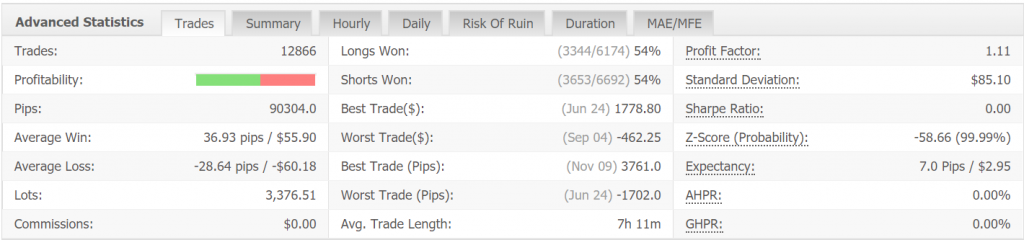

There were performed 12866 trades with 90304 pips. The average win ($55.9) is a bit less than the average loss (-$60.18). The win-rate was 54%. The average trade length was 7 hours. The profit factor (1.11) was quite low.

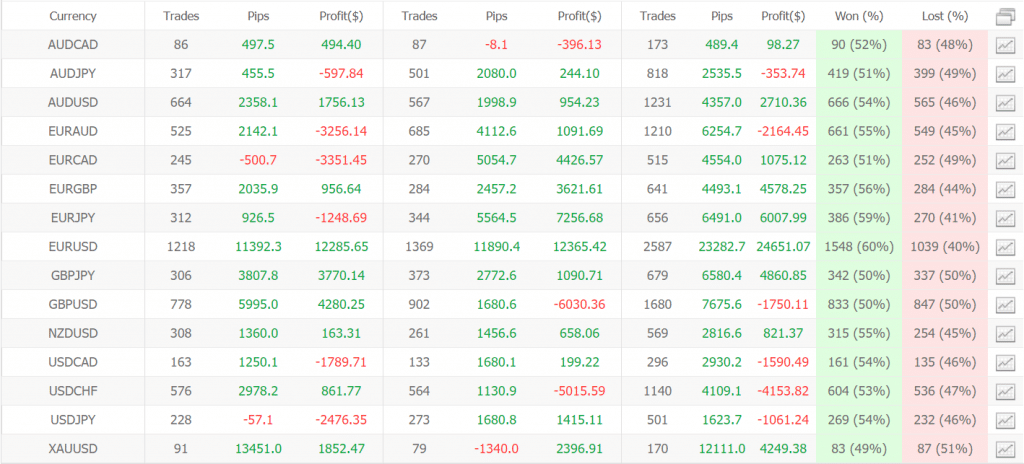

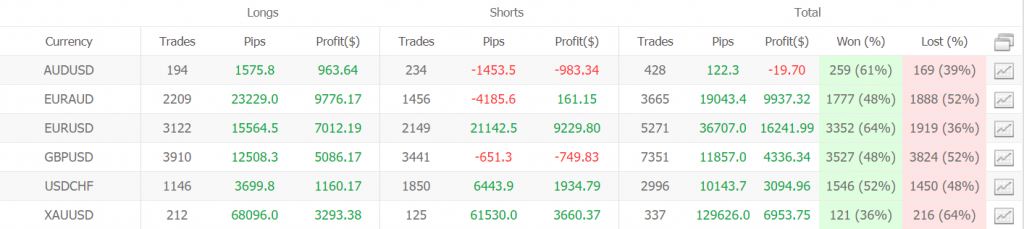

As we can see, the results vary depending on the symbols.

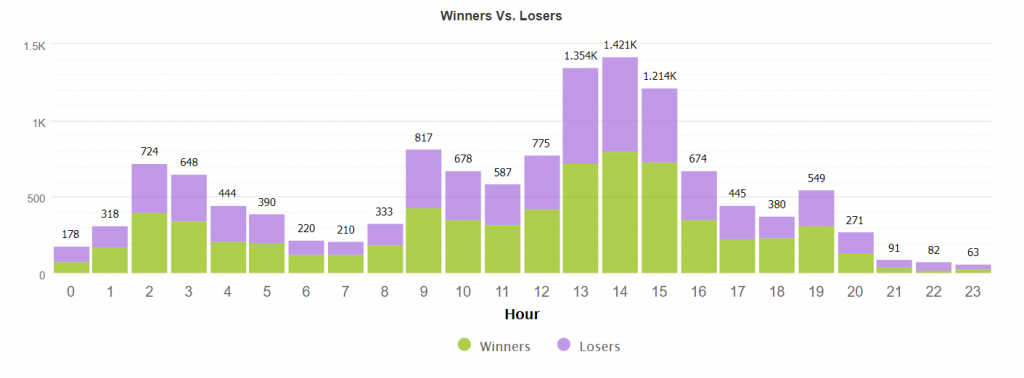

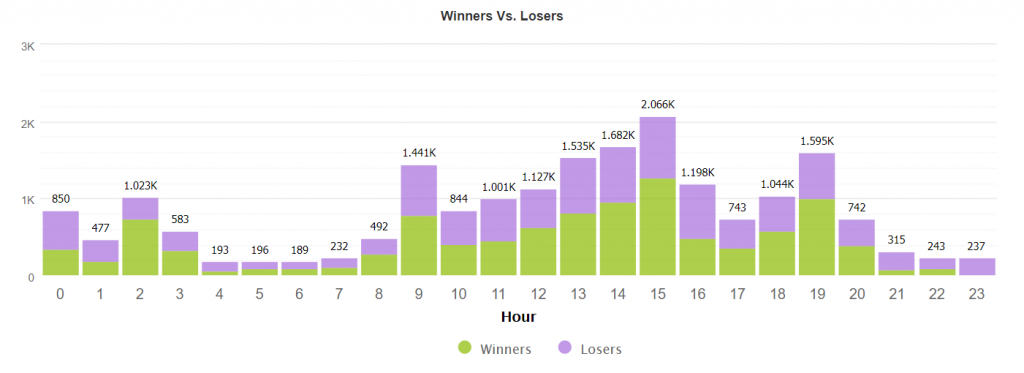

The system avoided trading during the Asian market scalping hours.

The EA shows garbage kind results in the last year of its performance and has been stopped.

The silver-white’s account has been funded at $50K. The EA provided +81.09 of the total gain and has been stopped two years ago. The monthly gain was 2.1% and the max drawdown was 10.35%.

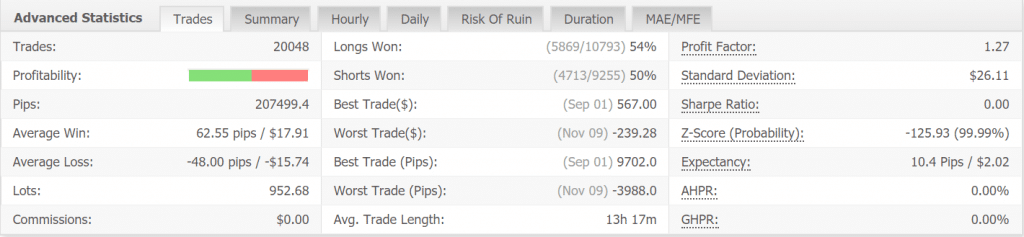

The robot performed 20048 deals with 207K pips. The average win ($17.91) equals the average loss (-$15.74). The average win-rate was between 54% and 50%. The average trade length was 13 hours. The profit factor was 1.27.

EA traded 5 currency pairs and gold.

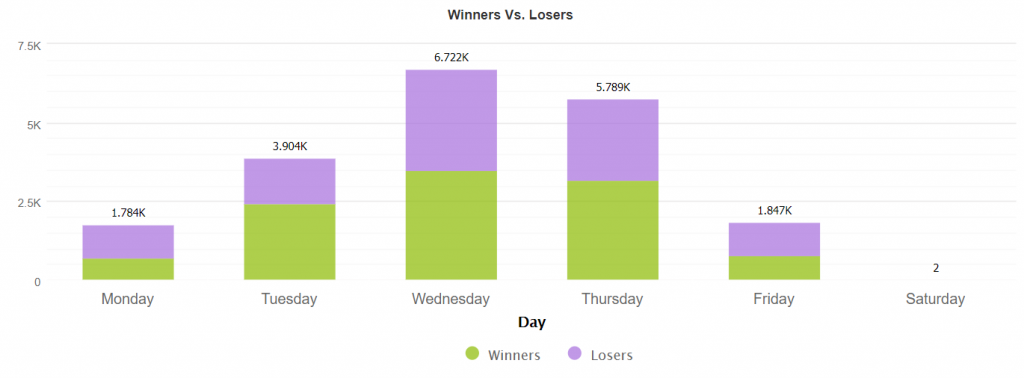

EA avoided Asia opening but liked the European market opening.

EA mostly avoided opening trades on Monday and Friday.

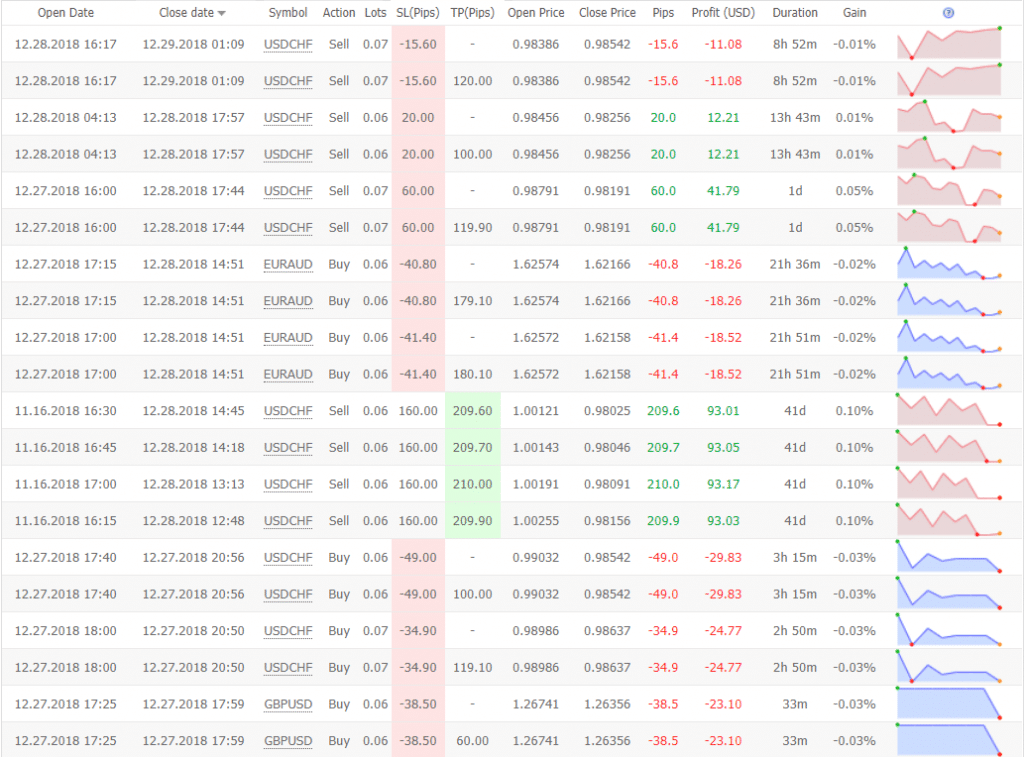

The robot has died like this, having closed almost every trade by reaching the SL level.

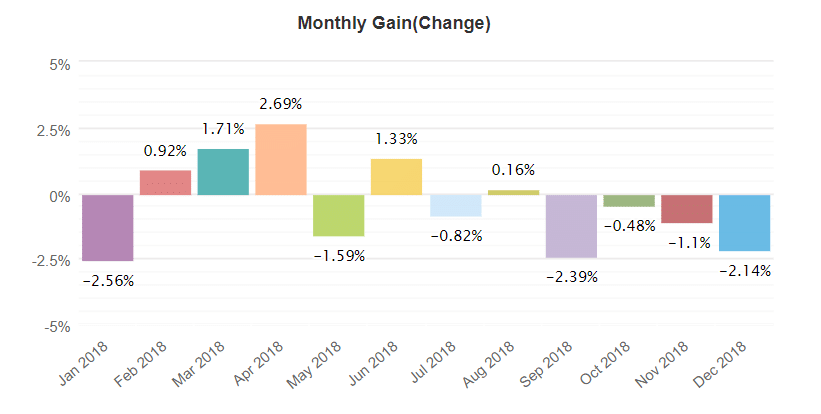

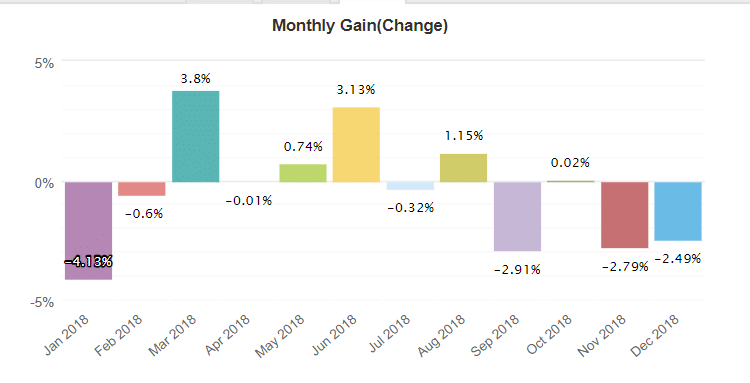

The final score has shown the four bad-traded months in a row.

Pricing

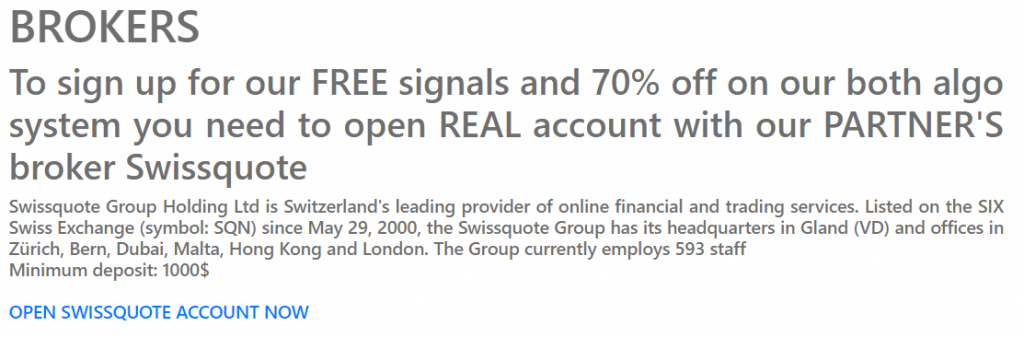

The devs suggest us to open a live account in a Swissquote bank.

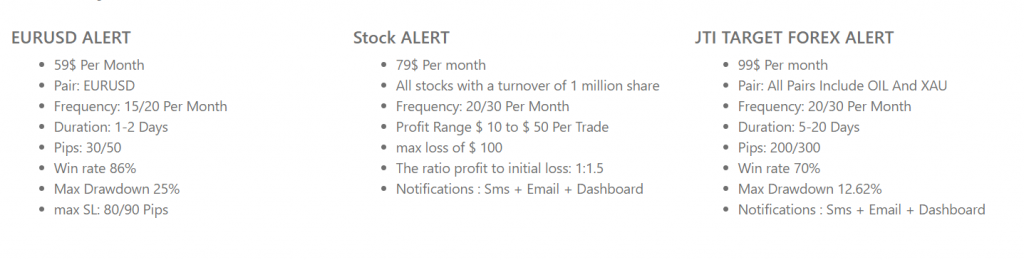

There are two types of products. The first one is “alerts”. The price starts from $60 monthly for EUR/USD ones to $100 for all pairs + oil + gold.

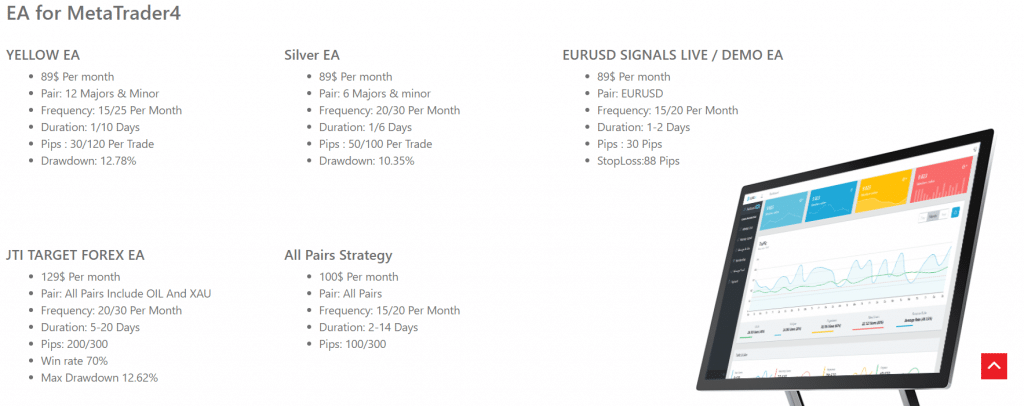

There are five EAs to work with from $90 for Yellow, Silver, and EUR/USD ones to JTI for $130, or $100 for “All Pairs Strategy.”

JTI company is a scam

Pros

- Real-account trading results.

- Big deposits on the real accounts

Cons

- No backtests provided

- Very weak trading results

- Trading with high risks

- All robot on the real accounts has been stopped

- No money-back-guarantee provided

Now, all the products look like scams. All the real accounts have been stopped and some of them were withdrawn. They started trading in a big way with huge deposits, but time has shown that the systems are far from being well-designed. There’s no product in their case you’d focus on now. We’d suggest you avoiding trading via JTI EAs.