Today’s forex robot is Raybot. The presentation starts with screenshots of the trading results of the 2010-2015 years.

The main features are:

- The robot trades price swings between Support/Resistances.

- The robot is a frequent trader making about 5 to 10 trades per week on each currency pair.

- A potential gain will be between 5% and 10%.

- The max drawdowns according to backtests were 25%.

- No grid.

- No martingale.

- NFA/FIFO compatible.

- Stop-loss and take-profit features.

- Win-rate about 57%.

- ECN account type is recommended.

RayBOT has an advanced trading logic that trades swings near support/resistance levels. A highly dynamic trade management module takes over once a trade is triggered. The system immediately calculates the ideal stop-loss level/target price and sets them on the broker side for protecting the trades. The system hides the stop-loss level and goals. It uses broker side trailing stop-loss in case it finds the volatility to be higher than normal. The average SL is 35 pips (65 is a limit). During volatility is handled by setting stop-loss at a maximum of 200 pips. Trades are usually closed when the trend loses strength or at the first sign of reversal.

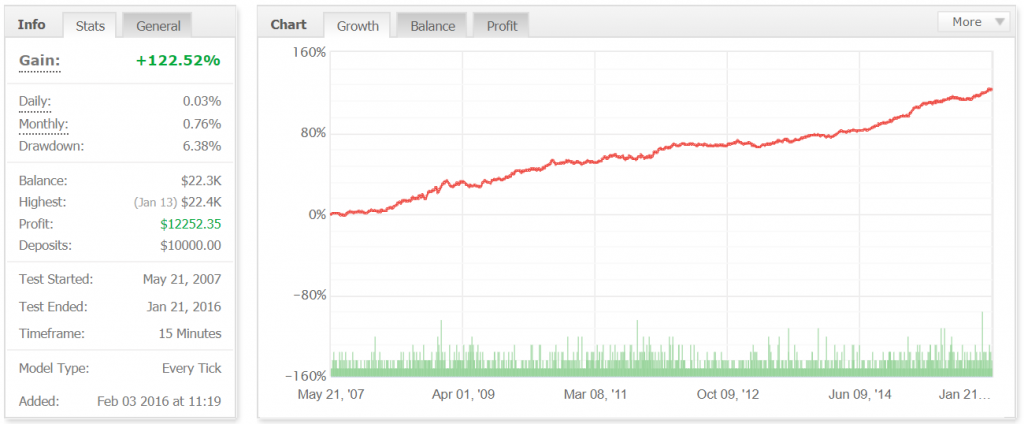

Backtests

It’s a backtest. During 9 years the robot provided just +122.52% of the gain. The monthly gain was 0.76% with low enough drawdowns (6.38%).

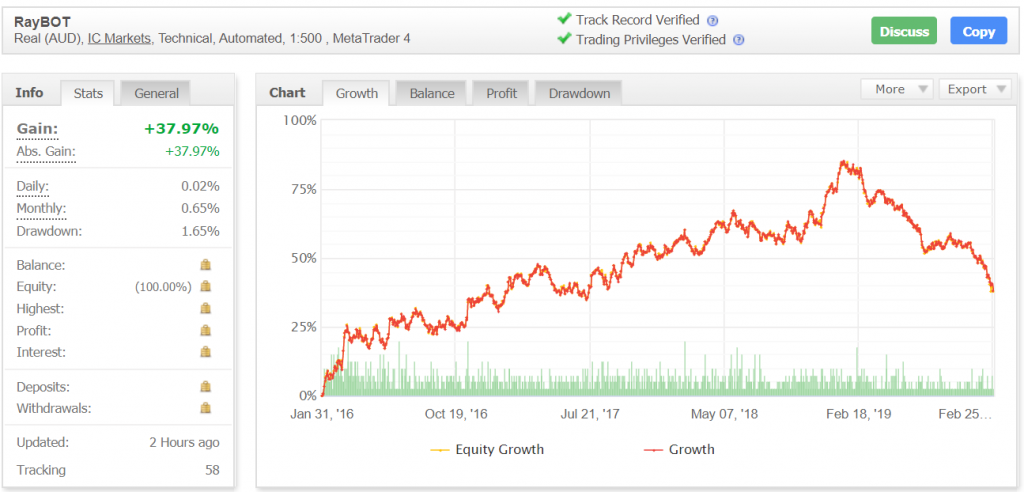

The robot provides mediocre results. There were performed 2393 trades with 12302 pips. The win-rate was 49-50%. The profit factor was 1.3.

We’re not sure it’s a good even for the backtest.

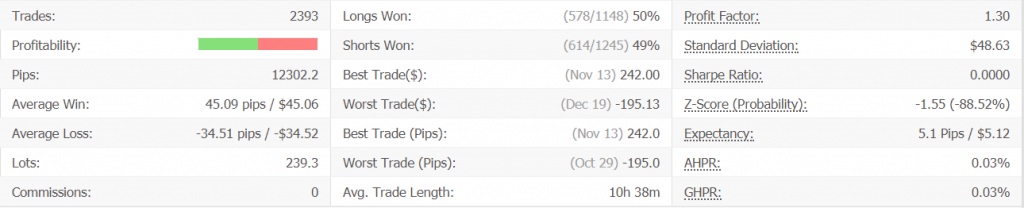

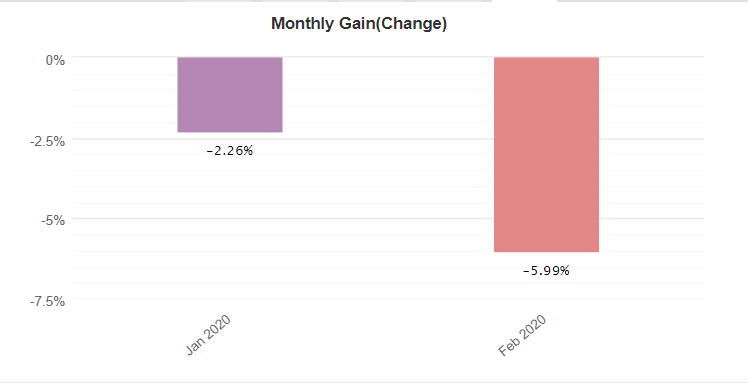

The real account trading results

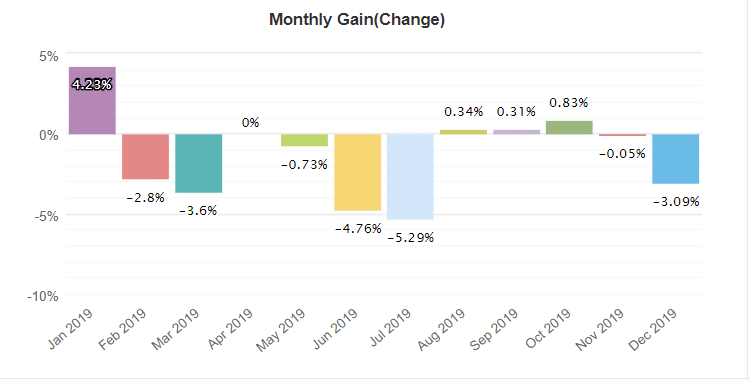

It’s a real AUD account. The robot works through IC Markets with 1:500 leverage on the MetaTrader 4 platform. The monthly gain is 0.65%. The max drawdown was 1.65%. As you can see, the robot slowly but surely goes to zero the account.

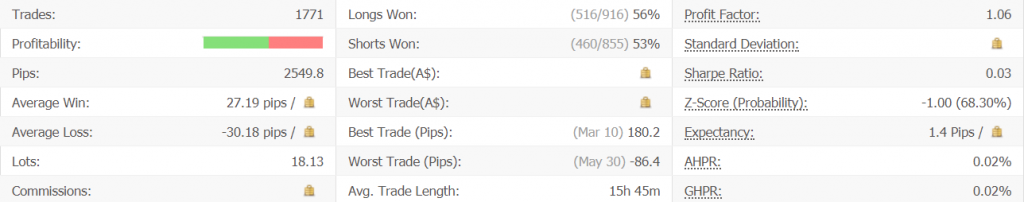

There have been traded 1771 deals with 2549 pips. The average loss (-30.18 pips) equals the average win (27.19 pips). Win-rate is between 53% and 56%. The profit factor is as low as 1.06.

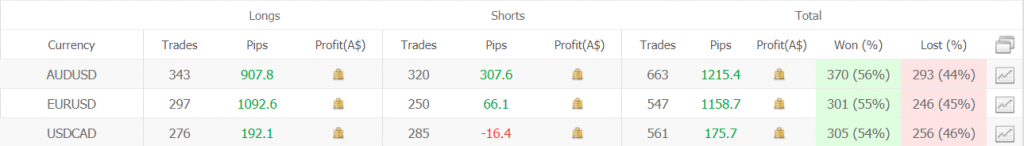

It trades AUD/USD, EUR/USD, and USD/CAD currency pairs.

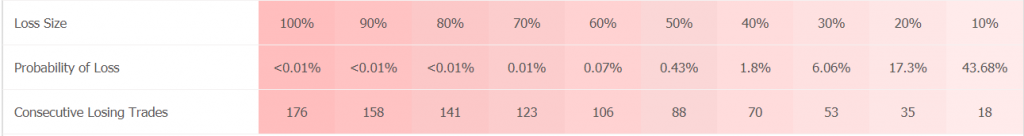

The robot still tries to recover the account trading with extremely high risks.

In the last two years, the robot did just one thing is wasting the account balance.

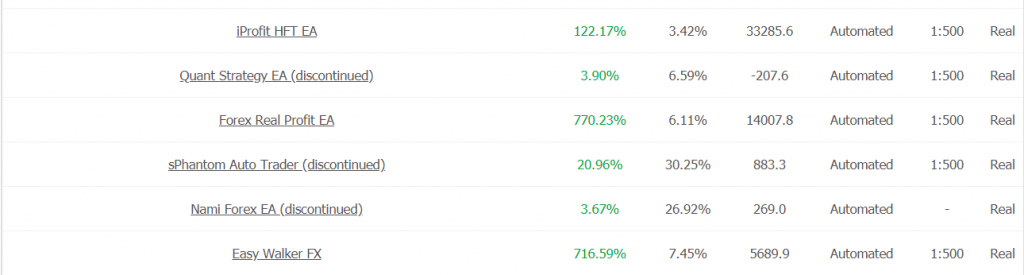

On the Forex Germany account, there are many other robots that run pretty well.

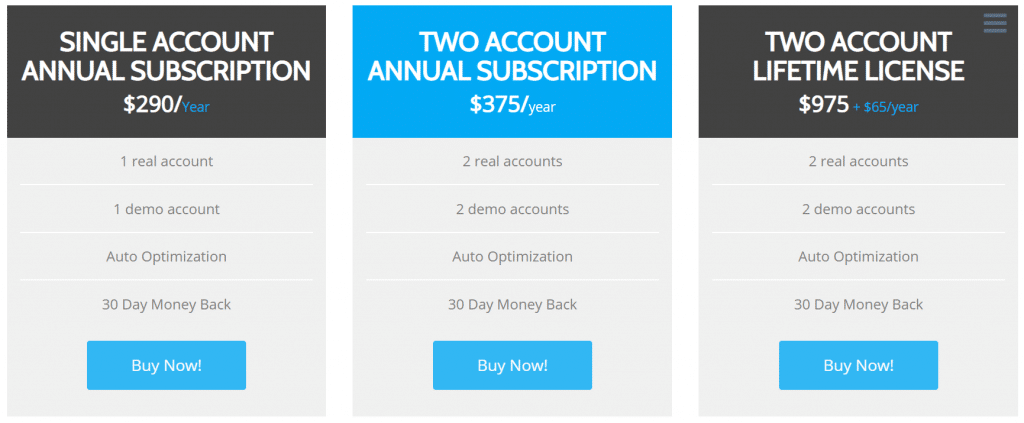

The offer

There are three packages of Raybot. The first one costs $290/annual. It provides one real account, one demo account, and a 30-day money-back guarantee. For $375 annually we’ll get two real and two demo accounts. The “Lifetime” license costs $1000 +$65/year(?).

Is Raybot Robot a scam?

Pros

- Strategy well-explained

- Backtests provided

- Real account trading results

- The 30-day money-back guarantee

Cons

- Extremely low results on the real account

- The robot has no updates for several years

- Extremely-high price

The robot is not a scam but slowly and surely goes to become one. The last 15 months showed that the Raybot can’t stop losing month by month. We’re sure it’s not a robot you should pay attention to.