The Australian Dollar, also known as the ‘Aussie,’ is one of the major currencies to trade in the forex market. Moreover, the United States dollar and the Australian dollar, that is USD AUD, is one of the major commodity forex pairs.

A lot of big Asian economies follow state management for their currency rates, which makes it difficult to trade them in Foreign Exchange. For instance, Japan and China are large economies that have strict control on the Forex market. On the other hand, Australia does not control the Forex market, and its bank, the Reserve Bank of Australia (RBA), follows a western approach for the value of the Aussie currency.

This makes the Aussie a great currency for trading. Through it, traders can take a position in the growth of Asian countries, where currencies like the Japanese Yen and Chinese Yuan are so uncertain and risky.

AUD/USD as a commodity currency pair

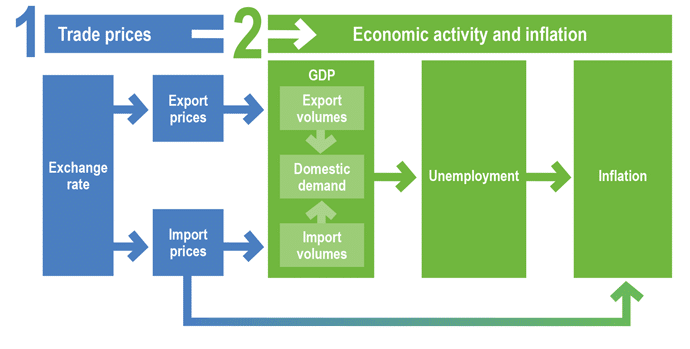

The exchange value of the Australian Dollar is mainly influenced by the global economy as well as the Australian economy. However, when it comes to the relationship between the Australian Dollar and the US Dollar, abbreviated as AUD/USD, these factors can be a bit different. This pair is one of the most liquid pairs in currencies.

The AUD/USD pair informs a trader as to how many US dollars they require in order to buy one Australian dollar, which is the base currency in this pair. The AUD is a commodity currency, along with the Canadian Dollar and New Zealand Dollar. A commodity currency is the one whose country’s exports mainly include raw materials, such as precious metals, agriculture, and oil.

A lot of traders use the AUD/USD pair for the relation of the USD with commodities and to take a position in both the Asian and global growth.

The AUD/USD Economy

Australia has a much higher interest rate as opposed to a majority of the western economies, particularly after the introduction of the European common currency. This is why the Aussie is preferred by many ‘carry traders.’ These are traders who make profits from the rate difference between a high-yielding currency, that is the Aussie, and a low-yielding currency, such as the Japanese Yen or USD.

Currently, both Australia and the US have the same 1.5% overnight discount rate, which is fixed by the RBA and the Federal Reserve respectively. However, they are not always the same. And, when they vary, they considerably affect the AUD/USD value.

This means if the US Federal Reserve raises the rates, the capital will flow from the Australian Dollar to the USD. On the other hand, if the US Federal Reserve does not raise the rates due to its huge debts and deficit and the commodity markets also rise due to the weak USD, then the capital will flow from the USD to the Aussie.

Several macro factors can cause these changes. The RBA cannot control these factors, which in turn also affects the value of the Aussie. Its value is directed by commodity prices, Asian growth, and the Australian housing market among other factors.

What moves AUD/USD

As mentioned above, there are a few economic factors that drive the AUD/USD currency pair. You need to consider these factors before trading in this pair. Some of the major drivers behind the AUD/USD currency pair are as follows:

1. Chinese data

The Chinese data written below affects the AUD/USD value.

- The Chinese PMI or Purchasing Manager Index is significant since China’s growth mainly relies on industrial production. If it is more than 50, then you can expect expansion, though the market expectations are crucial for the trading data.

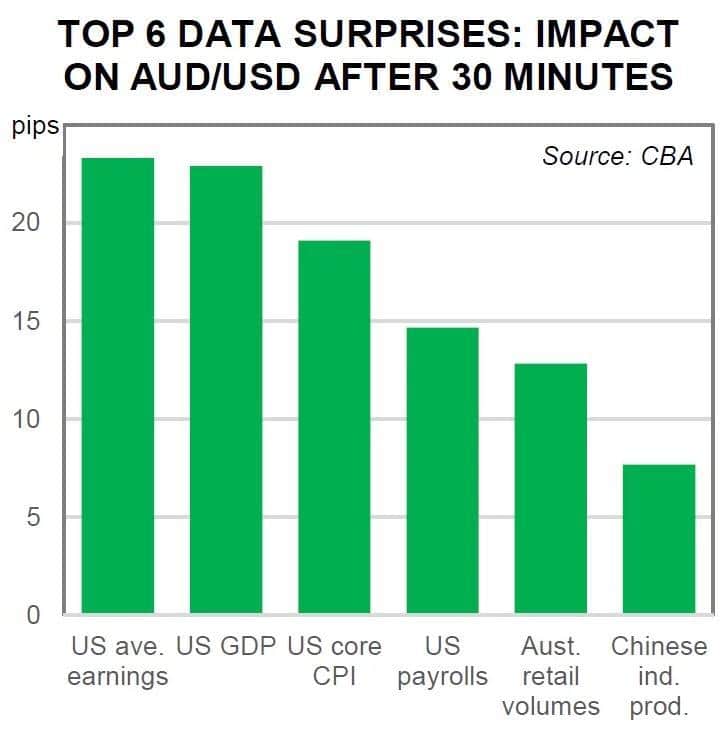

- After the GDP of the United States, the Chinese GDP is the second largest in the world. This greatly influences the global growth and the Australian economy since a major portion of mineral exports goes from Australia to China. Thus, a fall in the Chinese GDP means the weakening of the AUD against the US dollar.

- The Chinese import figures, mainly dealing with coal, iron ore, and industrial metals, allow you to determine any demand fluctuations in the country, which can result in a significant change in the Chinese economy. And, China imports a major portion of these industrial metals from Australia.

2. Commodity prices

Commodity prices can also affect the AUD/USD pair. If the coal or industrial metals market is strong or weak for a long time, then it will affect the Australian economy and the AUD/USD commodity forex pair accordingly.

This means high commodity prices will result in high interest rates of the Australian dollar and vice versa. And, these changes can be quite unexpected since the commodity market is quite volatile as compared to the GDP data that comes with an economic calendar.

3. The Federal Reserve and Royal Bank of Australia minutes

Both the US FED and the RBA disclose minutes from their policy meetings, just like most of the central banks. These minutes hint towards the future decisions related to interest rates.

4. Australian data

The Australian economy and its data have a major effect on the USD/AUD value.

- The Australian housing data is one of the things that can drive the Aussie’s value. Since it is not exactly booming right now and can further drop, it can also deteriorate the value of AUD against other world currencies.

- The Australian GDP is mainly determined by the commodity market since the nation is a huge producer of coal, gold, industrial metals, and iron ore. This means rising commodities make the Australian economy and the value of Aussie stronger.

- The RBA considers the Australian inflation numbers in order to make its policy decisions in the same way as the CPI in the USA. This provides similar results, that is high inflation means an increase in the interest rates and low inflation means a more relaxed monetary policy made by the RBA.

5. US data

The US data cannot be left behind when it comes to determining the value of the USD/AUD forex pair.

- The US GDP influences the value of the USD in significant ways since the GDP is a major economic health indicator of a country. Its increase or decrease can result in the boost or fall of the largest currency markets worldwide within seconds.

- The US Dollar Index shows the value of the US dollar against other key currencies. This value influences commodity prices inversely.

- The Federal Reserve, which is the central bank of the US, makes use of the US CPI in order to test its monetary policy. With a high inflation rate, the conditions can become a bit harsh, which can lead to a high interest rate of the USD. This can augment the demand of the US dollar, particularly if the RBA does not raise its interest rates.

The conclusion

The USD/AUD commodity forex pair allows traders to trade in the Asian market while using a western financial system. This currency pair highly influences global growth with high liquidity and less interference from a central bank.

Due to these reasons, the USD/AUD pair is great for taking a position in global development, which is not so easily possible with other major currencies. However, make sure you consider the above-mentioned factors that drive the USD/AUD pair before investing in it.